Among the benefits of working from your residence are home office tax deductions.

“Check with an accountant on the specifics,” says Rieva Lesonsky, CEO of GrowBiz Media in Irvine, Calif. “But the tax breaks may be nearly the same as if you had a separate office. The deductions alone are worth it.”

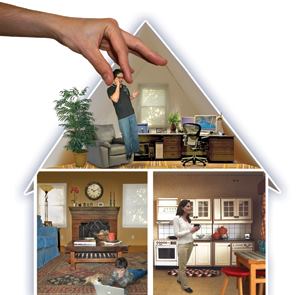

In order to cash in, at least part of the home must be used for one of two purposes, according to the IRS:

- Exclusively and regularly as either the principal place of business, or as a setting in which to meet or otherwise deal with clients during the normal course of business; or

- For regular storage – including inventory or product samples – or as a rental property.

“Exclusive use” is defined by the IRS as a specific area of the home used only for trade or business. “Regular use” means the area is used consistently for business.

A detached structure like a cottage or pool house does not have to be a principal place of business or a place for meeting clients or customers. It only has to be used in connection with the company.

Also, you may be able to deduct expenses related to a detached home office if, again, it is used for an exclusive and regular part of the business.

In general, the amount you are able to deduct depends on what percentage of the home is being used for business. Deductions may be limited, however, if the gross income from your business does not exceed your total business expenses.

For more information, including specifics on home office deductions, log onto www.irs.gov.