Five-Timer’s Club

These companies have appeared on the list going back at least five consecutive years. Asterisked firms have made the list every year since the program’s beginning, in 2018.

Five-Year Trending

We wanted to track performance of the Top 50 over time, but the list changes each year, making it impossible to compare apples to apples. To provide a consistent sample, we isolated and tracked “The Five-Timers Club.” These 18 firms, listed on page 38, have ranked in the Top 50 going back at least five consecutive years, from 2020 to 2024.

The charts below show this group’s progress. To account for inflation, one chart shows results in both real-time dollars and in 2019 dollars. This was done to more easily compare year to year, however it can’t reflect all the ways inflation can affect performance, such as reduced consumer confidence.

Five-Year Trend: Total Service Revenue

Clearly, this group has steadily thrived for the past five years. Especially encouraging is the steep incline from 2022 to 2023, both in real-time and 2019 dollars.

Five-Year Trend: Total Service Accounts

This group signed on more clients from 2020 to 2024, with substantial increases each year, even when removing the impact of mergers and acquisitions among consolidators.

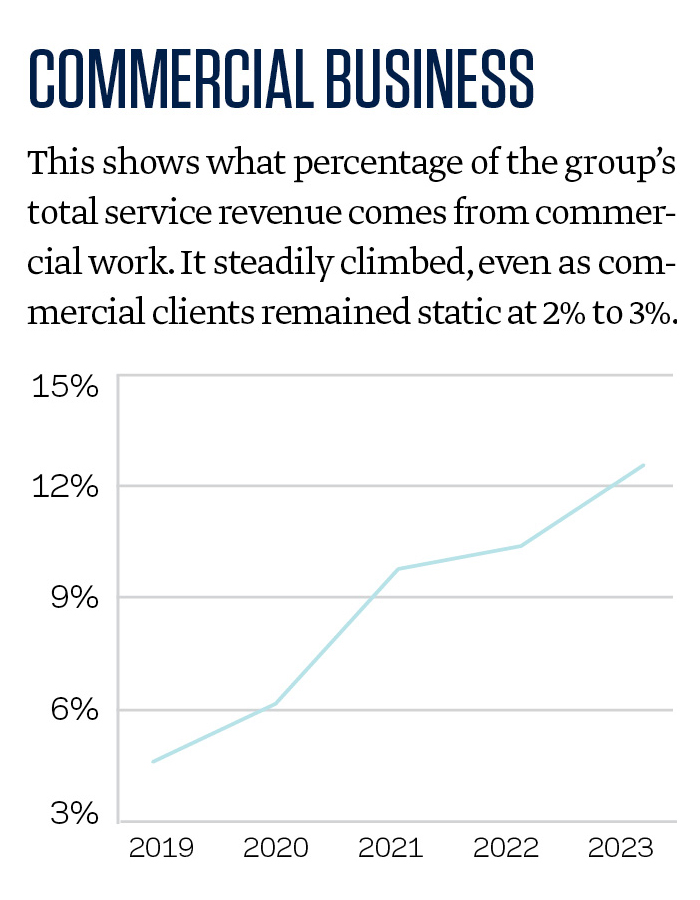

Five-Year Trend:Commercial Business

This shows what percentage of the group’s total service revenue comes from commercial work. It steadily climbed, even as commercial clients remained static at 2% to 3%.

