John Psaroudis likes to joke that pool professionals were so unfamiliar with ultraviolet sanitation systems that they couldn’t even spell UV.

How things have changed over the years.

“Now you can’t pick up an aquatics magazine without seeing an ad or an article about UV,” says Psaroudis, aquatics sales manager with Aquionics, a manufacturer of UV systems in Erlanger, Ky.

Indeed, secondary sanitation systems have come to the forefront as an effective clean-water solution in both commercial and residential markets.

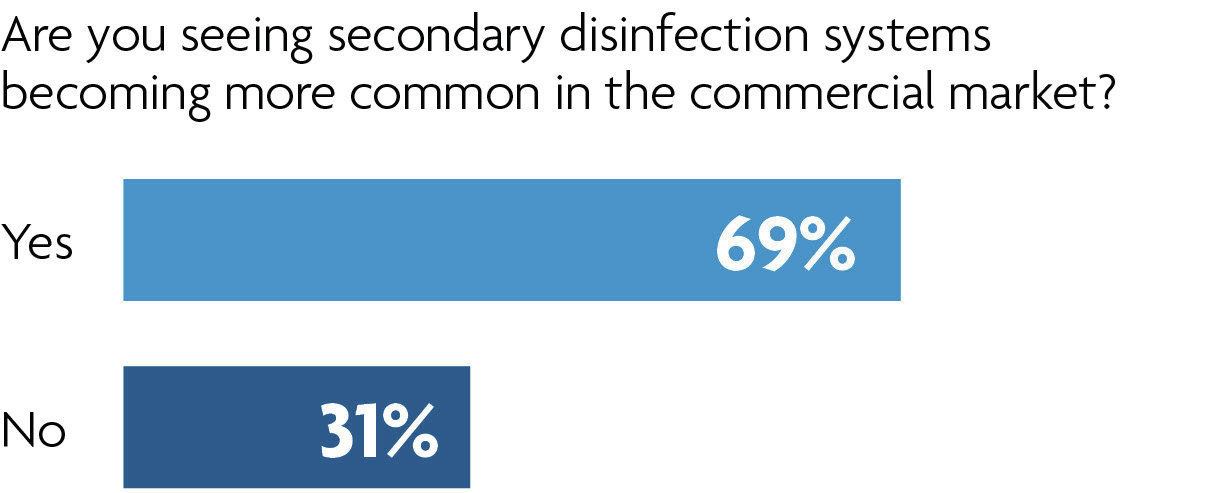

According to a recent Pool & Spa News survey, 69 percent of respondents are seeing UV, ozone and mineral sanitizers becoming more common at commercial pools across the nation, a trend driven largely by the public’s growing awareness of recreational water illnesses.

Rampant media attention on cryptosporidium — a chlorine-resistant virus — outbreaks and stricter safety standards imposed by state health departments are motivating more aquatics managers to equip their pools with a secondary sanitizer.

“I think there’s a fear factor,” Psaroudis says. “One is a fear for the safety of the patrons and the other is a fear that, with municipality or privately owned [facilities], a couple of lawsuits could sink the entire organization.”

