The times remain uncertain, but Top 50 Builders are holding steady, as evidenced by our annual survey of this group, in part covering performance in 2024 and this year so far.

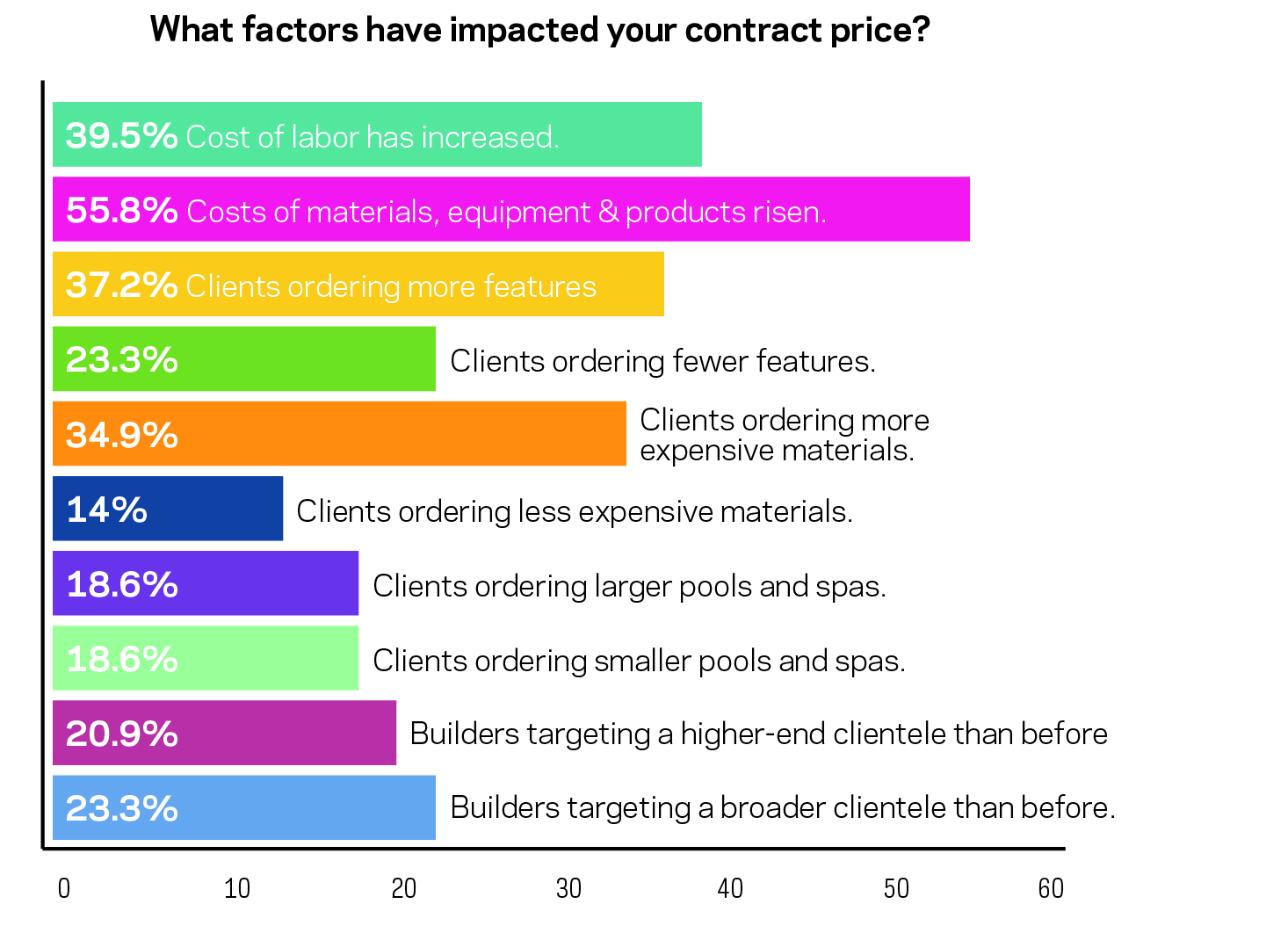

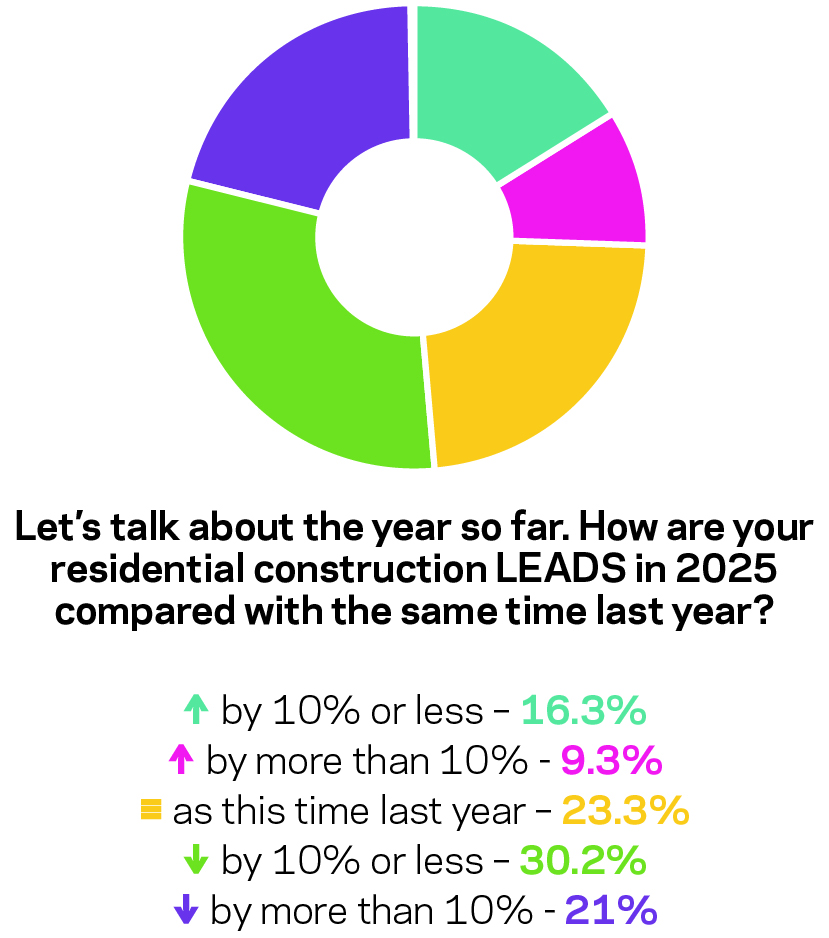

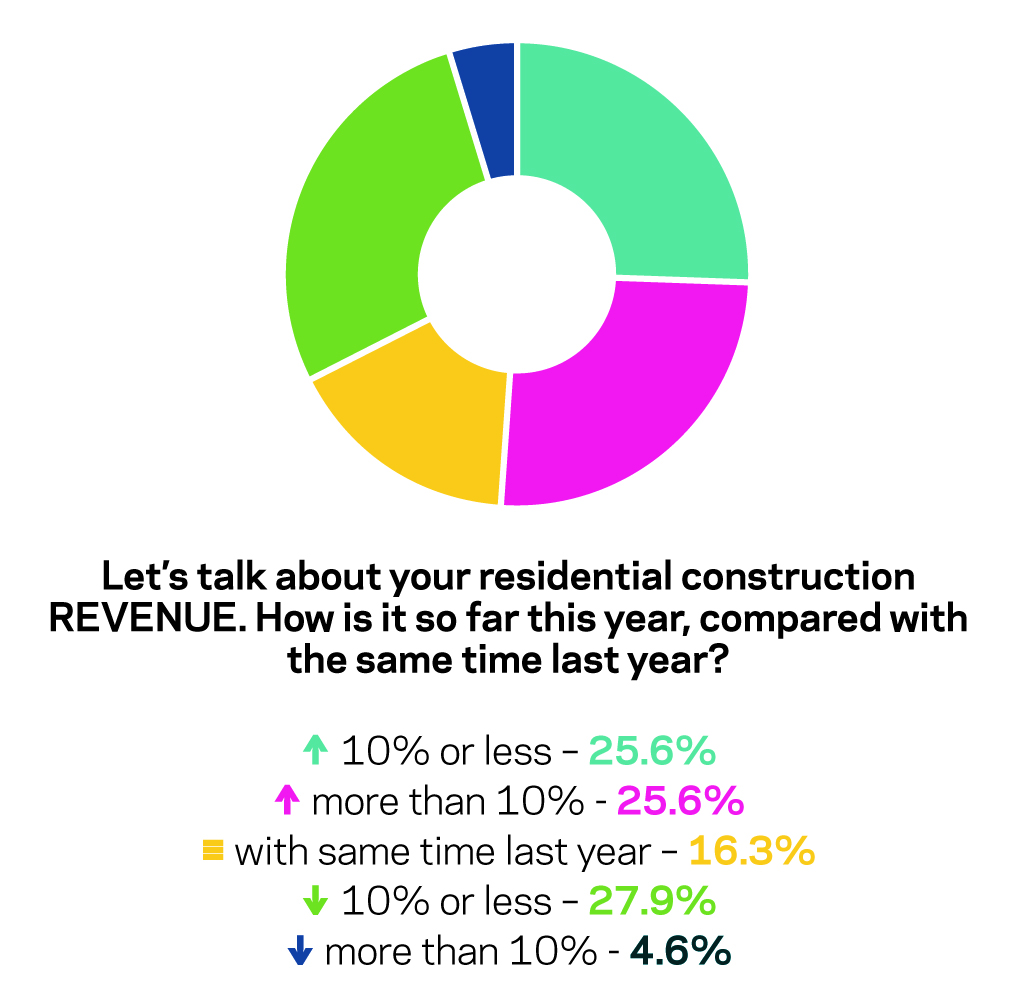

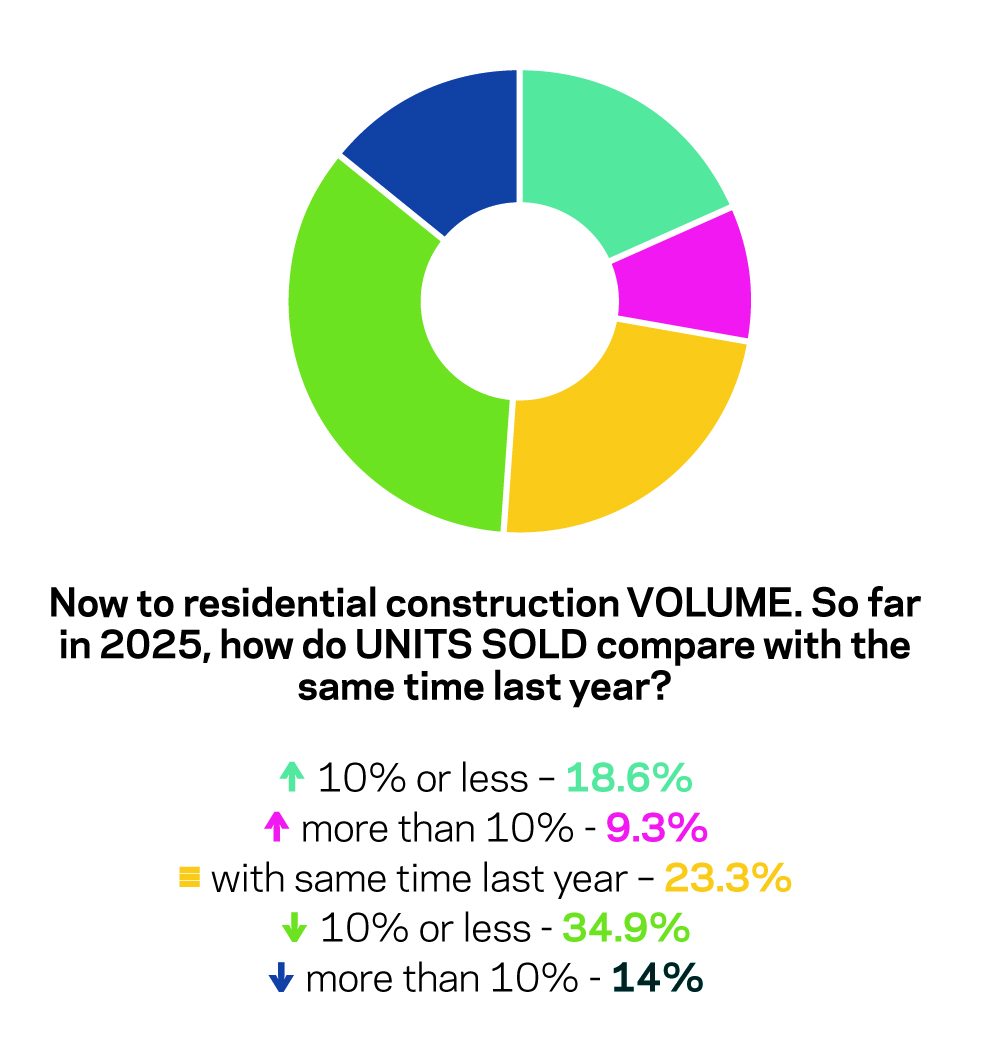

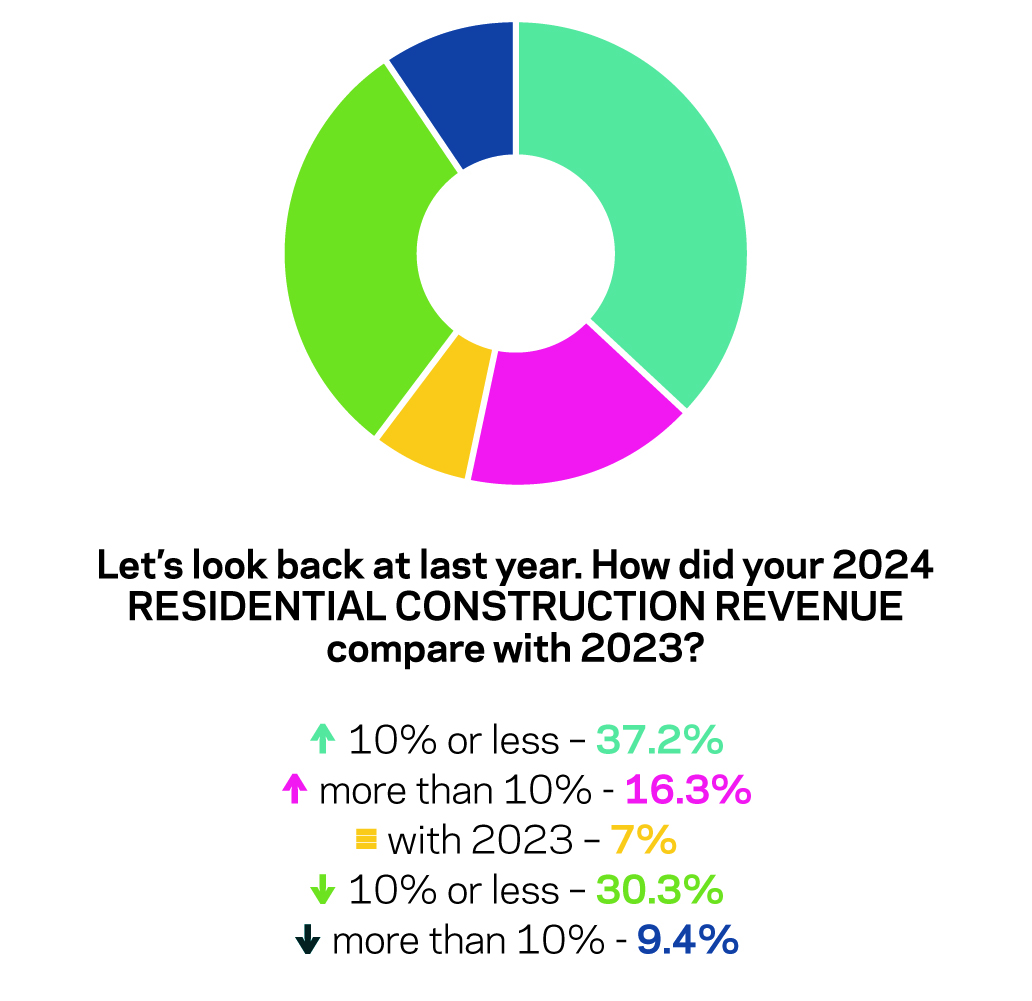

Leads and volume continue to decline, with about half of these builders reporting drops in both so far this year. Many of the Top 50 have offset this by building higher-ticket projects, as seen by an increase in average contract prices. This left just over 50% enjoying year-over-year boosts in revenues from residential construction, despite the downward trends in volume.

But it’s also clear that many builders continue looking to other revenue streams to compensate for reductions in new construction. Asked what they believe presents the biggest opportunity for the time being, 35% said not in new construction, but renovation or service/maintenance. In response to another question, 53.5% said renovations account for more of their work in 2025 than last year.

Top 50 Builders also were surveyed on their attitudes, experiences and expectations regarding current trends and issues such as private equity, tariffs, and succession planning.

