READER RESPONSE

We value your feedback. You are welcome to share your thoughts on this and other issues with Pool & Spa News.

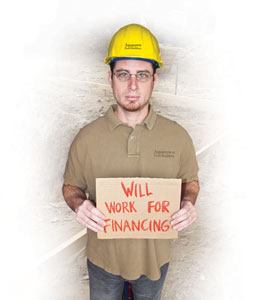

The economic crisis is a serious matter, but many still find time for gallows humor.

This is especially true when it comes to the subject of credit.

“We have a new financing program here,” says Mike Giovanone, owner of Concord Pools in Latham, N.Y., a Pool & Spa News Top Builder. “It’s 100-percent down, no payments. And it’s been working pretty well: Look at the postage you’re going to save.

“You’ve got to laugh about it.”

There are many reasons why credit is so tight. Some financial institutions are gun-shy after the losses they’ve taken, while others are bracing for another cluster of foreclosures, both residential and commercial.

Unfortunately, when it comes to credit, there’s no good news for the immediate future. But that doesn’t stop pool and spa and construction companies from trying. In an effort to help consumers, many in the industry are getting creative. Read their accounts.

• The Broker

Mike Hermann is a Phoenix-based broker who had been serving the pool and spa industry exclusively for more than two decades. For the past couple of years, he’s scoured the country in search of funding sources for his pool-builder clients. In doing so, he has tried putting together packages where the industry itself could build up a reserve to guarantee the loans 100 percent. Participating pool builders and suppliers would contribute, and then companies would pitch in a portion of each sale.

“In other words, we’d maintain a reserve so that if [the lender] had any losses, it would be covered,” says the president of the Finance Office and secretary of the Southwest Pool & Spa Association. “But even at that, they were still unable to make that kind of [commitment].”

• The Speed Dater

The lending crisis has hit the home-building industry hard. In an attempt to create growth, the National Association of Home Builders is trying to find creative solutions.

At its last convention in January, NAHB sought to bring potential lenders together with potential borrowers.

“We set up something called the Partnership Pavilion,” says David Crowe, chief economist for the Washington, D.C.-based association. “It was essentially a speed dating of sources of funds, both equity and debt, and builders who had specific projects that they needed funds to go toward.” Equity funds, private investors and even some large banks such as Wells Fargo and Bank of America showed up. “We left no stone unturned,” Crowe says.

At the time, NAHB heard that the project peaked some interest, but is still waiting to confirm whether any leads have evolved into successful matches.

• The Cold-Caller

In parts of Texas, cold-calling can do wonders. The idea is simple, but not easy, as Sherry Fowler found out. She has come across a few local credit unions willing to work with her, but they weren’t publicizing their loans, so she had to find them.

“I dialed every single [bank and credit union] in the Yellow Pages to find out what their loan packages were, research the limits and learn which ones were more flexible,” says the owner of Premier Fiberglass in Austin, Texas. “You have to make several calls until you can get to the right person who’ll tell you the real story. Call until you actually reach the director or manager of the loan department. You can’t just talk to a teller who might only provide basic information. You really need one of the loan specialists.”

When she asked about the programs themselves, some were more open than others about their terms.

“I would ask hard questions: ‘What are your criteria? What do their credit scores need to be? What is your loan-to-value?’ And I did a little spreadsheet table to try to figure out which ones seemed to be a better program, or gave customers more flexibility.” By getting feedback from her customers who tried using the institutions, she could hone in on which were most hassle-free.

• The Packager

Banks are more willing to issue loans to people who already work with them. That’s why Stan Griffin is trying to find a bank that will provide loans for his customers if he does more business with them.

“We have some smaller local banks that [we are considering], to give them our merchant account, where we run all our credit cards through them, because the bank makes a lot of money processing credit cards,” says Griffin, president of Griffin Pools & Spas in South Carolina, a Pool & Spa News Top Builder. “We’ve put our credit card account up for grabs with any bank that looks favorably upon giving our potential customers home equity lines.” While no bank has taken the bait, his current financial institution knows he’s looking around. “I think they’ve become more lenient with home-equity lines,” Griffin says. “I think they’re getting the message.”

• The Problem-Solver

For Concord Pools’ Giovanone, finding funding has been a matter of working the system to help his clients and his company.

For starters, before his customers file an application for financing, Giovanone suggests that they run a credit report and try to clean up any blotches on their records.

“We’ll pay for it,” he says. “For $7 you can get three reports. If there are any discrepancies, a customer can call and straighten them out or, post the explanation on the credit report Websites. Someone may have paid this one or that one off and it’s not showing.”

He’s also aware of the fact that every time a consumer applies for credit, it actually hurts their score a little. If you’re the second or third in line for a particular customer, they may have credit available for the first couple of projects, but not the others.

“It’s the same concept as if you had 10 credit cards with $10,000 of available credit and you have zero balance on them,” Giovanone says. “You’re $100,000 in debt in the eyes of the credit bureaus, because the credit is available. If someone applies for five or six different loans, when the final pool loan application comes in, they may say, ‘No, they have too many open inquiries now.’”

This puts each bidder in competition for funding — whether it be other pool builders or contractors working on other parts of the backyard. So Giovanone tries his best to beneficially position his company. “You have to be very diligent about finding out what the project is going to run and getting them approved,” he says. “You can always modify the loan request, but be the dealer in first position.”

Still other customers are putting their pools on credit cards. These are usually homeowners who expect a large sum of money soon, or want to get miles from the airlines. But that means the pool company has to pay a fee to the credit card processor. Because these transactions are so much larger than the average charge, Giovanone will negotiate his company’s fee with the financial institution.