People figures with comment clouds above their heads. Commenting on feedback, participation in discussion. Brainstorming, fresh new ideas. Communication in civil society. Cooperation and Collaboration

Every year, we survey our Top 50 Builders as a barometer of how the industry is faring. This year, in addition to sales and revenue, we checked on certain aspects of how they do their business. Results show that this group pivots when needed.

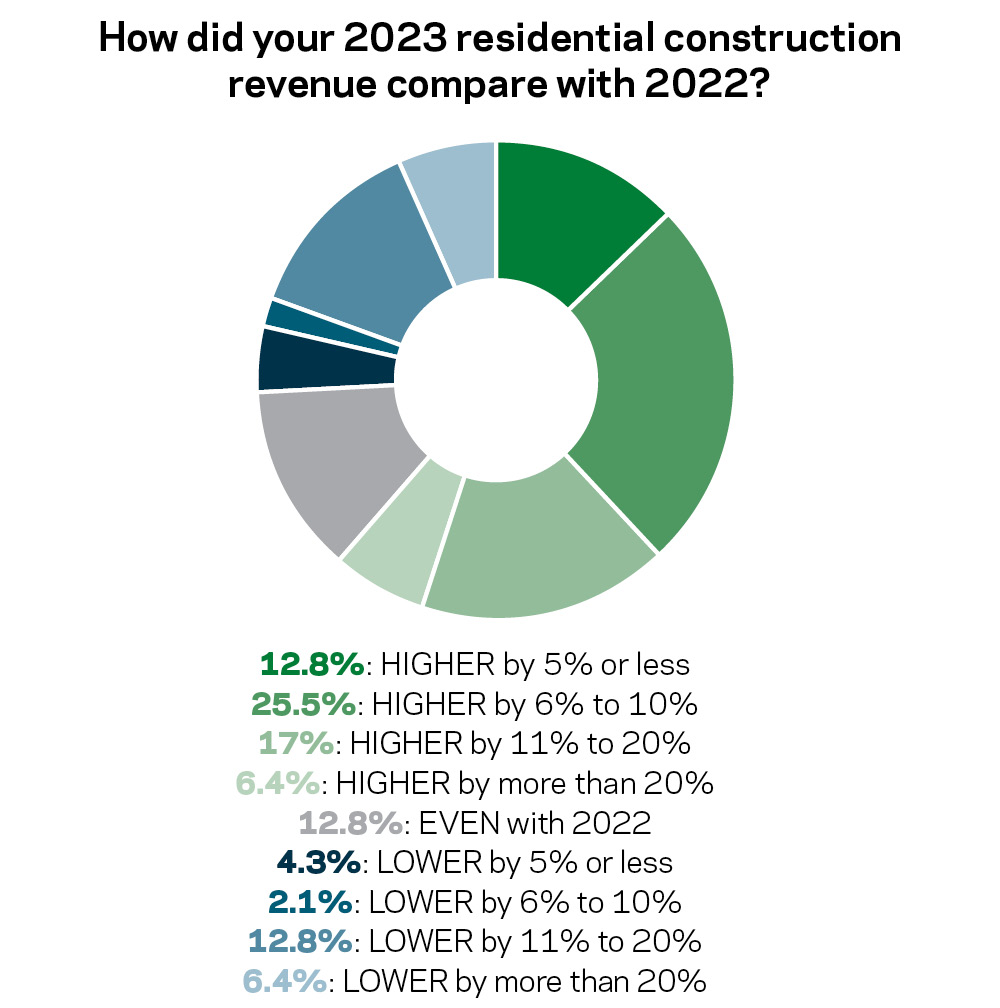

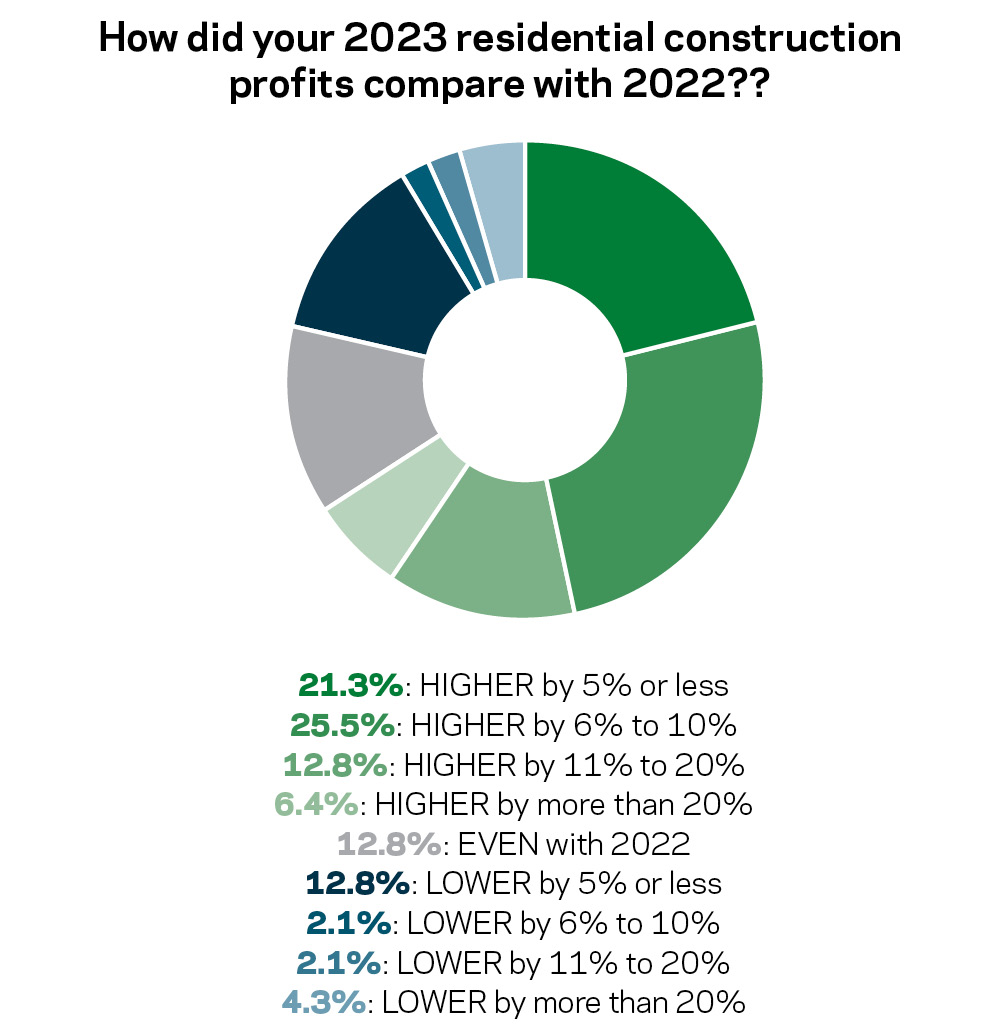

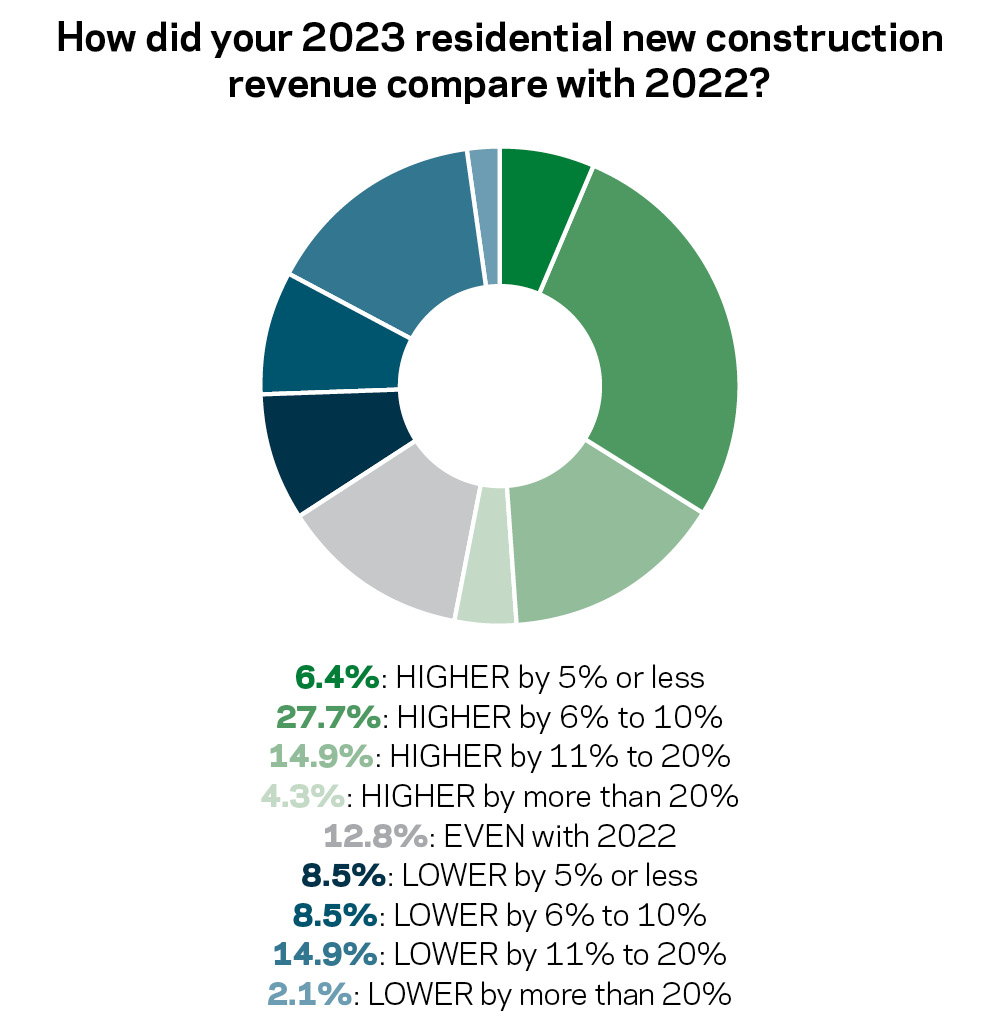