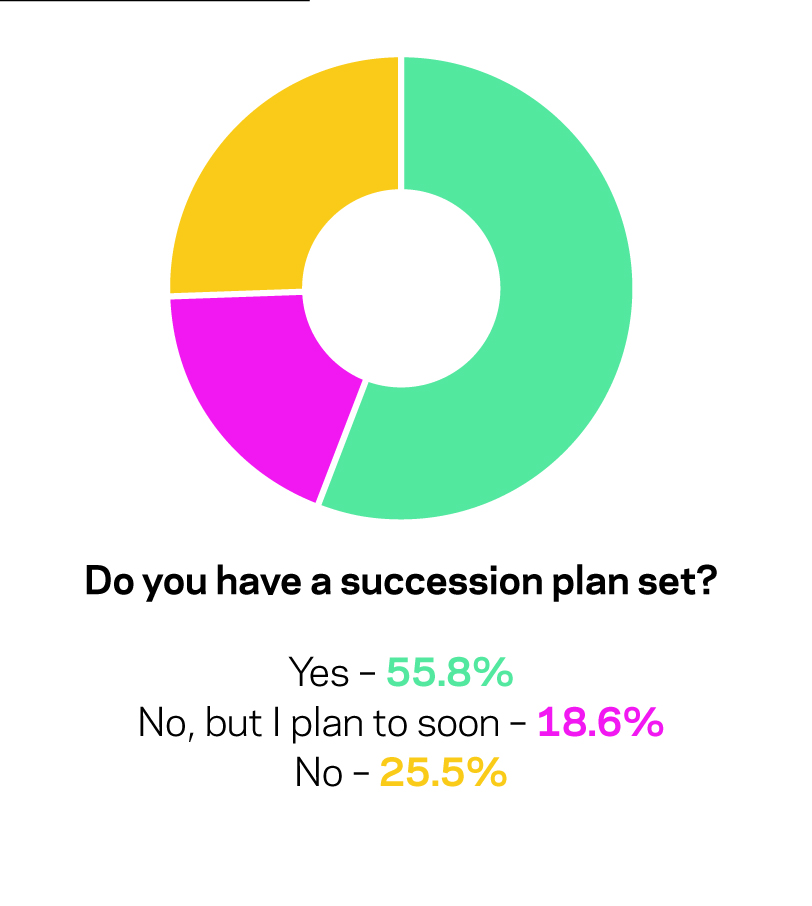

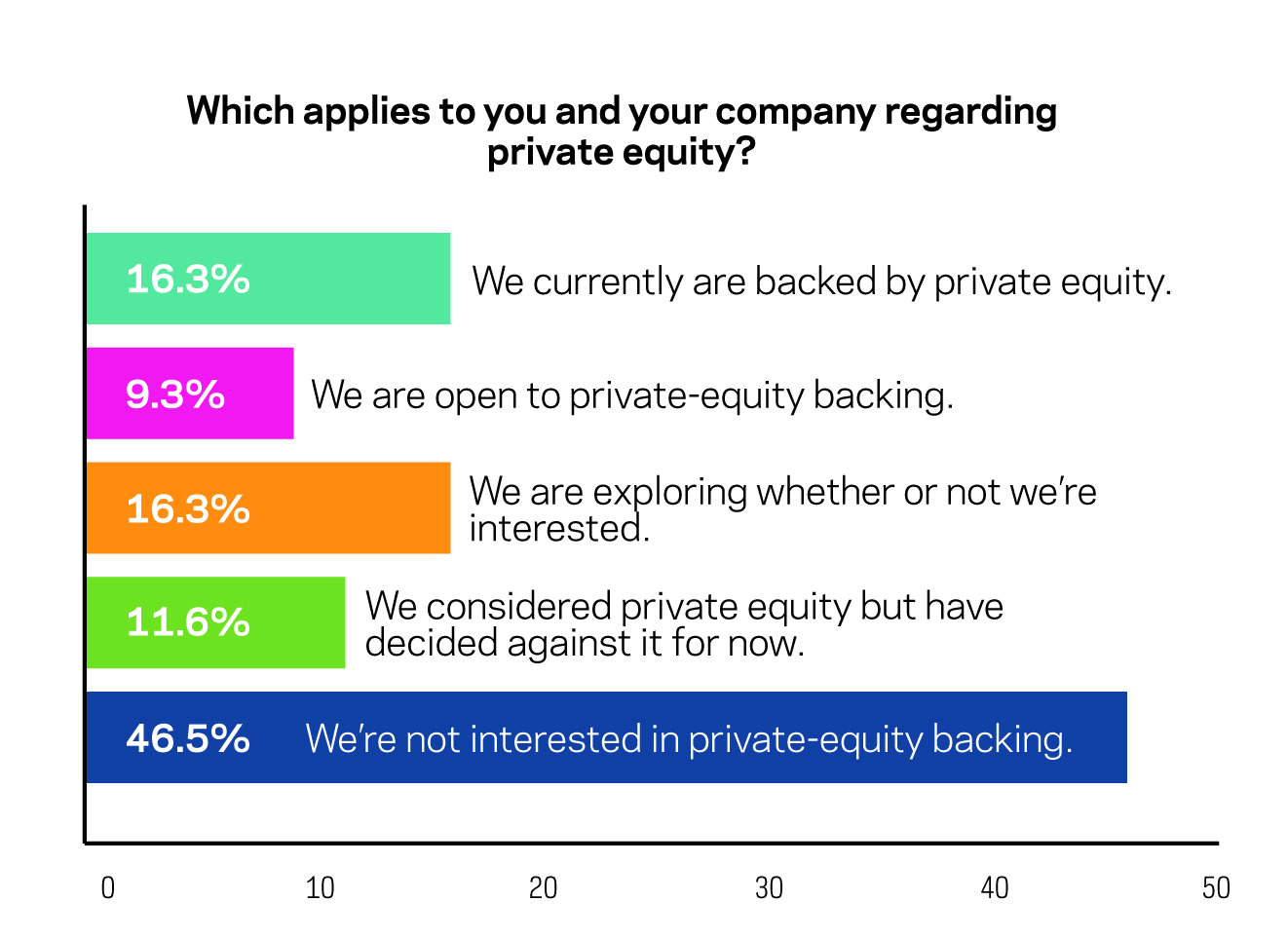

While times are changing, major shifts are generally incremental, and we’re seeing that here. Asked about private equity investment as it relates to their own firms, 16% revealed they already have such backing. But nearly half are not interested in it for their own companies. While private equity and franchising may have set the path for some companies to bridge generations, nearly half of the Top 50 have yet to determine their succession plans.