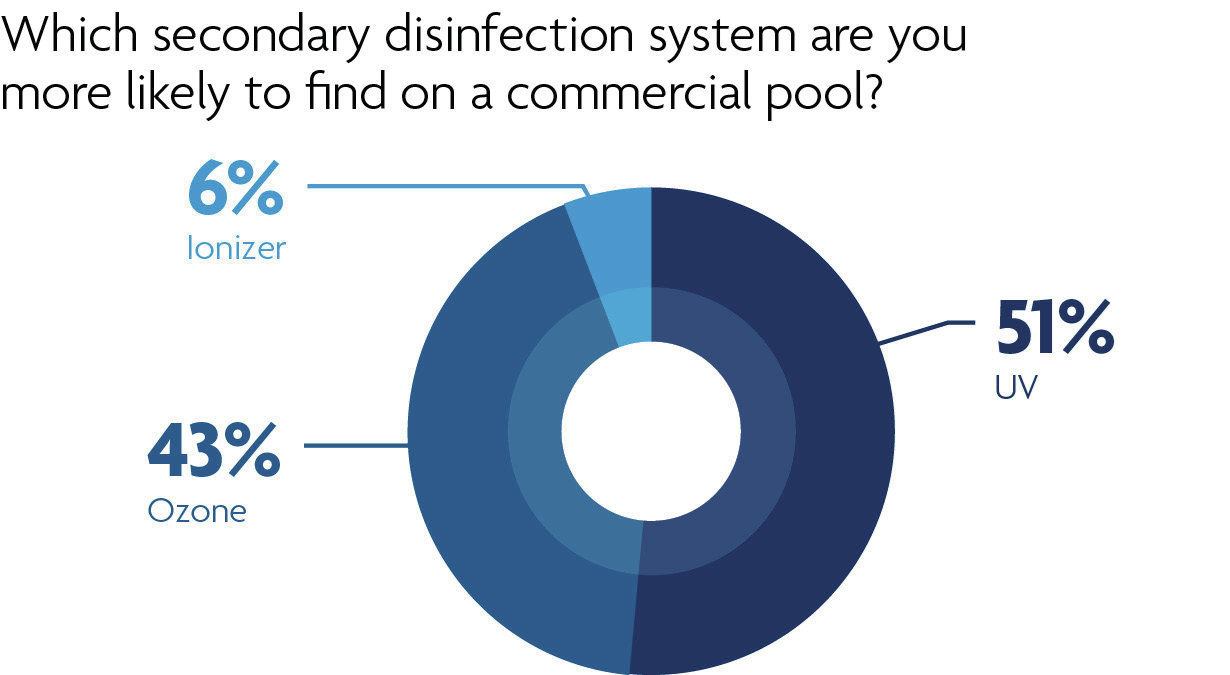

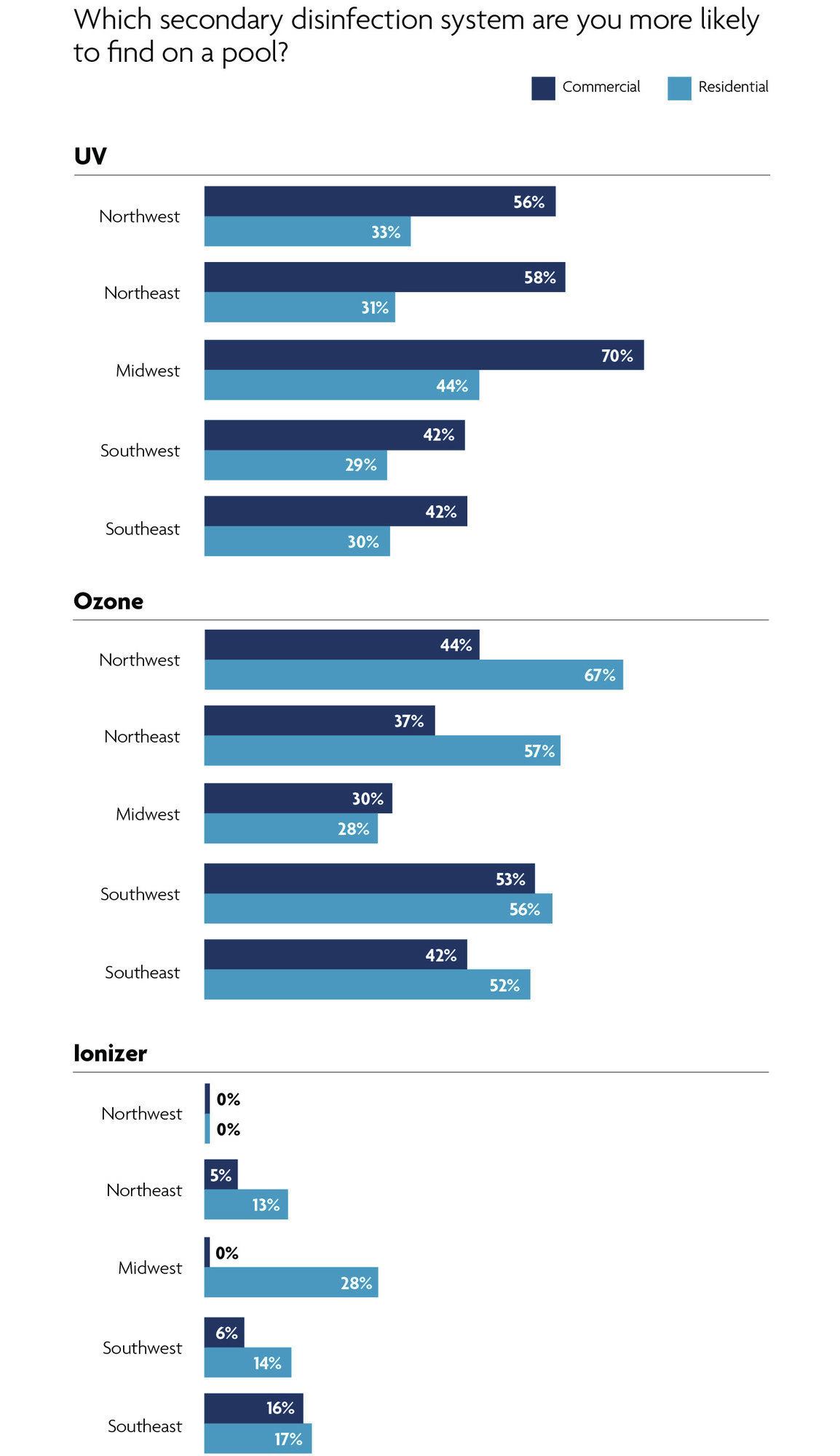

In most cases, they’re turning to UV. According to the survey, UV leads ozone as the sanitation system more commonly found in the commercial market.

That’s because ultraviolet radiation tends to be the sanitizer of choice among health code enforcers.

Though John Stein prefers ozone, “the pushback from health departments will force your hand toward UV,” says the construction manager of SRK Modern Pool Solutions in Wainscott, N.Y.

There’s nothing in the state code that specifies which secondary sanitizer to use, Stein adds, so it’s generally up to the inspector to determine what’s acceptable. And more often than not, they’re opting for ultraviolet radiation.

Why UV over ozone? Industry observers point to a 2005 cryptosporidium outbreak that sickened about 2,300 people in New York. Health officials traced the source of the virus to a splash park in Seneca Lake State Park. In response, the state made secondary sanitation systems mandatory at public sprayparks. Because UV is commonly associated with water play features — due to its ability to zap diseases that could be inhaled through a fine spray or mist — the system earned favor, at least in the Northeast.

“UV caught on and everybody jumped on it,” says Beth Hamil, vice president of DEL Ozone in San Luis Obispo, Calif.

Ozone, however, has its fair share of fans, as well. Asked which system is more commonly found at commercial pools, 51 percent of respondents said UV and 43 percent said ozone, with the remainder going toward ionizers.

The survey’s finding comes as a surprise to some in the industry.

“I would have expected it to be a lot higher for UV,” says Psaroudis, figuring a 70-30 ratio in favor of UV would have been more likely.

Mick Nelson agrees.

“I don’t know of a large commercial pool that we do meets in that depends on ozone,” says the facilities development director for Colorado Springs-based USA Swimming. “They’ve all gone to medium-pressure UV.”

The reason some commercial facilities are equipping pools with ozonators, which attack organisms with a naturally occurring gas, is because it both oxidizes and sanitizes the water.

“UV is just killing; you’re not doing any oxidizing,” says James Burkhart, owner of Pools Plus, in Katy, Texas.

Though UV has the edge over ozone, both systems benefit when chemicals are questioned. Jeff Boynton sees a direct correlation between negative publicity trumping up pool chemical hazards and sales of secondary sanitizers.

“We seem to be on the upswing for UVs right now,” says the sales and marketing director at Delta UV in Gardena, Calif.