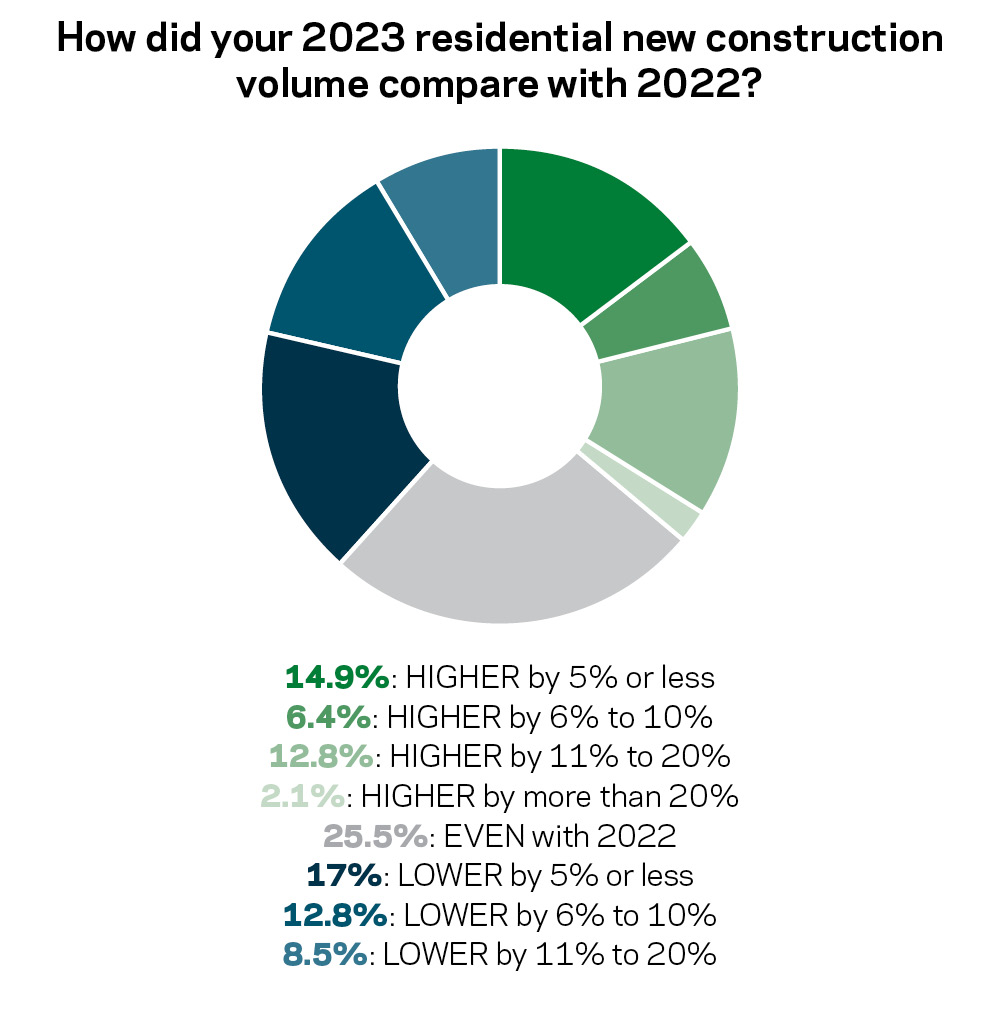

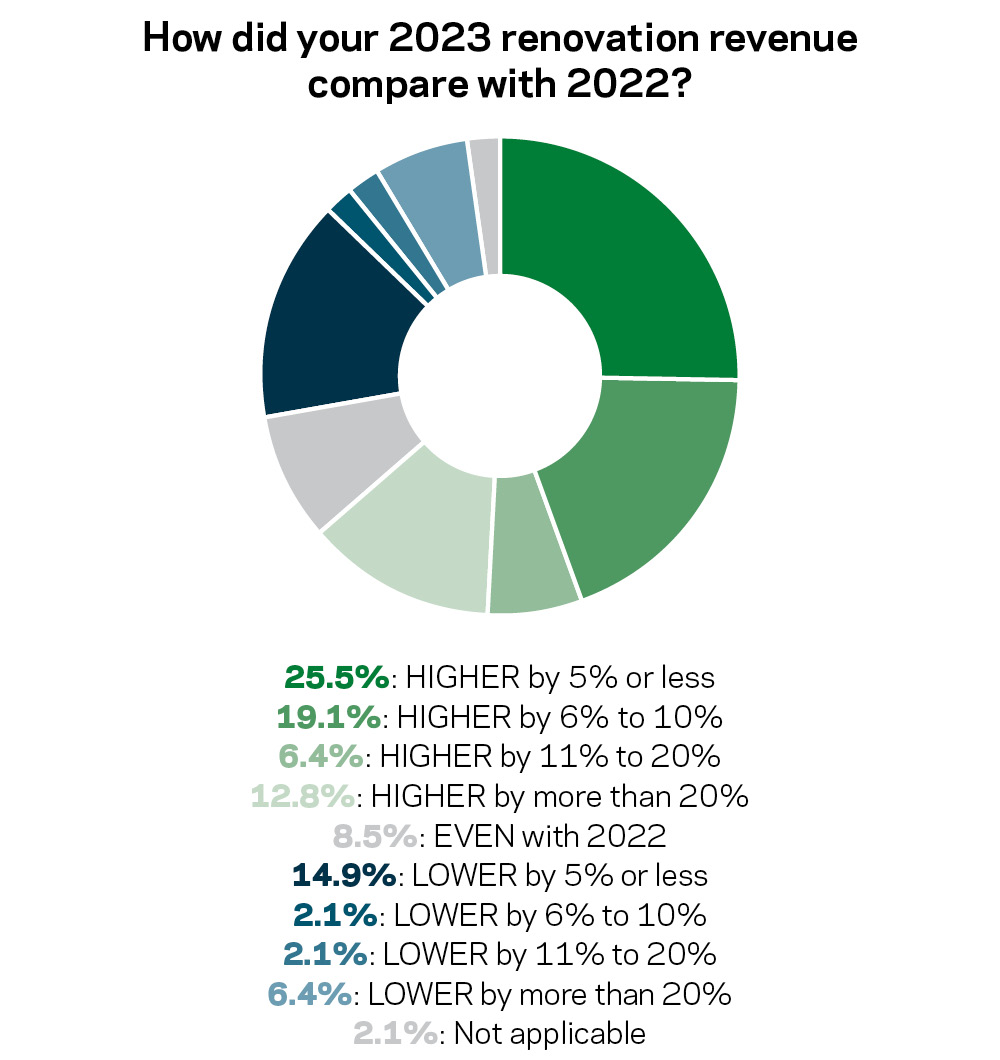

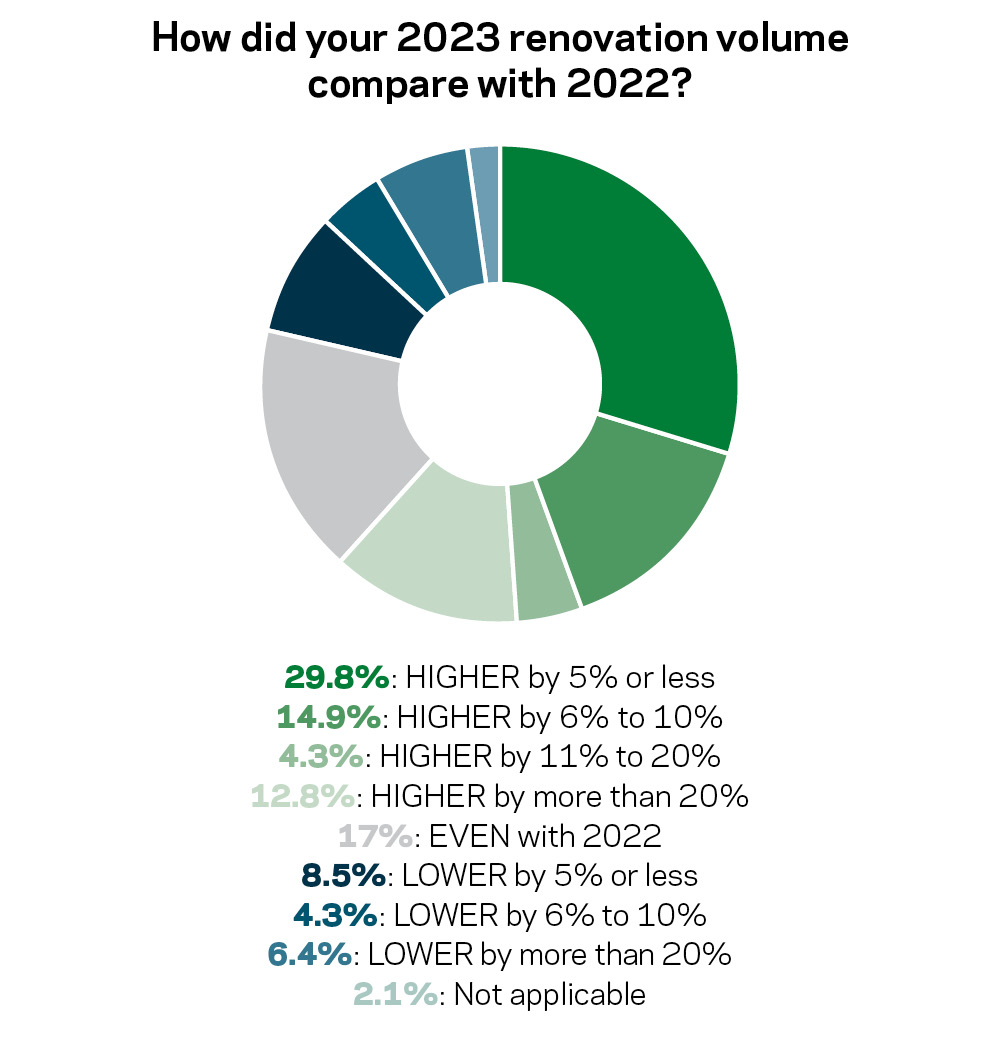

The graphs below use a color gradient system, with blue indicating decreases and green indicating increases. The darker the color, the higher the increase or decrease.

We start by looking at how these companies performed last year. Knowing that inflation can artificially boost contract prices,we did a comparison of residential construction revenue (top) to profits (immediately above). In both cases, the news was positive: A full 61.7% reported higher revenues than the year before, while 66% reported increased profits. For both revenues and profits, 12.8% said 2023 mirrored 2022. On the other hand, 25.6% saw lower revenues and 21.3% reported lower profits.

The two charts above compare 2023 new construction revenue and volume among the Top 50 builders. While it appears revenue and profit lined up for the most part, the numbers skewed slightly in favor of revenue, with 43.4% reporting increases, while 36% saw increased volume last year. When it came to decreases, more were reported for volume (38.3%) than for revenues (34%).

In the above two charts, we look at revenues and volume for renovations. Clearly more builders saw growth here than from new construction in 2023, but the numbers favored volume over revenue. Almost 62% performed more renovations in 2023 than in 2022, while relatively fewer, 53.8%, saw increased revenues from renovations, perhaps suggesting lower-ticket projects. But renovations clearly are on the rise. Of the Top 50 Builders, 43.8% reported performing more renovations in 2024, compared with the same time last year. Another 43.8% have done the same amount.