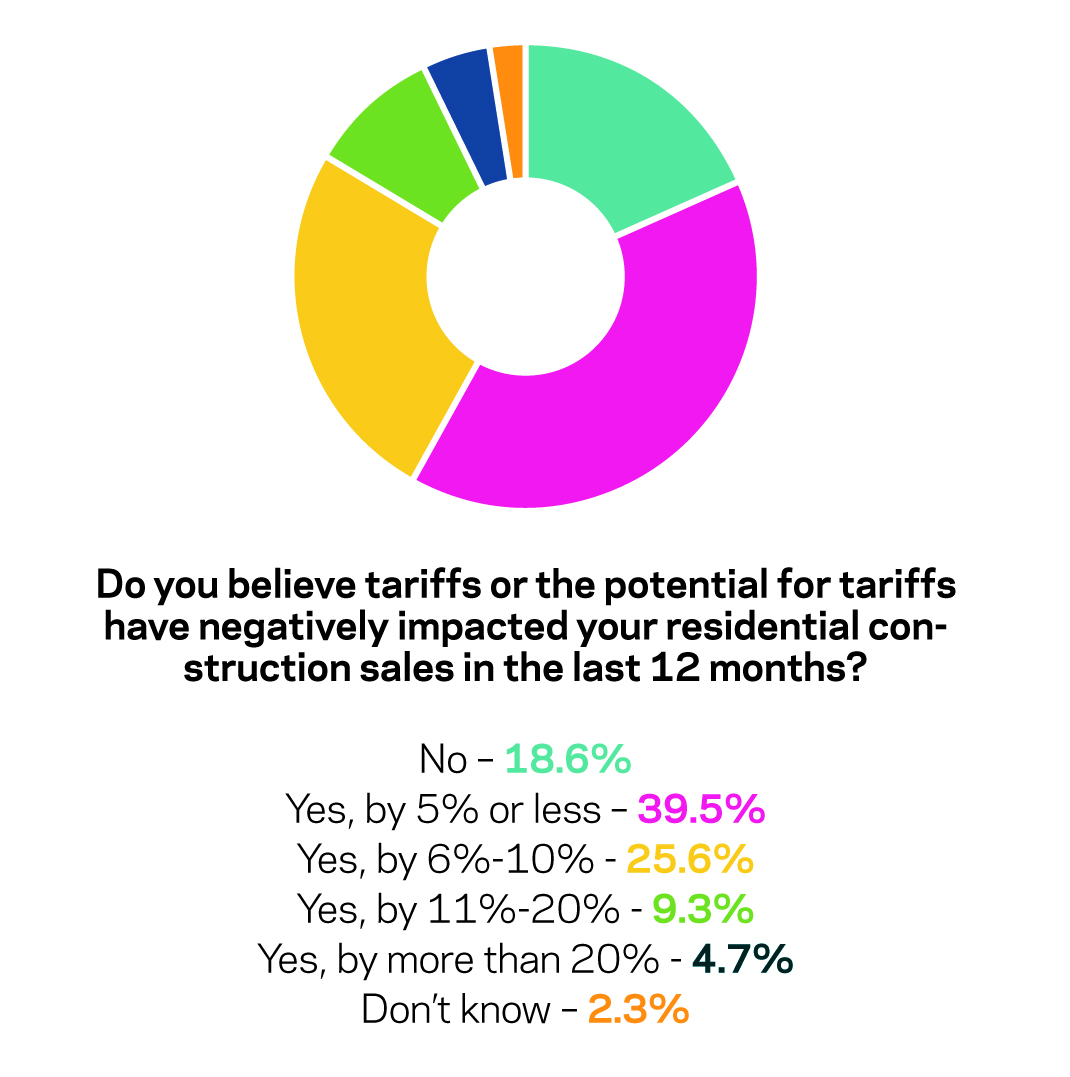

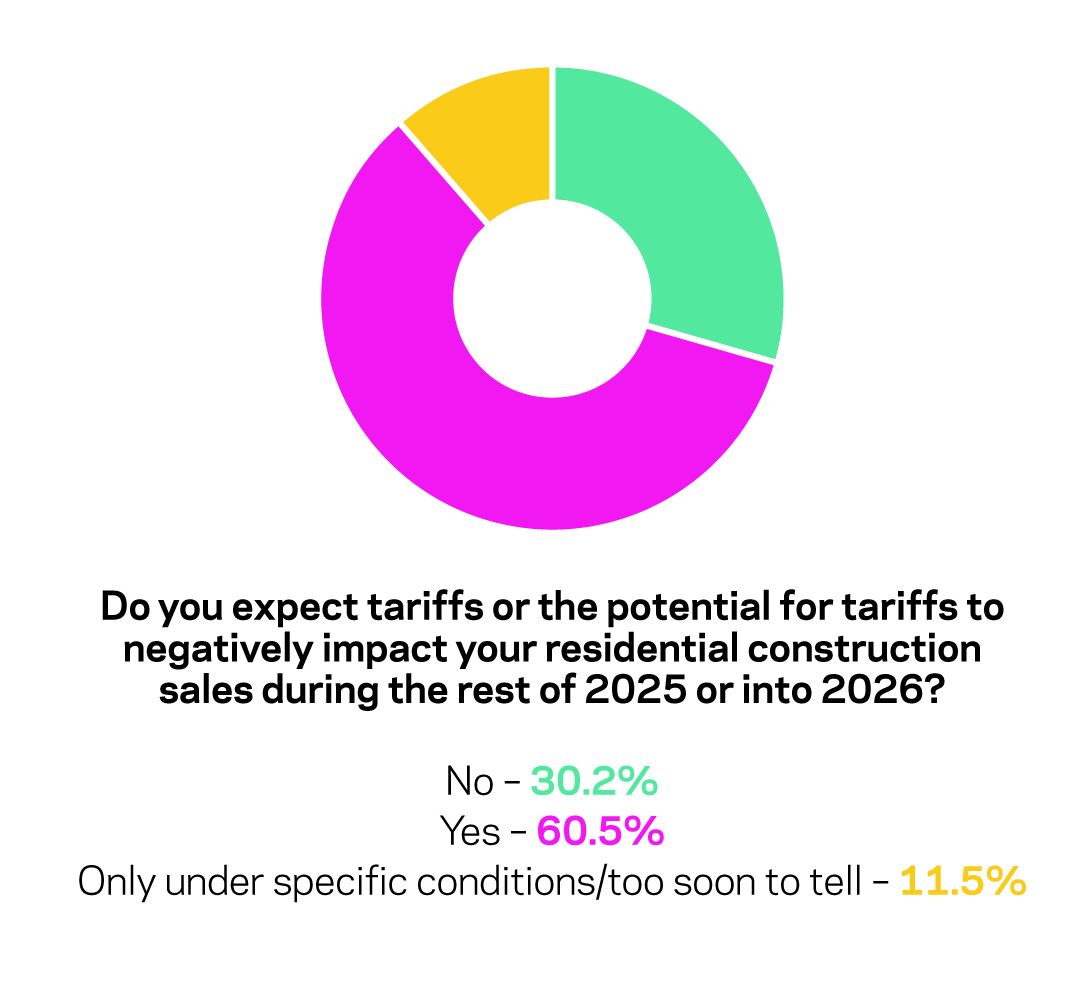

The concerns facing the entire industry have not escaped these companies. The question of tariffs weighs heavily, with almost 80% saying residential construction sales were adversely affected by the issue, and more than 60% expecting negative impacts in 2025 and 2026. When