It’s been five long years, but pool firms say they are no longer treading water. “Business is good,” says Jeff Hunt, who manages high-end residential pool sales and commercial projects at Cox Pools in Panama City and Destin, Fla. “It’s the best it’s been in five years.”

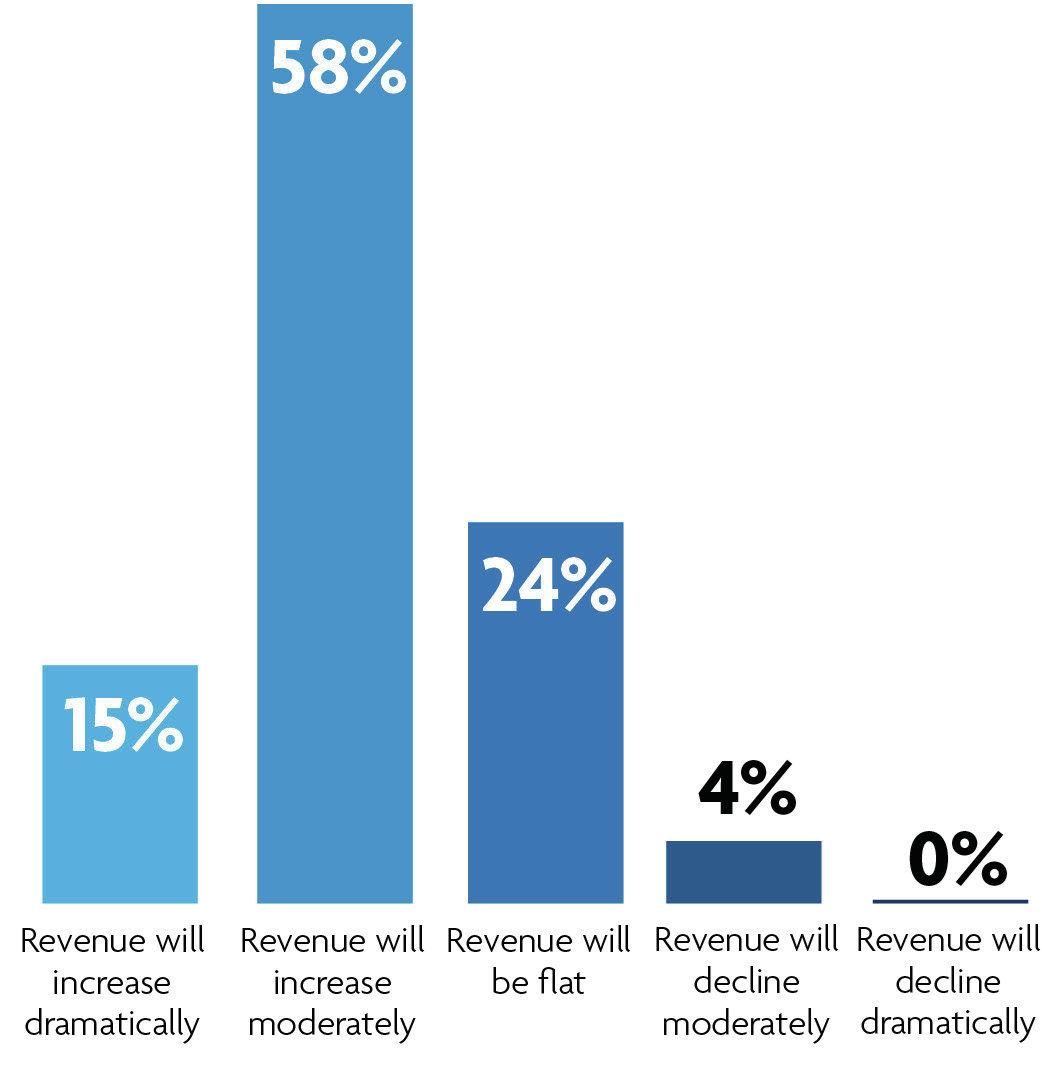

Cox Pools isn’t the only pool firm exhaling with relief. In our most recent builders’ survey, more than half of respondents reported that their business either did “better” or “much better” than expected in 2013, giving pool firms some financial room to maneuver. With sales on the upswing, they are replacing worn equipment, hiring employees, managing costs, and staying alert for post-recession growing pains.