Market watch

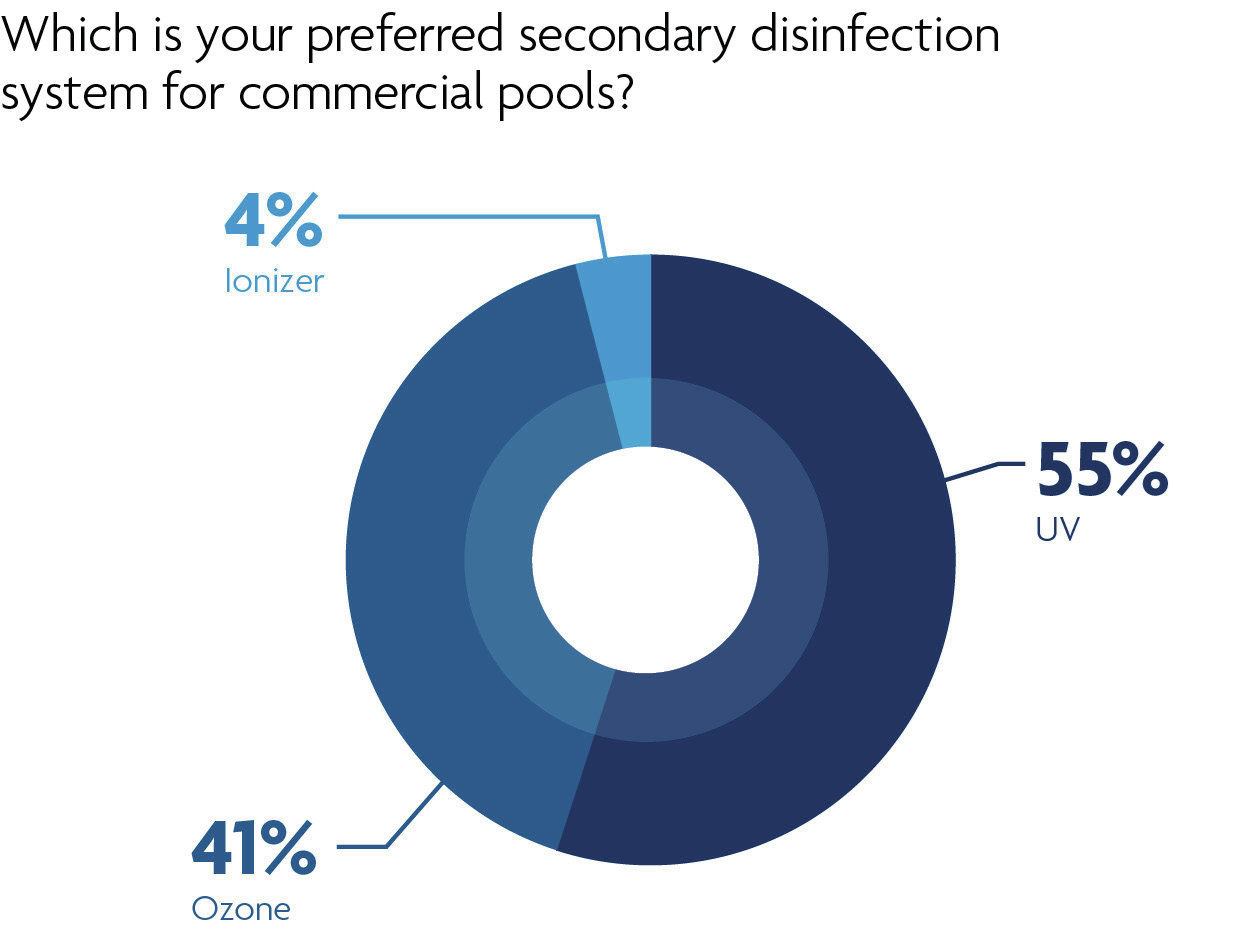

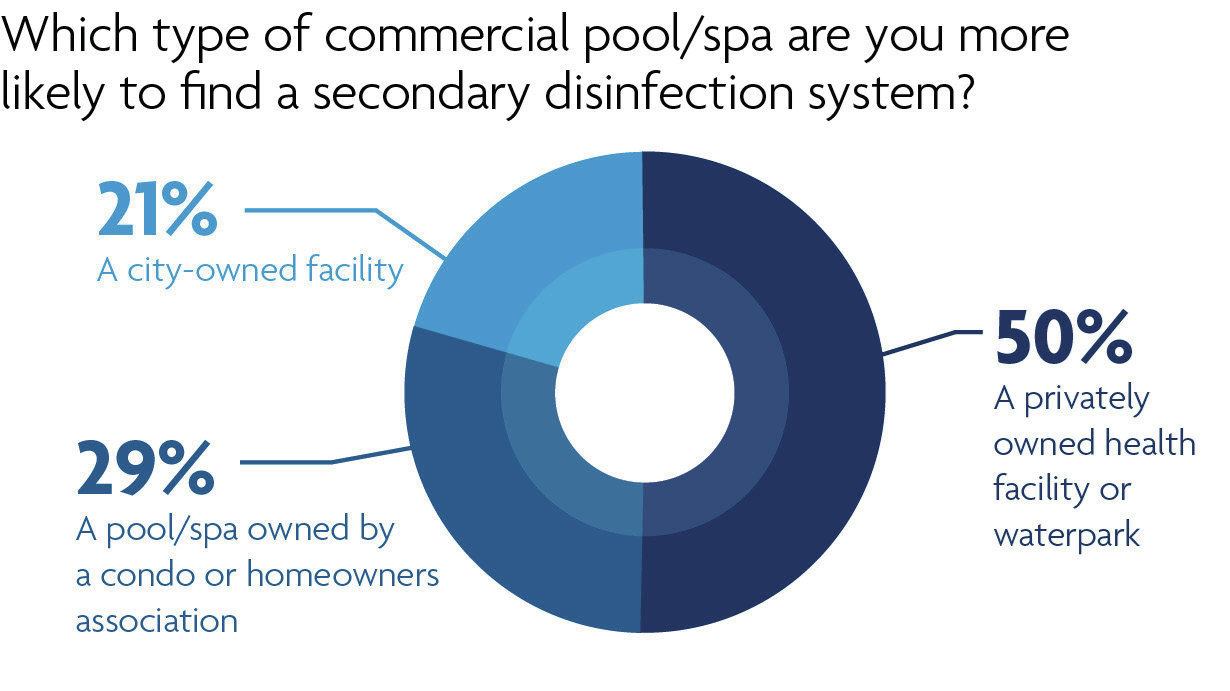

While the majority of survey respondents believe secondary sanitation systems are fast making inroads to the commercial arena, some markets are better than others.

Privately owned facilities are ripe for UV and ozone systems. These facilities, such as health clubs and waterparks, are far and away the most likely to have some sort of automated disinfecting system, according to the survey.

City-owned pools, however, are a harder sell. That’s because budget-strapped municipalities are more likely to close a pool than make improvements.

Another not-so-hot market: homeowners associations. Not only are HOAs notorious for being behind the curve when it comes to compliance, they’re difficult to persuade. Because these associations are governed by a board, they’ll have to justify hiking fees to dues-paying members.

“I personally don’t see that much business in independent HOA-type facilities,” Psaroudis says. “For example, in my neighborhood, we have a YMCA with a UV system, but the homeowners association has three outdoor pools, none of which have any kind of secondary disinfection system.”

Privately owned facilities, on the other hand, are easier to access. Take the YMCA, for example. Psaroudis need only convince a regional director that his UV system is a must-have. That way, he’s selling not just one unit, but a dozen or more to outfit every YMCA within a 60-mile radius.

“You actually get to meet with people that have 18 or 20 different facilities, whereas the homeowners associations, they’re all independent,” he said.