asked for their biggest worry for this year and next, 49% cited economic uncertainty.

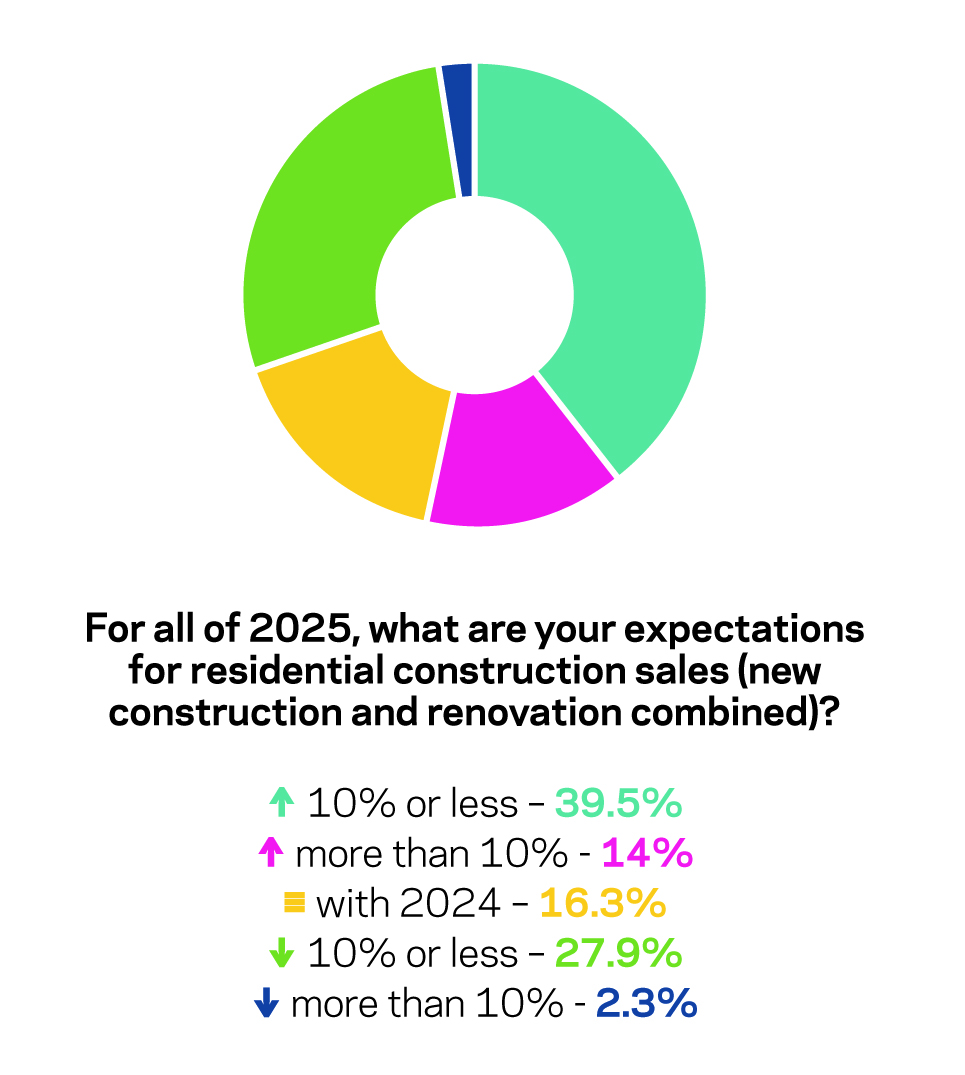

But overall, this remains an optimistic group. Looking to the rest of this year, 53.5% foresee an increase in residential construction revenue. The boosts are expected to be modest, with 39.5% projecting increases of 10% or less.