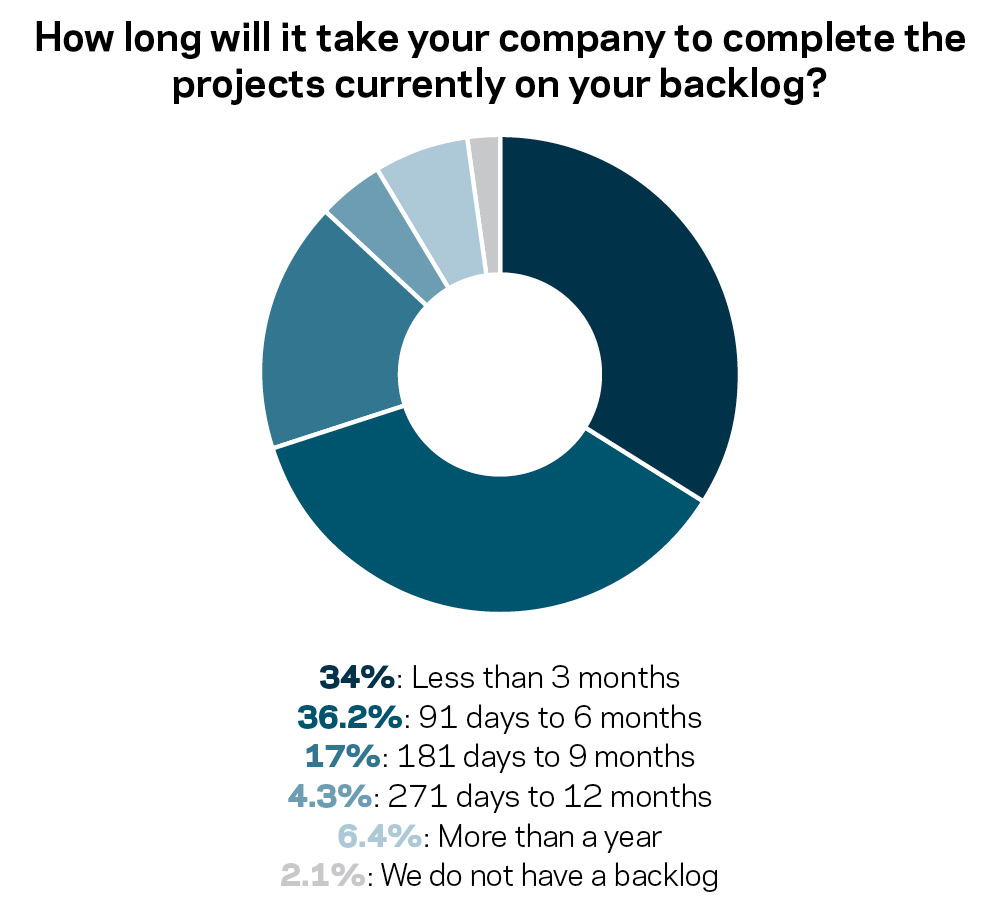

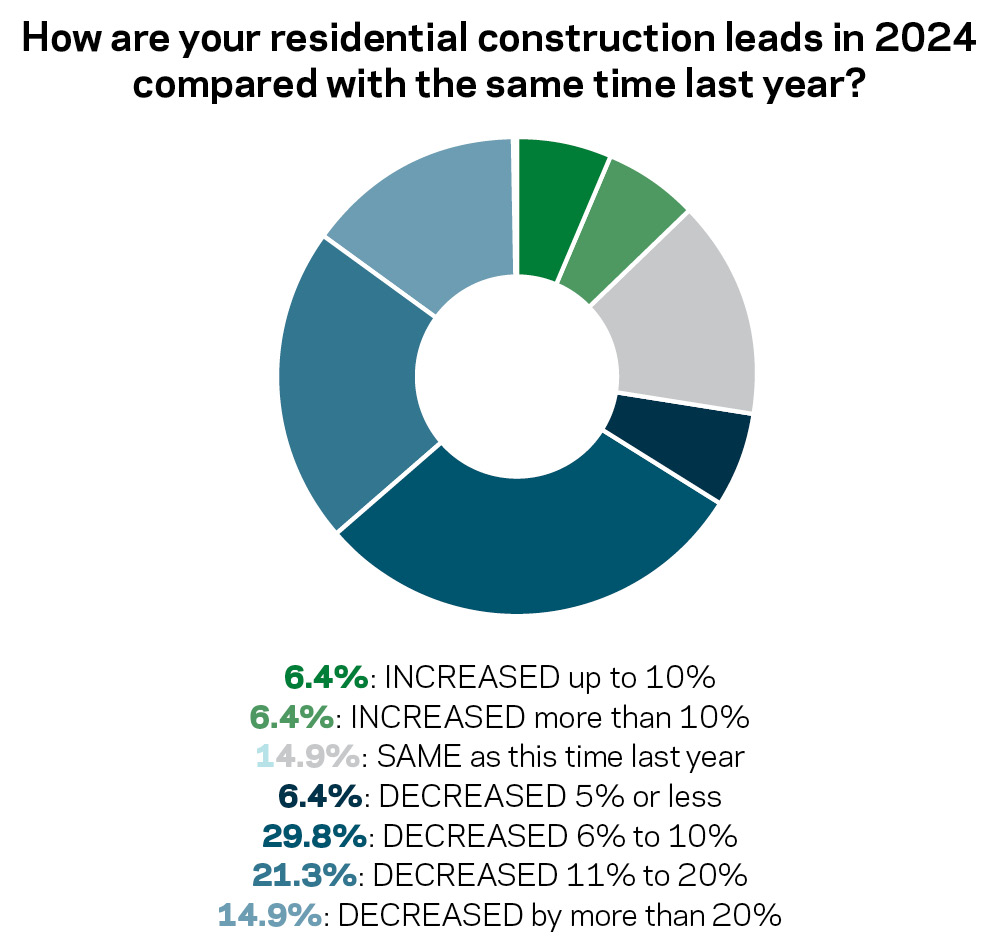

The Top 50 Builders are keeping busy this year. As of May, more than 64% expected to work on their backlogs for more than three months. But consumer interest had shown a decline: More than 70% saw a decrease in leads compared with the same time last year, while only 12.8 saw and upward trend.