Residential rise

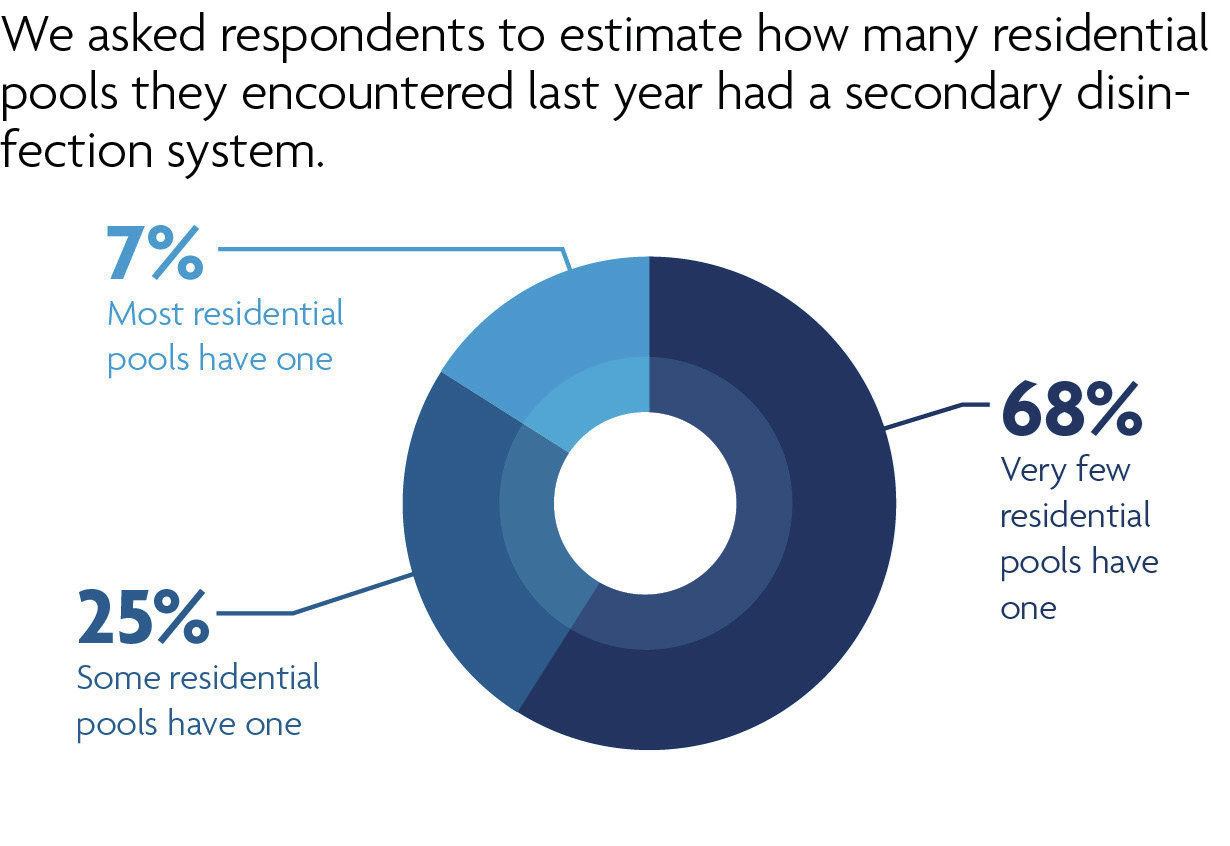

Secondary sanitizers are nothing new to the residential market. Ozone has been a common hot tub application since the mid-80s. It was only a matter of time before the technology was included on swimming pool equipment pads to keep organic matter at bay.

DEL Ozone introduced its first ozone system for the backyard pool in 1986.

“And that market has just grown, slowly but surely, year by year,” Hamil says.

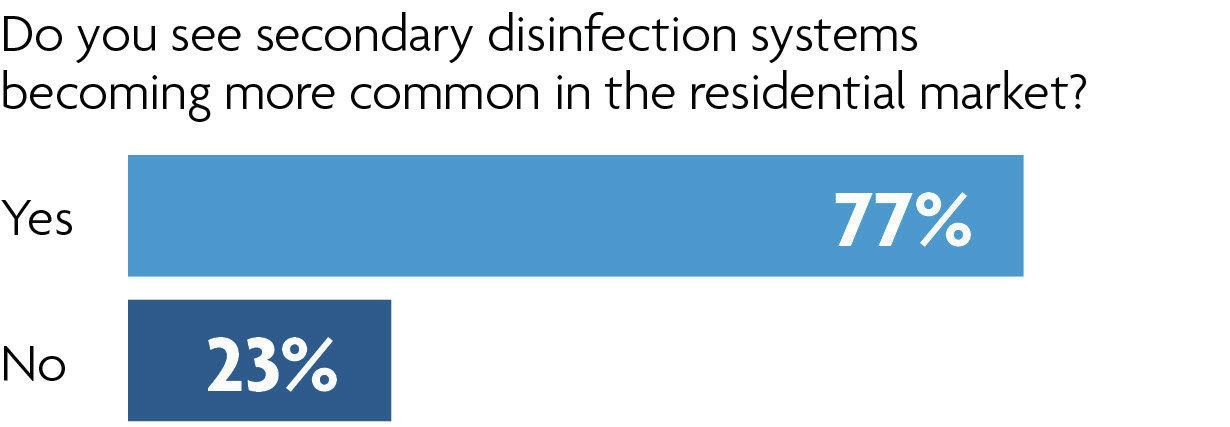

The growth isn’t so slow anymore. Prices have come down and more homeowners are trying to curb their chemical consumption, lending to a dramatic rise of secondary sanitizers on the residential side in recent years. Survey: 77 percent of respondents agree that UV, ozone and mineral sanitizers are becoming a common fixture at backyard swimming pools.