The Year So Far

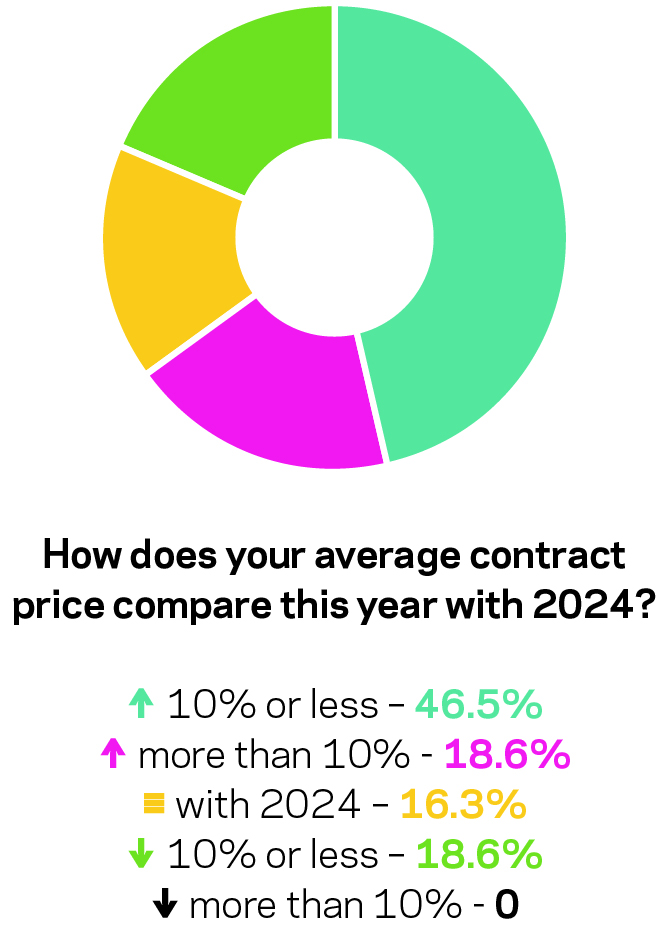

Nearly two-thirds of the Top 50 — 65.1% — have seen an increase in average contract price since even last year. Of these, 20.9% of respondents said the price has risen 5% or less, while 25.6% have seen hikes of 6% to 10%.

Nearly two-thirds of the Top 50 — 65.1% — have seen an increase in average contract price since even last year. Of these, 20.9% of respondents said the price has risen 5% or less, while 25.6% have seen hikes of 6% to 10%.

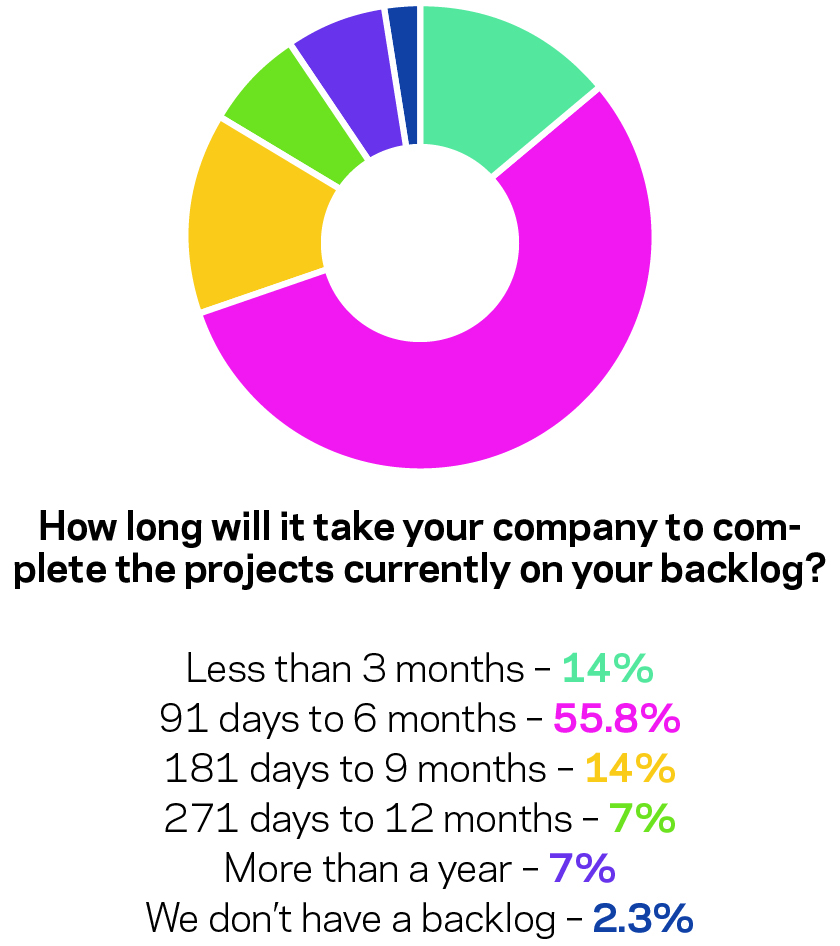

While year-long backlogs may have become less common, many of these builders remain busy, with more than half enjoying a backlog of three to six months.

When it comes to leads this year, the trend has definitely gone down more than up. Just over half – 51.2% – reported decreases. Breaking that down further, the largest portion of these builders report decreases of 5% or less.

Just over half have seen residential construction revenue rise compared with the same time last year. Even among those who saw decreases, they were very small, with 20.9% reporting decreases of 5% or less.

Almost half — 48.9% — reported year-over-year drops in volume so far in 2025. However, 23% said those decreases capped at 5%.

In These Times

Tariffs remain a concern for these builders, with just under 80% believing their residential construction sales have been negatively impacted by tariffs, and just over 60% expecting them to have such an effect in the near future.

Succession planning remains a pain point even among Top 50 Builders, with 44.1% saying they have not yet developed their strategies.

As the industry consolidates, more Top 50 Builders have taken private-equity backing. However, most companies in this year’s group do not see it fitting in their business models for the time being.

A Look at Last Year

Last year, 53.5% experienced an increase, while 39.7% saw a drop. Broken down further, 18.6% saw increases of 5% or less, while the same reported boosts of 6% to 10%.

