NICK ORABOVIC

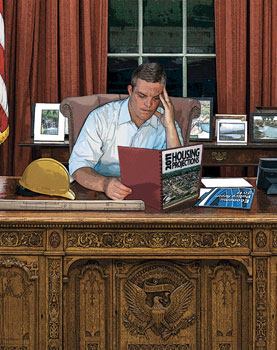

Saddled by crushing debt, high unemployment and a plummeting housing market, the U.S. economy has seen brighter days. But whether the nation’s current leadership has the chops the reverse the slide remains to be seen.

Enter the Top 50 Builders.

Recently, Pool & Spa News sat down with the decision-makers from five of the country’s most successful swimming pool construction firms to tap their wellspring of wisdom. The discussions ranged from corporate taxation to unemployment benefits to incentives for green technology — all with the goal of providing lasting prosperity across the land.

Following, in their own words, are excerpts from those conversations.

On taxation

Paying its bills while balancing the budget has proven a persistent challenge for the federal government. But is major tax reform the answer? Can we live without the IRS?

Cecil Fraser, CEO, Swan Pools, Lake Forest, Calif.: The solar industry, for instance, has tax credits, so why not have tax holidays or tax incentives for small businesses? There’s a huge number of U.S. companies capitalized at under $100 million. So if we had a tax holiday, which is equivalent to these tax credits we have on solar — do it for 5 years — and under a certain level of capitalization. You could reduce small business operating costs by 5 percent just through a reduction in taxes.

We also need to encourage the people who drive business to innovate and take risks. So let’s reduce the risks and put some money in their pockets. Companies must be able to buy the new toy, invest in the new product — do the things that help drive the business. We should give them an incentive to do that, but only based on their ability to be successful. I want to give a tax credit to those who generate tax revenue — the people who sell things, and build things.

Ken McKenna Jr., president, Tampa Bay Pools, Brandon, Fla.: There should be a flat tax, and get rid of the IRS altogether. We don’t need it — it’s ridiculous. How many illegals and others are out there who float under the system, that don’t pay taxes, and that the government has to go after? All of them buy things, and this way they have to pay taxes. I think a national sales tax, or some kind of flat tax, would be a very good thing.

Steve Ast, vice president of sales and marketing, Shasta Pools & Spas, Phoenix: The U.S. is the most corporately taxed country in the world. It’s no wonder many of the big corporations strategically put plants overseas, or set up headquarters in small towns in Switzerland, for example — it’s only because it reduces their corporate tax structure so much. And this adds up to billions of dollars. I think corporate taxes should be reduced, and a national sales tax could then be introduced. That would stimulate the economy, and you would start to see businesses bringing back employees, plants, etc. You can stimulate your way temporarily to job growth, but not for the long term.

Ron Robertson, owner, Robertson Pools, Coppell, Texas: I think we should have a national flat tax of 17 percent, and nobody gets a refund. The nation would actually be much better off, and you could do away with the IRS completely. For example, we have an education problem here in Texas, but we also have a Robin Hood plan. Instead, we should assess a 1-cent sales tax for education on everything purchased in the state of Texas, across the board. And quit stealing from rich school districts to fund poor ones. But they won’t do it, because those people in the poor districts don’t want to have to pay that extra penny.

On stimulation

Despite the government spending billions to jumpstart public and private businesses, unemployment remains perilously high. Do solutions lie in innovation, or perhaps in public works?

Ken McKenna Jr.: During the Great Depression when FDR came in, the government basically funded construction of the infrastructure of the United States. They built dams and bridges and so forth, and a lot of that work needs to be redone today. The levees in New Orleans were never completely fixed after Katrina; levees in Northern California need repair; bridges in New York City and so on. Construction work creates jobs, and that’s one way to stimulate the economy.

Brett MacNally, partner, Performance Pool & Spa, Woodbury, Minn.: If you get out of the way of business, it’s been proven time and again that the jobless rate will drop. Stop regulating, stop raising taxes and fees, and stop making it more cumbersome to do business with all of these requirements and regulations. For instance, nobody should pay over half of their income in taxes (as some do in Minnesota). And they’re trying to raise taxes on the top earners again, another 4 percent. Those things make business owners not want to increase hiring, open another store, or take risks.

Cecil Fraser: Why don’t we take a look at green issues like water conservation, desalination, etc. We lose an inch of water a week to evaporation, and there are products that you drop in the water and they help stop evaporation. You could put an incentive out for that — that’s a green issue. We need water, and we have a growing population, so we need to drive things like water reclamation. It’s providing incentives in a positive direction, in a place we like to go. It’s a feel-good buy to a lot of people.