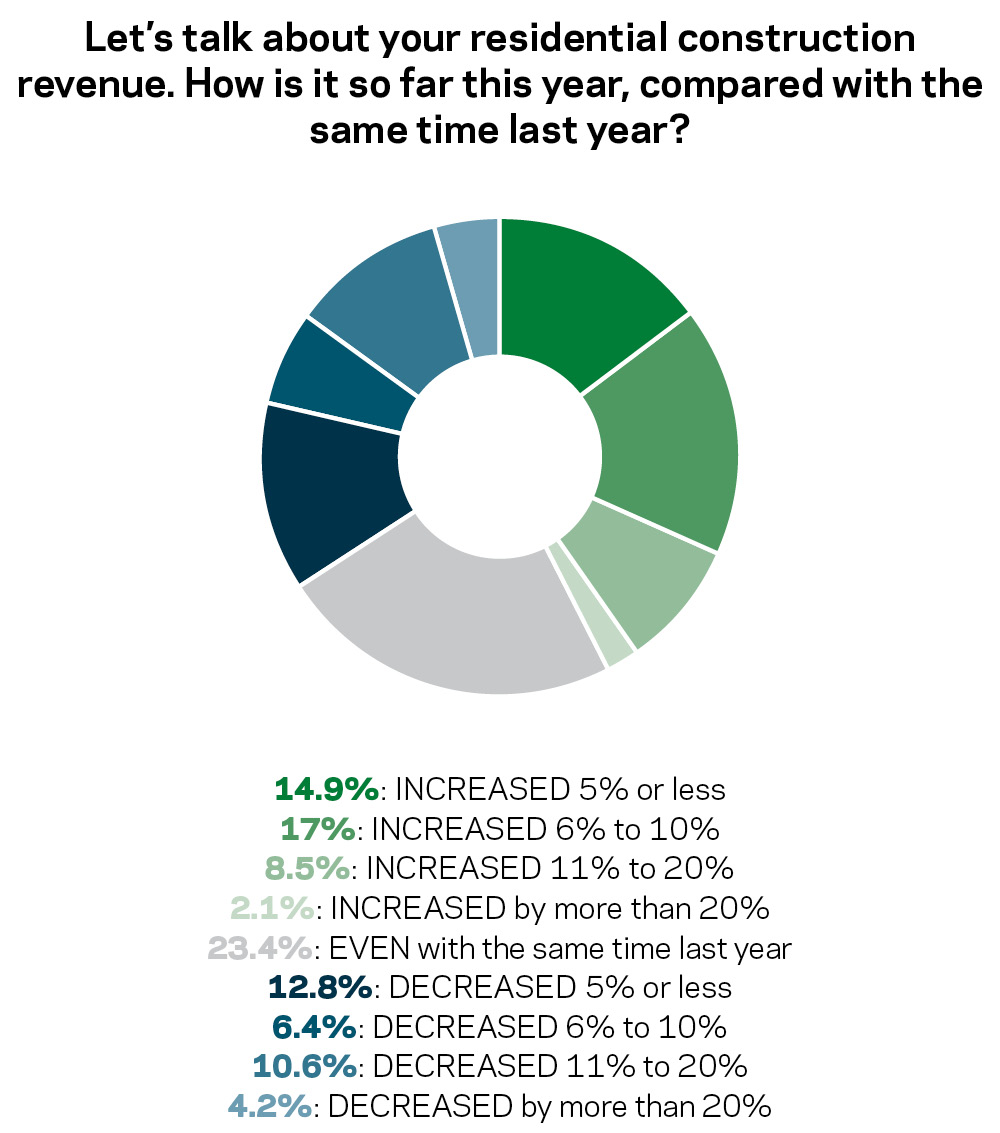

For the most part, these builders are having a positive 2024 so far, with 65.9% seeing increases or remaining even. However, 34% are experiencing reductions.

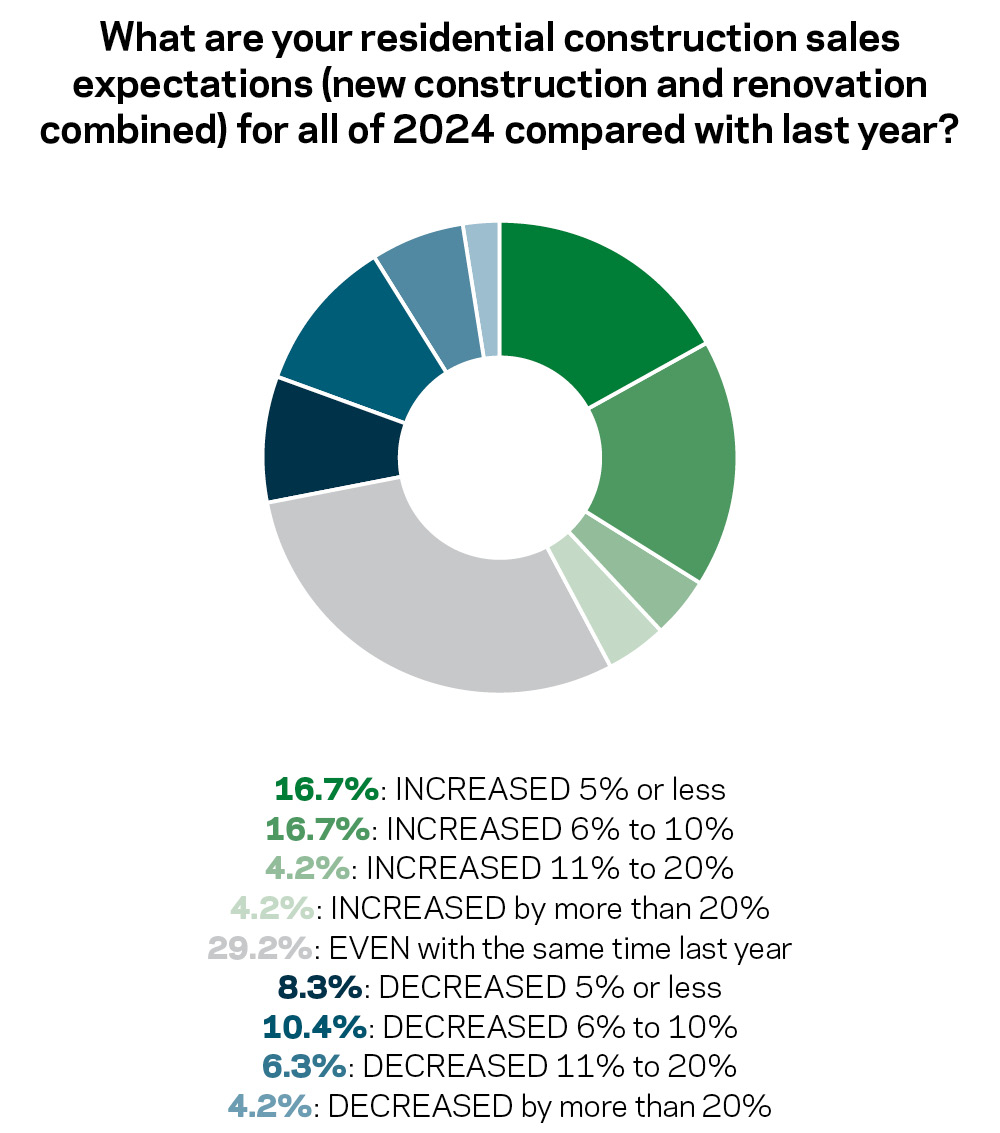

A mostly positive outlook: 71.2% expect residential construction sales to increase or remain even this year. Just over 26% expect a downtick.