Top 50 Service Survey

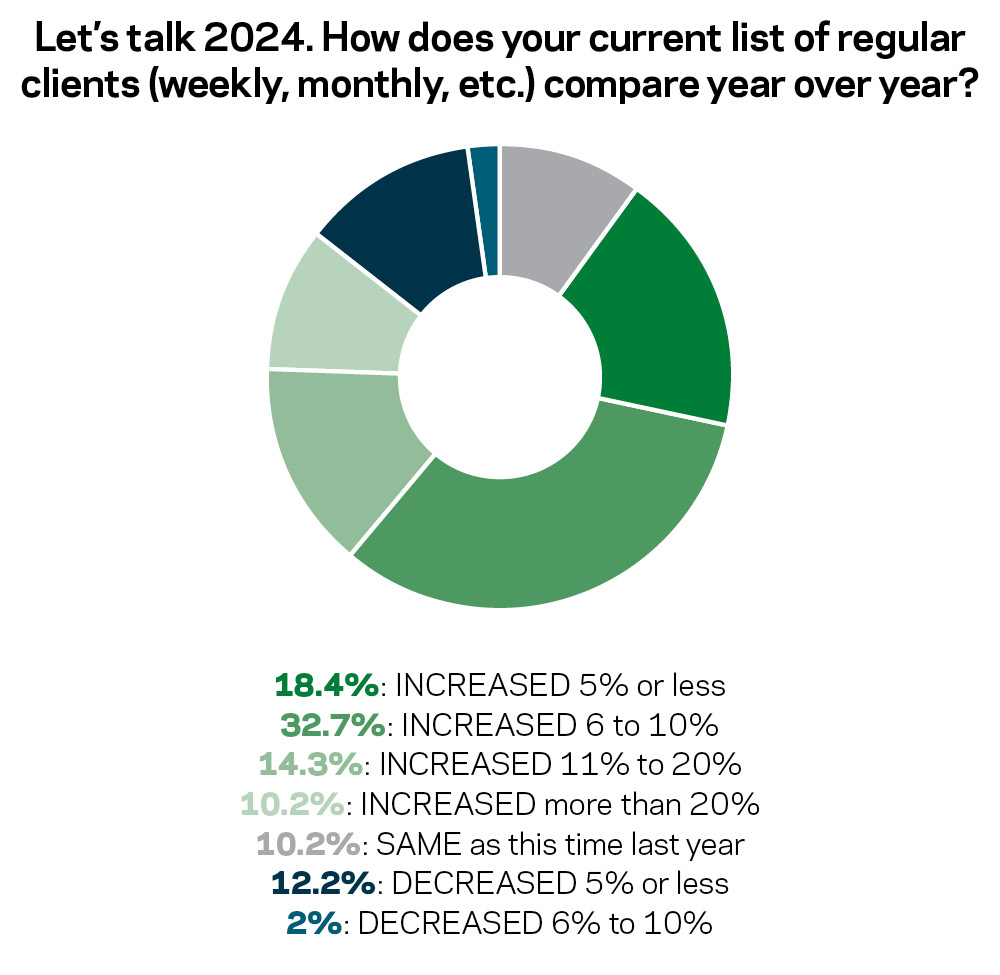

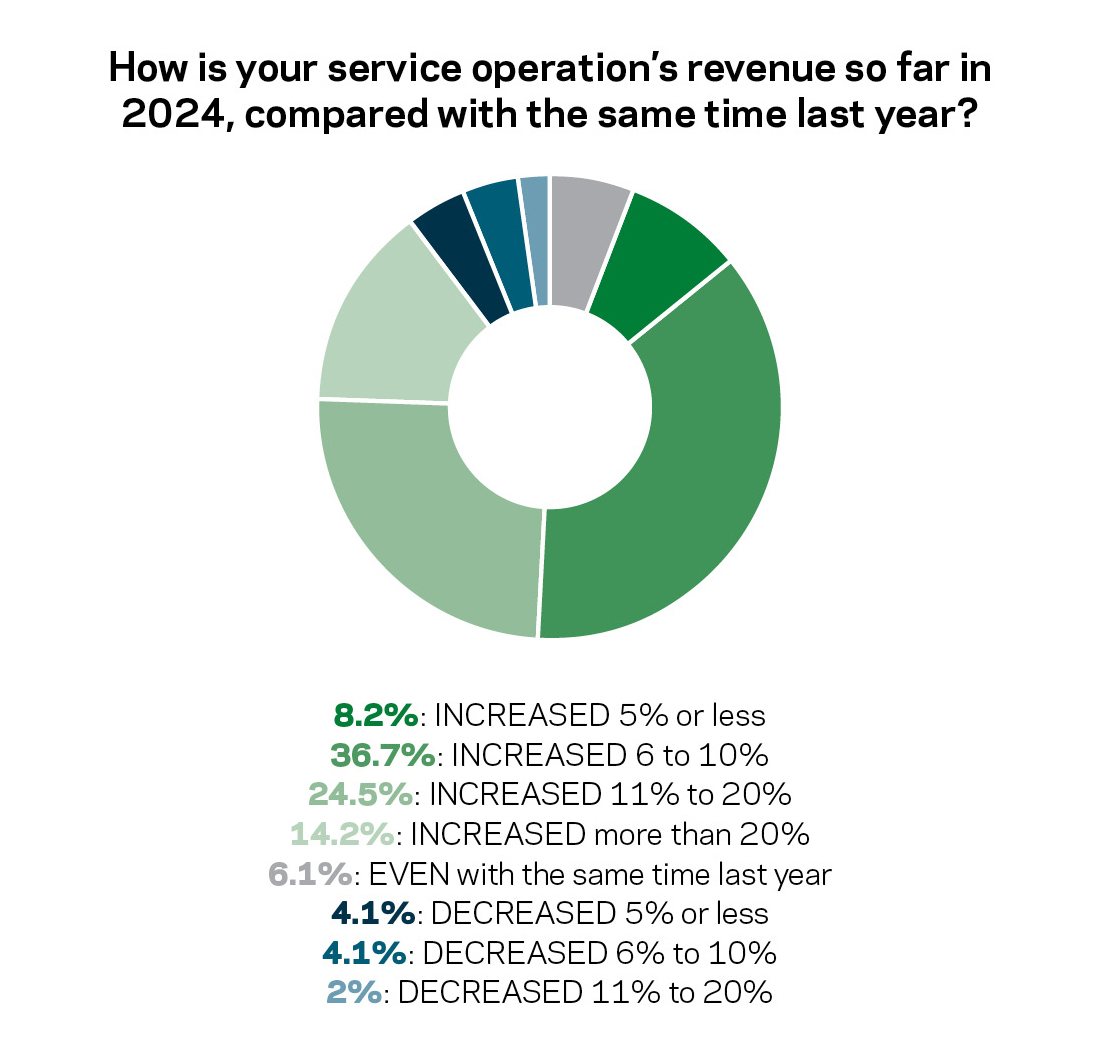

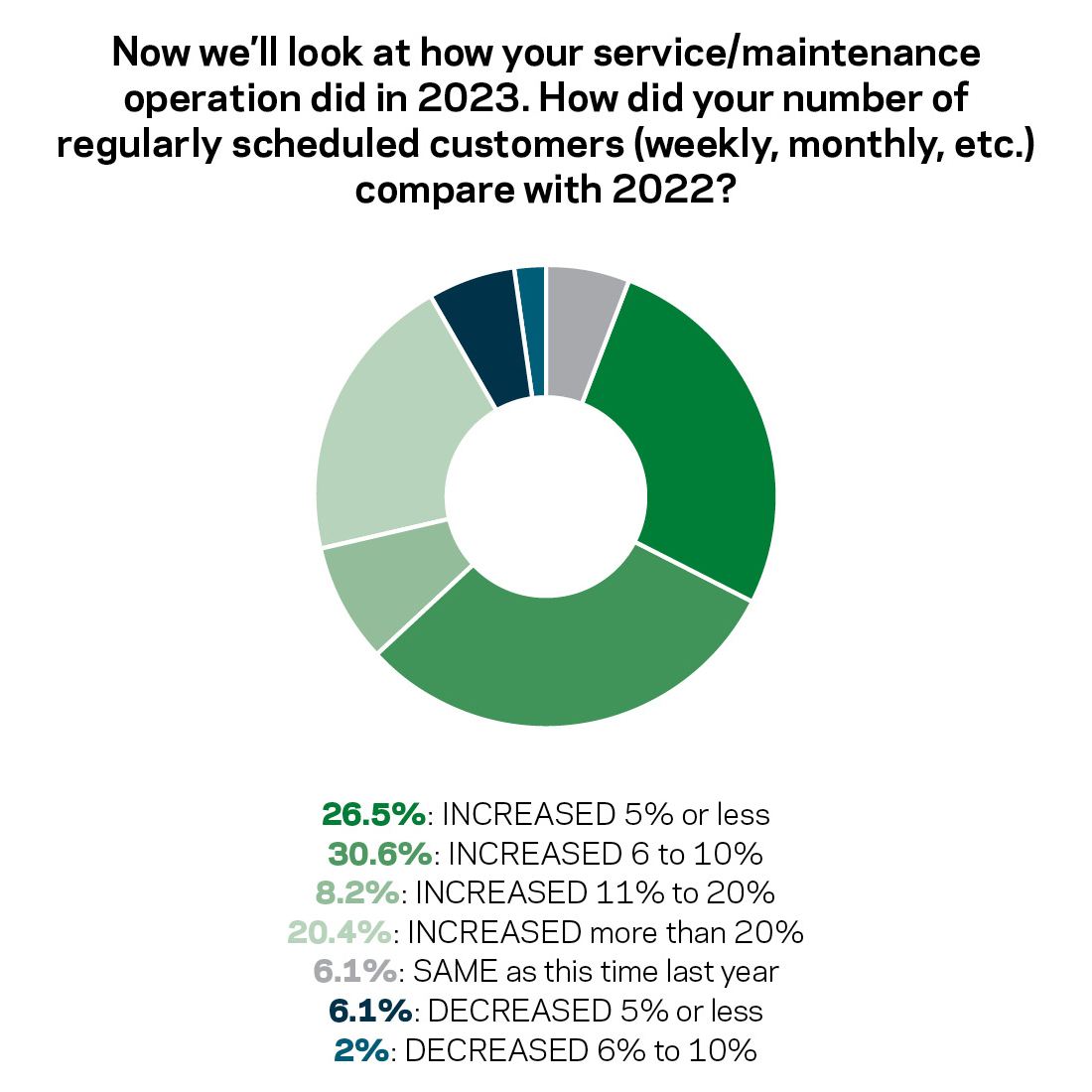

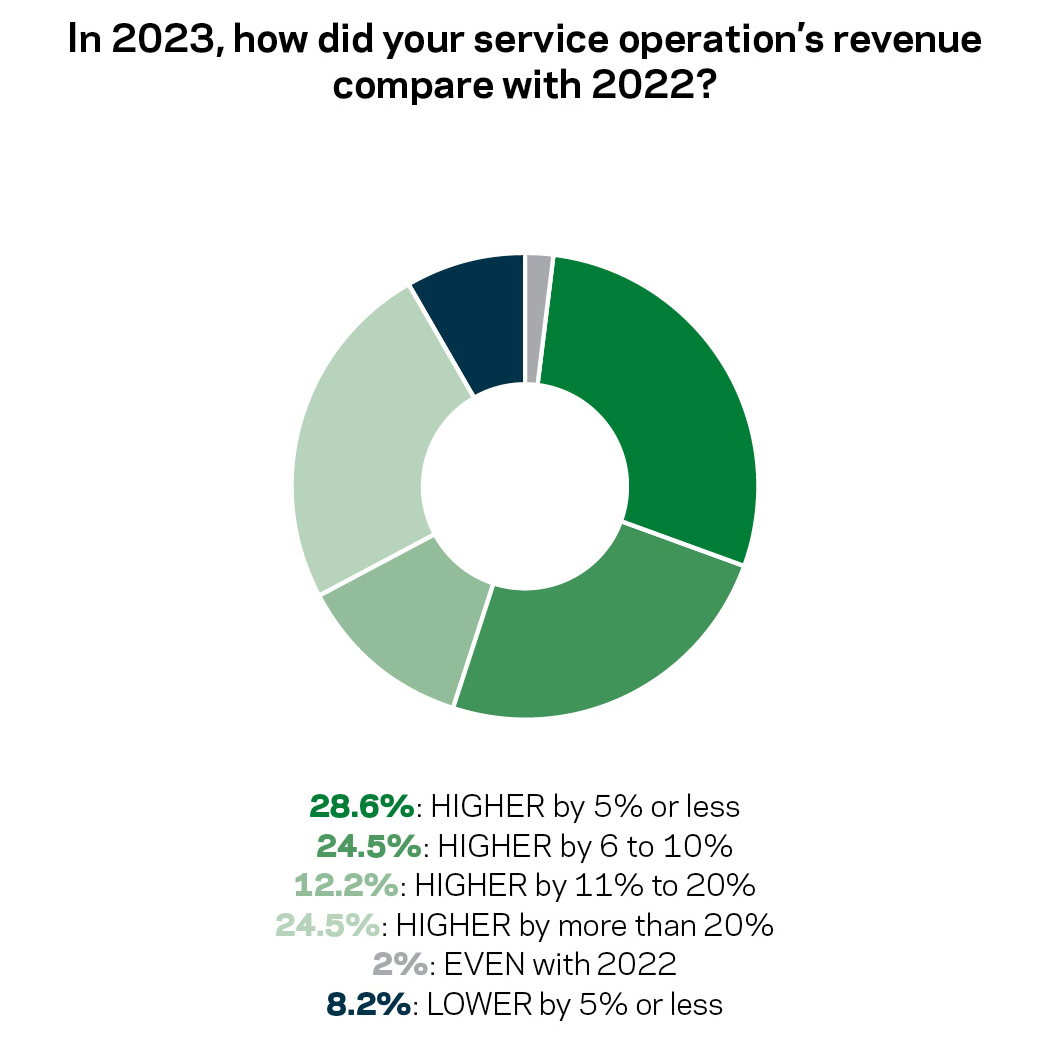

A survey of this year’s Top 50 Service companies reflects a segment as healthy as ever. As charts on this page show, 2024 looks good so far, with most