“Homeowners seem to be younger and younger and more information savvy, and I think they’re driving the need for healthier water quality,” Boynton says.

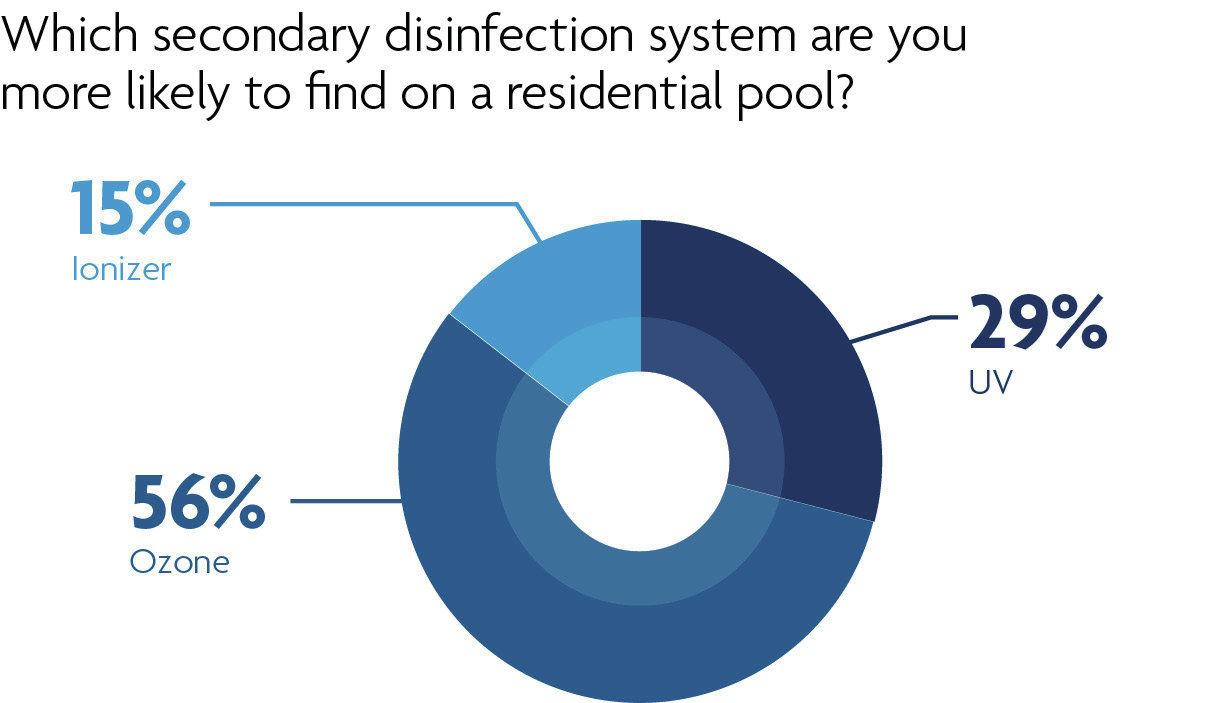

Whereas UV dominates the commercial market, ozone holds sway with homeowners. Industry members say this trend is builder-driven. Anecdotes suggest pool builders are more likely to package pricier ozone systems into a new installation. UV, on the other hand, tends to be a more affordable aftermarket add-on.

Ozone territory

Market trends by region are a bit ambiguous. There is no clear winner among UV, ozone and ionizers in any specific region — save the Southwest.

The Southwest stands apart because ozone is the leading sanitizer in both residential and commercial arenas.

How did ozone earn the edge in the commercial market? Southern California, Arizona, Nevada and Texas are states that enjoy year-round swimming. Because of that, there are more kid-friendly learn-to-swim facilities, which are ozone prone.

That’s Nelson’s theory.

“The smaller the pool, the more likely they were to try ozone,” says USA Swimming’s Nelson.

As for the residential market, because homeowners are swimming all year, they’re more apt to spring for applications to keep their pools in optimal condition with powerful oxidation and sanitation properties.