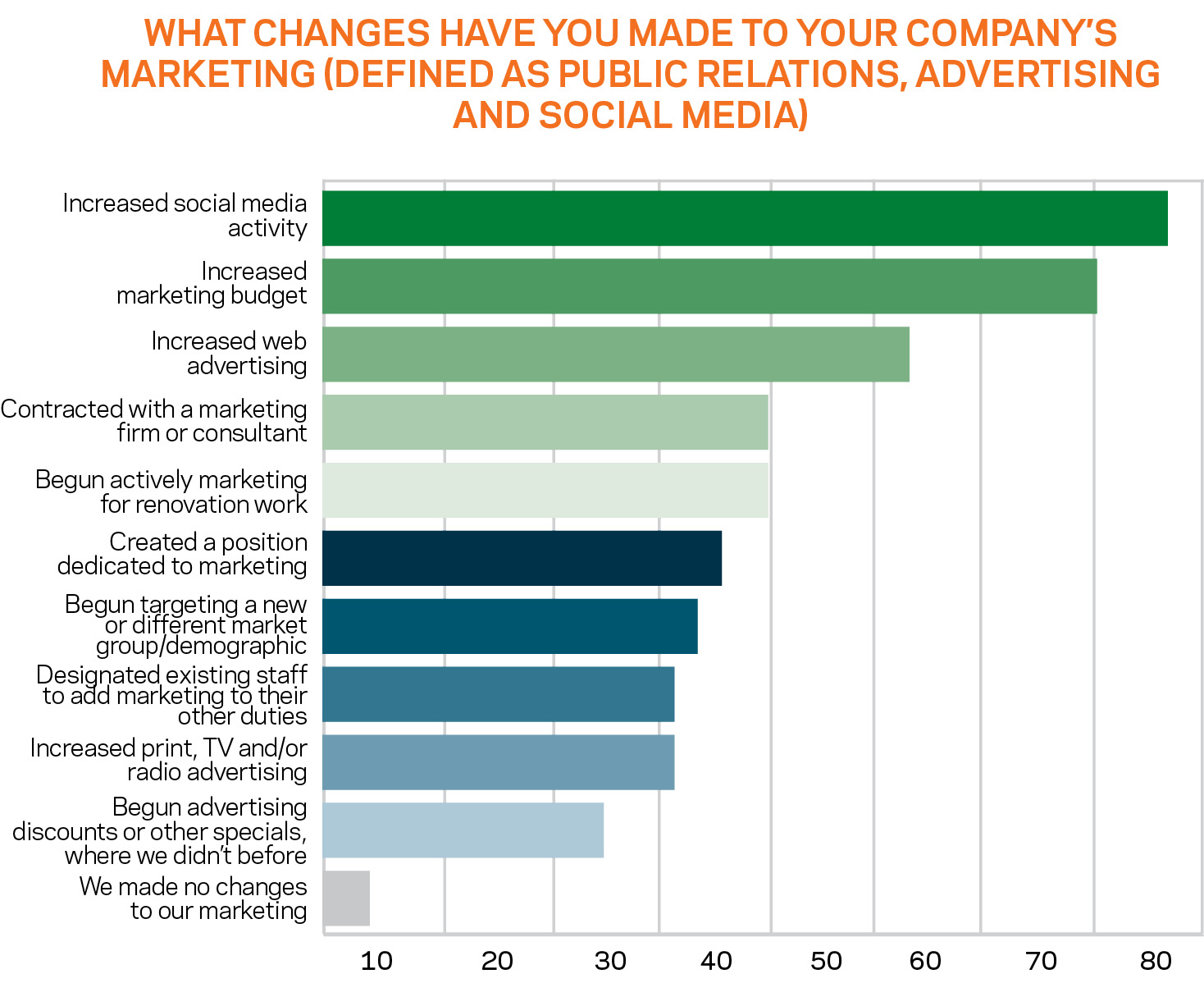

Fewer consumers are knocking at their doors, so builders now invest more in marketing, with 70.8% raising their budgets. Increased social media and web advertising were the most popular changes.

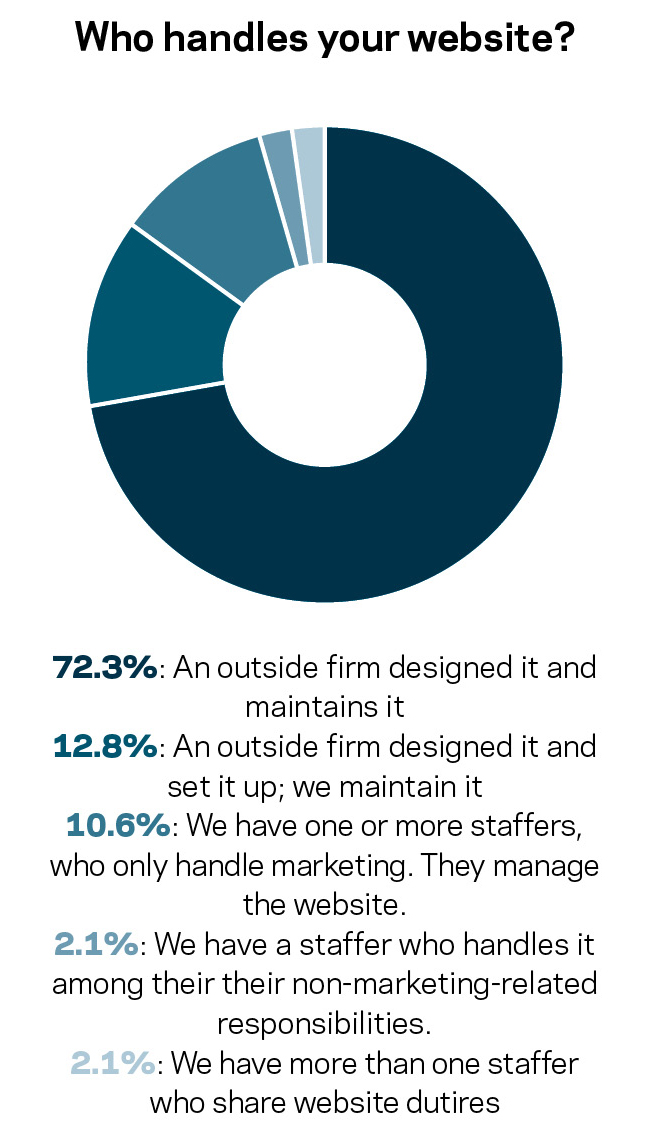

Websites among the Top 50 Builders have noticeably evolved over the last few years, so we asked how they manage their websites. This group overwhelmingly has turned to professional help on this front.