firms reporting increases in revenue and client rosters. While the trend definitely points upward, revenues seem to be increasing slightly more than client numbers, this year and last. And the increases aren’t always moderate. In some cases, significant portions of the Top 50 report inclines over 10% or even 20%.

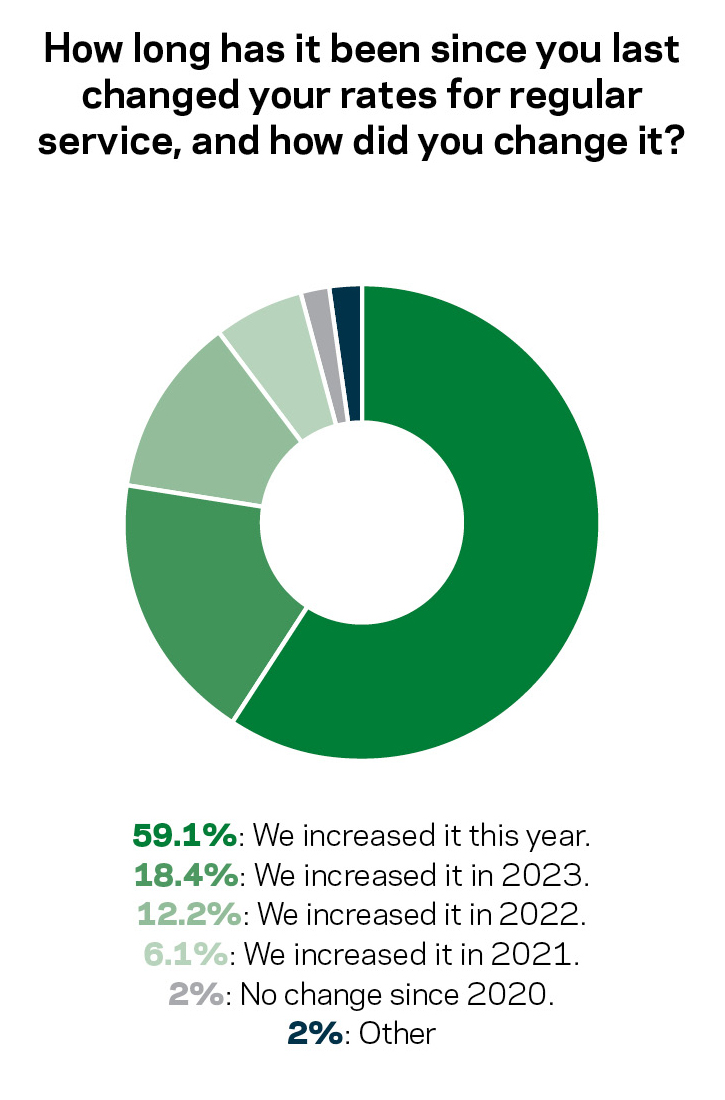

As seen on page 46, this group has not been shy about raising rates. Fully 59.1% did so this year, and another 18.4% instituted their latest increase in 2023.

Service continues to increase its mark. Among companies that also offer construction and/or retail, 46.7% said service accounted for a larger portion of total revenues in 2023 than 2022.

Finally, we gauged views on consolidation. While we see a diversity here, almost half — 44.9% — show no interest in joining one. On the other hand, 20.3% are consolidators or affiliated with one.

Note: These charts have been color-coded,with green representing increases, gray showing the status quo, and blue indicating decreases.