“Our big challenge is going to be managing the growth,” says Art Allen, president of A&G Concrete Pools in Fort Pierce, Fla., who remembers doing 10- to 14 pools per week during the boom. That sort of pace “is almost out of control,” says Allen. “Our workmanship is impeccable. We don’t want the quality to go down.”

Nationwide, the luxury home market (those priced at $1 million and up) is thriving, according to the National Association of Realtors, and so is the high-end pool market, according to pool firms interviewed for this story.

The caveat to the current surge of customers? Thanks to the Internet, today’s would-be pool owners are more demanding than their pre-bust counterparts. “Customers are getting smarter,” Allen says. “They get online and check companies out.”

That’s good news, of course, for firms with solid reputations and happy customers, but it is changing the dynamic between pool builders and buyers. “What is tough is the higher expectations of the homeowners,” observes Hunt. He also thinks buyers, even affluent ones, seem more price-sensitive than in the past. “Negotiations with homeowners are definitely more stringent.”

But pool builders who can satisfy such customers have plenty of business.

In the suburbs of St. Louis, Baker Pool Construction is keeping its 52 employees busy on complex pool installations for residential clients willing to drop more than $100,000 on a project. “The only thing that has hindered us so far is the weather,” says Ray Holt, owner and president of the Chesterfield, Mo., company, which built 55 pools last year.