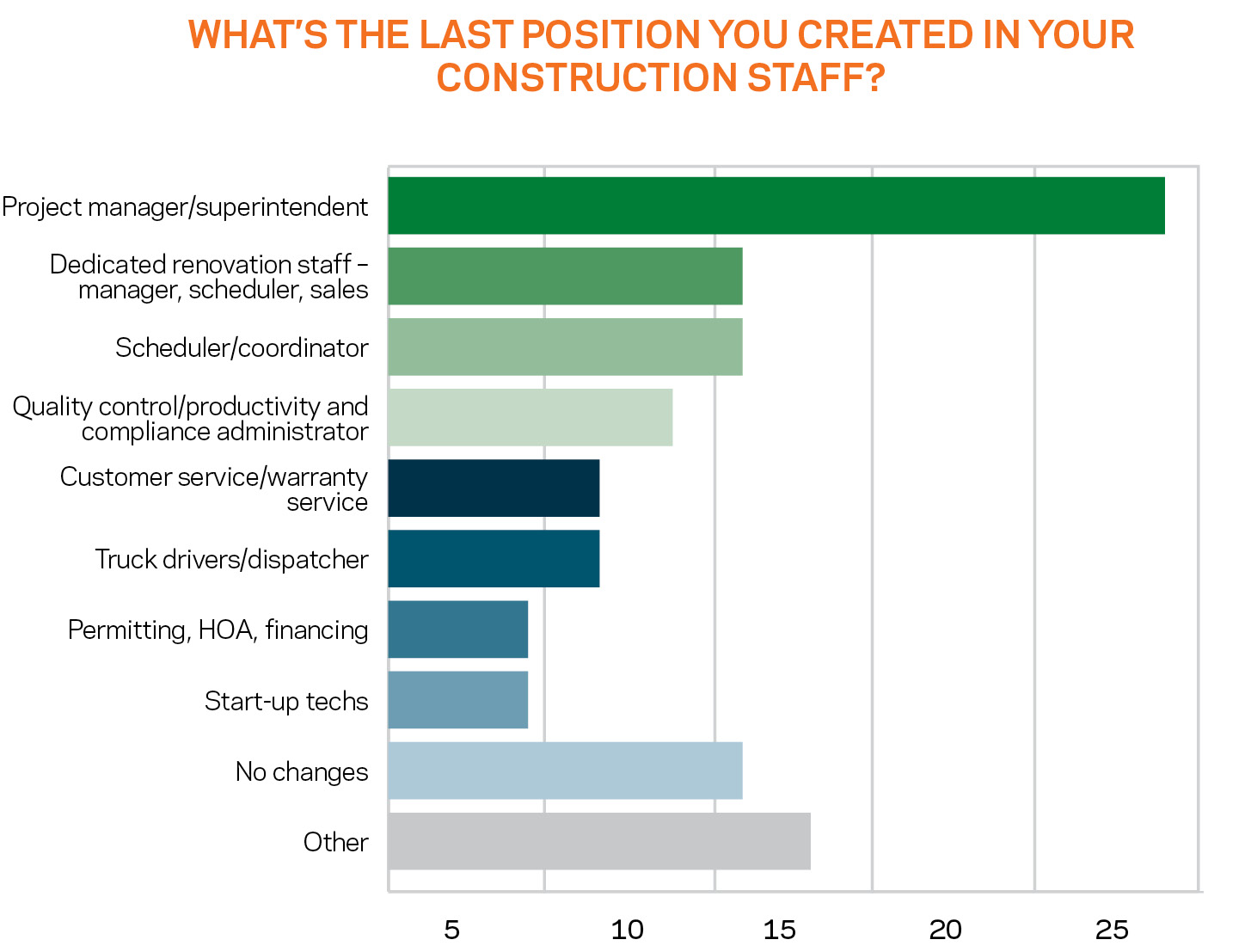

This chart shows what percentage of builders last created each position. Project manager/ superintendent was most popular by far, with nearly a quarter of respondents recently creating that position.In another question, Top 50 Builders were asked what position they’d like to create next. Here, too, project manager/superintendent/foreman stands at the top of the wish list.

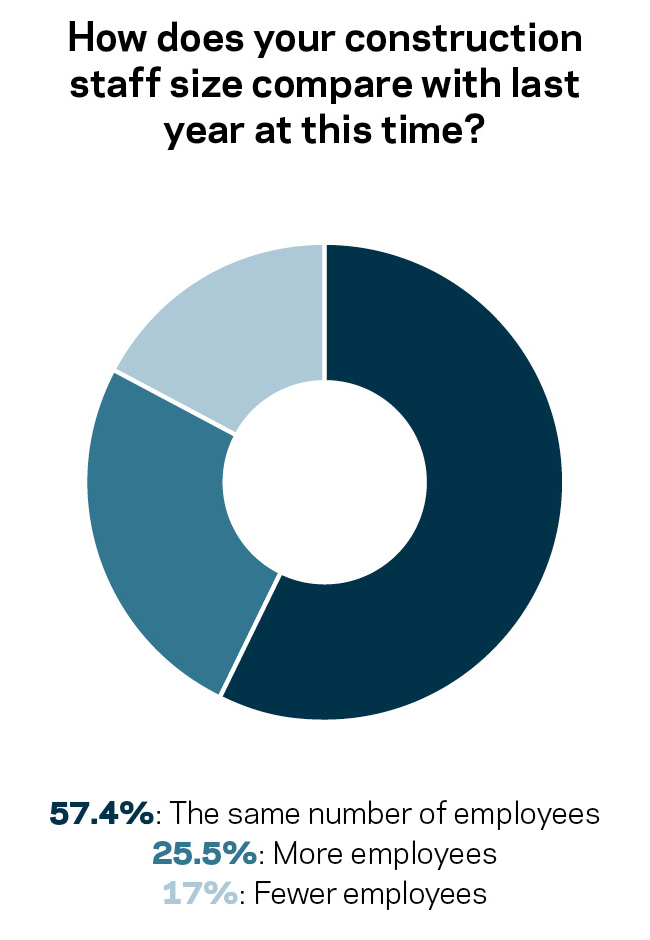

Despite some of the challenges being faced, 82.9% have increased or maintained staff sizes.