On government spending

Lawmakers in Washington have long struggled with a spending problem that borders on compulsion. So where’s the accountability? Is privatization the answer?

Ken McKenna Jr.: Every time the government collects money, they seem to find ways to put it into other things. It’s similar to the states that have a lottery that goes toward education. And it does. But what do they do? They cut the education budget by the same amount the lottery feeds it. So it’s not extra money for education. They’ve already proven that they’ve used the Social Security money elsewhere. So somebody would have to show me specifically where that money would go into paying down the debt and not be rolled into a regular budget that they can change where that money goes.

Steve Ast: You want to support your leaders who voted to go to war in Iraq and Afghanistan. But the American people don’t want to be in either one. I feel like the objective has gotten blurred. Plus, we’re offering so much foreign aid elsewhere when, economically, these billions of dollars could go to such good use in the U.S. Do the American people understand the objectives behind giving all those dollars away? Where’s the accountability that it’s even being well-spent?

In addition, we should reconsider health care, the Postal Service, Social Security, Medicare — all those need to be revamped. Fannie Mae and Freddie Mac — both should either be privatized or eliminated. Look at any opportunity where private business can do better than people in public office. We haven’t managed Social Security well, so let private companies manage that. Government just isn’t good at running those kinds of entities.

Brett MacNally: Someone has to have the political will to say “no” to entitlements. People on unemployment now are pushing what, two years? Many times there’s very little reason for them to want to get back into the job market. There’s this perception out there that they’re getting this money for free, which isn’t true.

The government is not being measured like the private sector — by what they accomplish. There’s no accountability. They can’t be fired — once they’re in, they’re in for life. The Post Office had a roughly $8 billion budget shortfall last year, and $5 billion of it was unfunded pension issues. Are you kidding me? Politicians, I hope, are on the verge of losing the faith of the electorate. Maybe it’ll take a debt default. It’s happening all around us — Greece, Iceland, etc. — and it’s all interconnected.

Cecil Fraser: The first thing I’d do is declare a permanent freeze on government hiring. And the second thing I’d do is require that for every new law we enact, we have to repeal, consolidate or get rid of two, because in that process you simply get to more pragmatic management of the overall system. These are things you can do almost by edict.

What Would You Do If You Were President?

Larry Duffy

Cameo Pools

Mesa, Ariz.

I’d focus on job creation as well as tax breaks for small businesses so they’d be able to hire people. I believe small businesses account for about 80 percent of the country’s employment, so [they should be given] more breaks to create more jobs. … Jobs are everything: You get jobs, you get tax revenue, and government can operate.

Debra Smith

Pulliam Aquatech Pools

Ft. Worth, Texas

I would reduce government, reduce taxes and spur economic growth. In my opinion, with the trillions of dollars spent on economic stimulus, the government could have given every U.S. citizen $150,000 or more, and the economy would have been rolling. Give small businesses tax breaks instead of taxing us to death, so we can actually hire people. Give the stimulus money to people who are actually working and paying taxes. … Also, if you’re collecting government assistance, you should need to get drug tested, just like you would for a job — or you get no benefits.

MikeChurch

Cody Pools

Austin, Texas

I would implement incentives for banks to provide lending to small businesses, which would in turn create a stronger job market.

Steve Foster

Caribbean Pools

Schererville, Ind.

Our platform slogan would be “Leadership with Integrity.” We would show America what genuine leadership looks like as an alternative to those that embrace a brand of “political integrity” that is more interested in the next election than how to solve problems. Our ultimate goal is a “trickle-down effect” where common courtesy and common sense, connected with a linchpin of honesty in all encounters, would permeate our society. Our administration would be held to the highest standards, not only in governing but also in our personal lives. … We would call on all Americans to follow our lead and reclaim the standards and morals that our country’s forefathers exemplified during those humble beginnings. Nothing will change without the majority wanting a better America and being willing to participate in the hard work that begins and ends with individual integrity and accountability.

Charlie Claffey

Claffey Pools

Southlake, Texas

Let’s increase our nation’s production model and reduce our dependency on imports. I would create “Made in the USA” tax breaks to re-instill the manufacturing arm of our country. Additionally, I would create “Produced in the USA” tax breaks for all domestically provided oil and natural gas. I would tighten up on unemployment and Social Security guidelines to assure that our tax dollars are going to our need-worthy people, not our lazy people.

MORE INFORMATION

Top 50 Builders Chart (PDF)See the firms who made it on the list this year.

- What Would You Do: Drain-Cover Recall

Top 50 Builders share how they would have addressed a recent and far-reaching product recall.

- What Would You Do: Immigration

How undocumented immigrants should be treated remains a hotly debated topic.