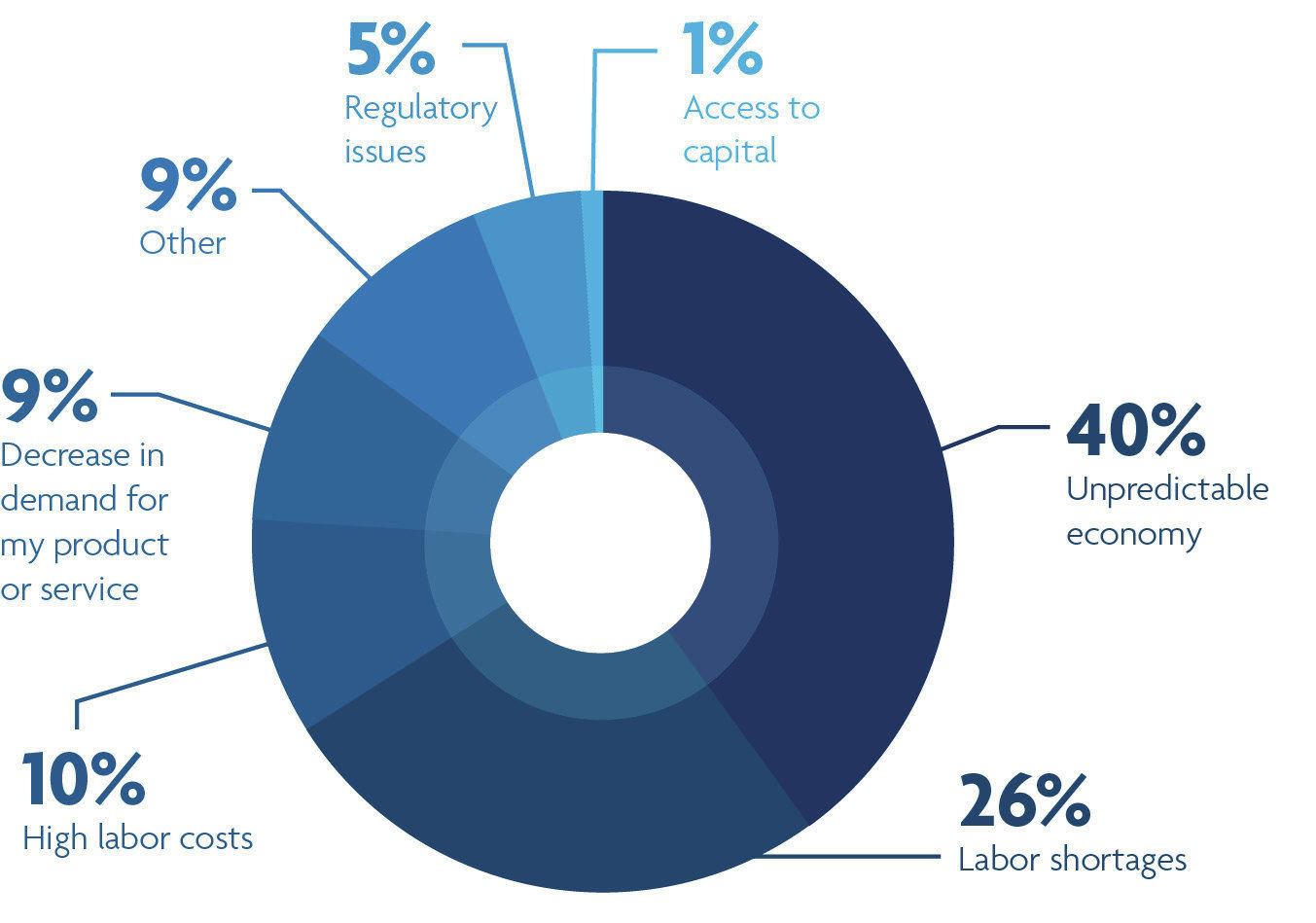

Of course, the weather can be a big issue. In California, where drought restrictions are already interrupting the construction of new pools in some localities and may affect the filling of existing swimming pools, builders and service firms are understandably worried. When we asked Pool & Spa News readers what they considered the biggest challenge to their business in 2014, a handful skipped our choices and went straight to Mother Nature. “Drought conditions and the ability to pull permits,” said one respondent.

Other top concerns, according to survey results? The unpredictable economy and workforce issues. That includes both the availability and cost of skilled and unskilled laborers, who may have left for jobs in other industries or states in light of the long-lasting recession.

“I probably spend double the amount of time on hiring a person that I did 10 years ago, and I have to filter through so many candidates to get to them,” says Holt. Despite widespread layoffs that left so many unemployed during the recession, he believes “the supply of labor is not as good as it was, in terms of quantity and quality.”

Respondents who said their firms did better or much better than expected last year are especially anxious about labor; 29 percent of those say they are worried about shortages of labor and 14 percent about the cost of those workers. They’re also concerned about their expertise. “I’m having to train people again,” says Allen, who is hoping to convert a floor tile installer into a pool tile expert. “But it takes time.”

Pool firm owners also are paying attention to expenses, with 52 percent of respondents saying controlling costs would be a critically important task in 2014. Many report that they are already seeing price increases for cement and delivery delays for items like simple pool pumps. “Nobody’s keeping any inventory these days,” Allen says.

With that in mind, Allen bought $300,000 worth of PVC in late 2013 as a hedge against rising building materials costs. “It was the first time in six years that I did a bulk buy at the end of the year,” says Allen. His decision was affirmed a few weeks later, when his supplier called him with an unexpected proposal. “He wanted me to sell the PVC back to him for 30 percent more than I paid for it,” Allen recalls cheerfully.

With $22 million worth of pool business projected for 2014, Allen decided he’d rather have the PVC.

Higher costs for health care

The implementation of the Affordable Care Act, or ACA, has expanded health care coverage to previously uninsured Americans, but it also has brought many headaches to business owners.

“It is very difficult to educate yourself on it,” says Ray Holt, president and owner of Baker Pool Construction in Chesterfield, Mo. The firm already provided health insurance to its 52 employees before the ACA made it mandatory, but Holt still had to familiarize himself with the details of the new law when his company’s health policy was up for renewal in 2013. “Your insurance broker can give you the highlights, but you have to sit through the webinars and learn the ins and outs” of the various plans available.

While the ACA has brought health care costs down for some, that hasn’t been the case for Holt’s company, where premiums rose 50 percent. “What are we going to do if we continue to see 50 percent increases? Can we be viable as a company?” asks Holt, who wonders if restructuring his business might lower its spiraling health care costs.

Holt has plenty of company. While 45 percent of our survey respondents told us that the ACA has had no impact on their business so far, more than half (52 percent) reported higher costs as a result of health care reform. Here’s how those pool firm owners are responding to their company’s higher health care costs.