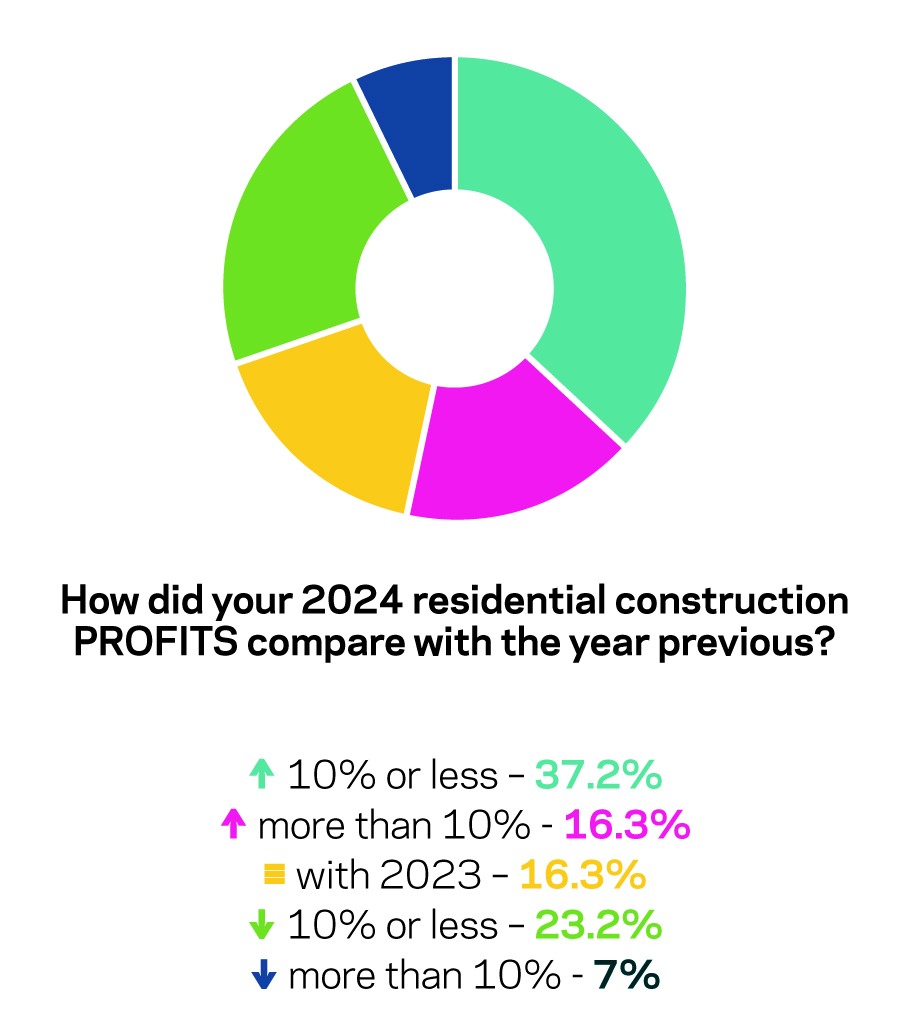

The profit comparisons closely resemble those for revenue. Of those who reported increases in profit from 2023 to 2024, most saw hikes of 5% or less, with 27.9% of respondents citing that amount.

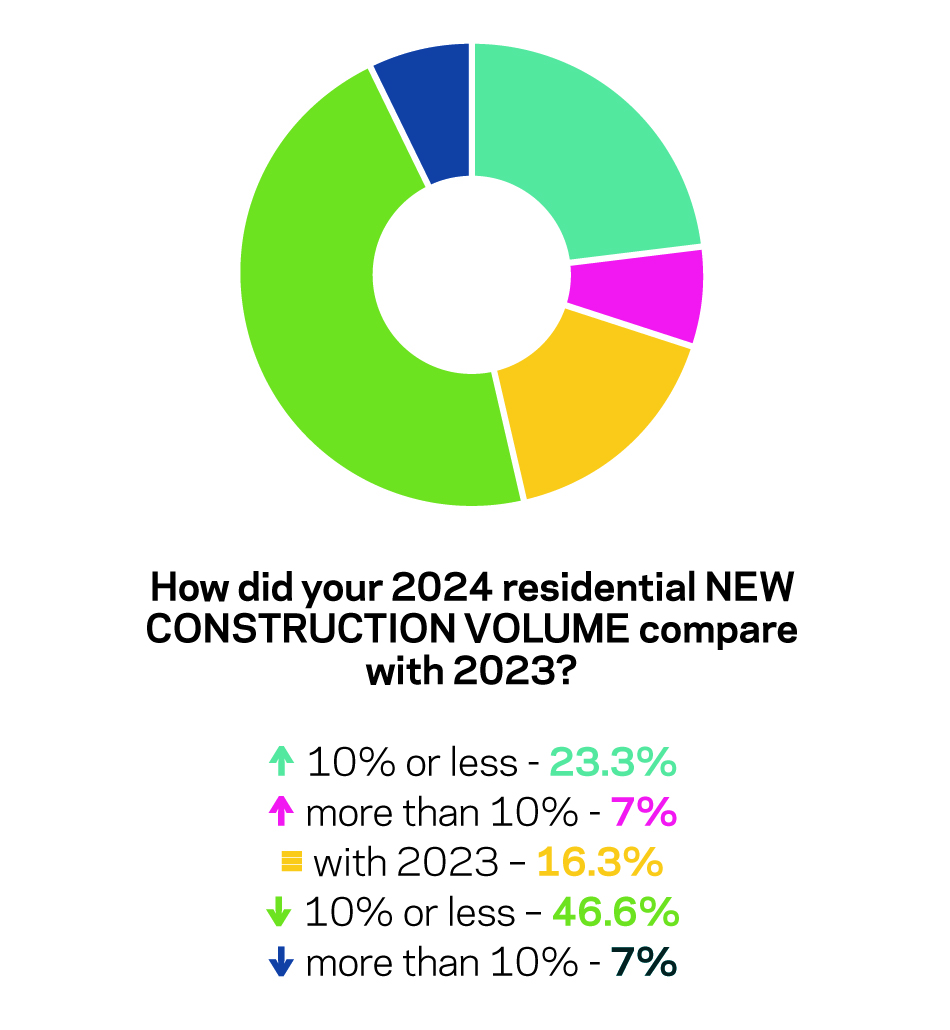

With number of new pools and spas built, the trend remains downward, with 54.3% building fewer units in 2024 than the year before. But both the up and down side favored smaller changes.

In projecting for the year ahead, hikes are expected to be very small, with 20.9% anticipating increases of 5% or less. Drops are expected to be moderate, with 20.9% expecting drops between 6% and 10%.