1:39

Thanks for reporting a problem. We’ll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

message

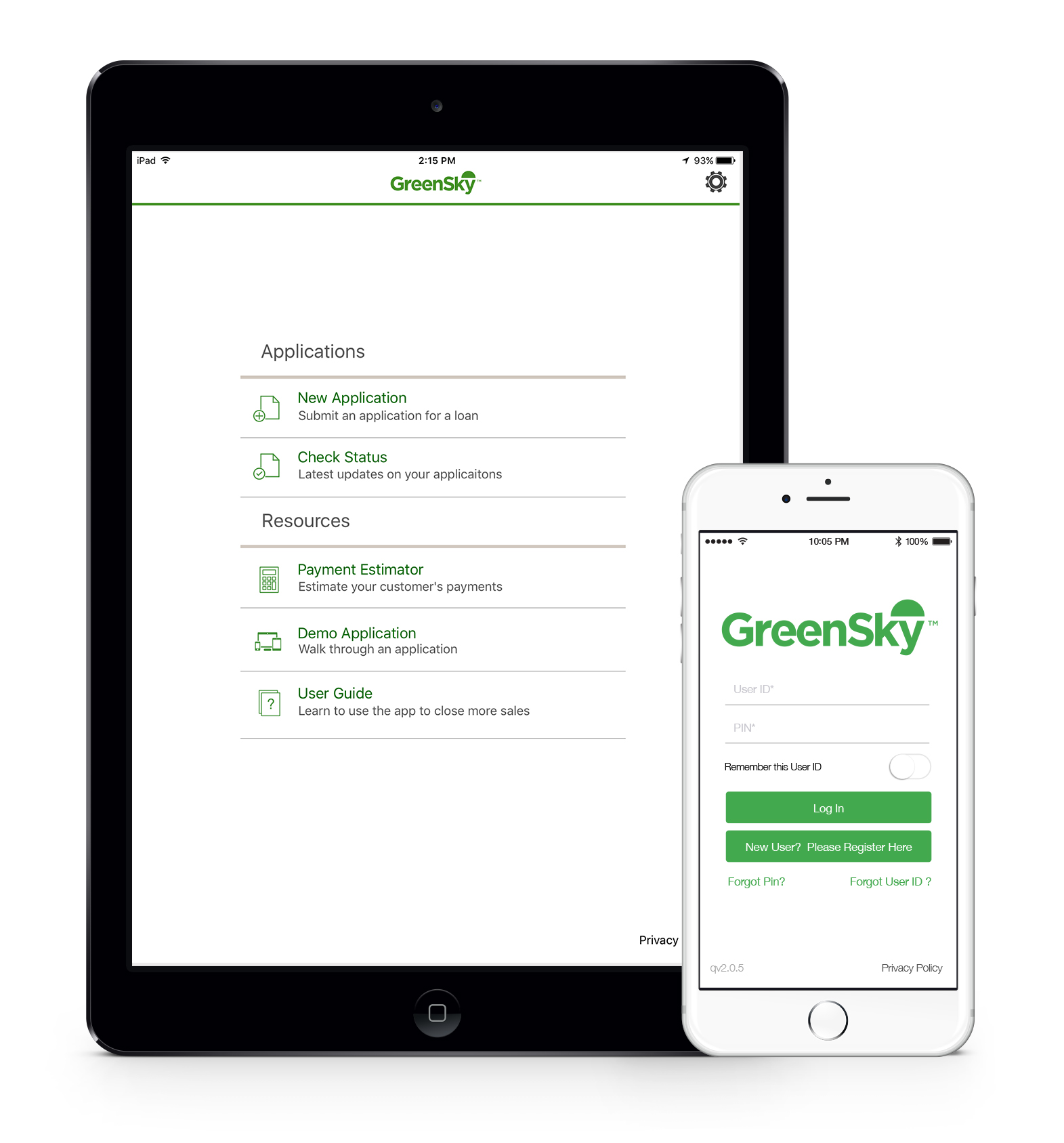

GreenSky’s app can be used from a tablet or smart phone to process credit applications on location.

Thanks for reporting a problem. We’ll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?