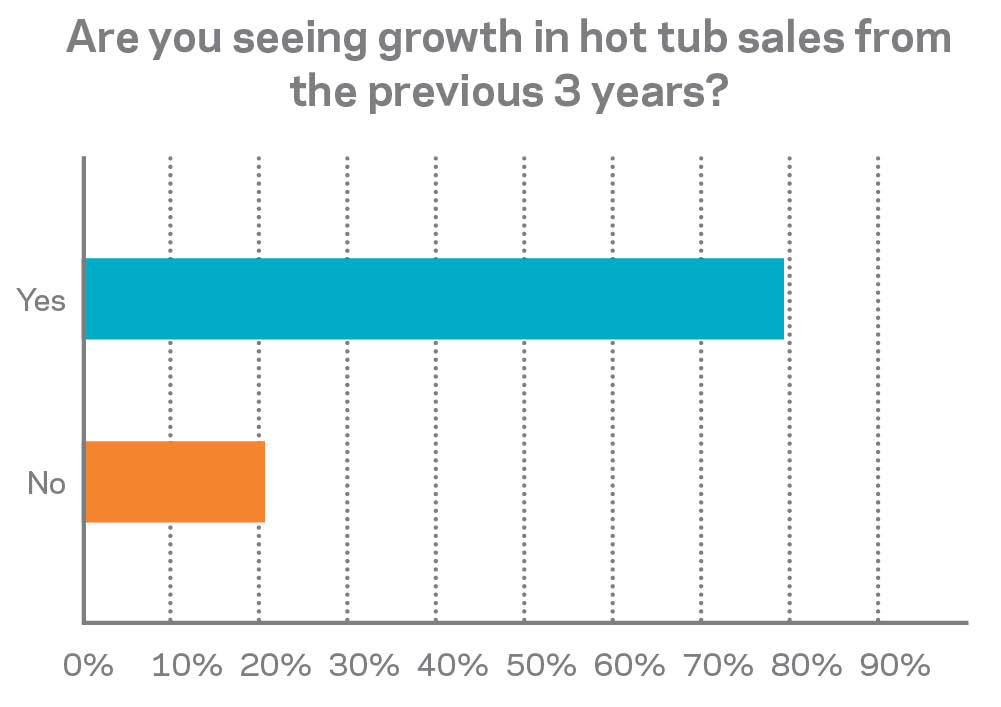

If a recent Pool and Spa News survey is any indication, things are looking good for hot tub dealers.

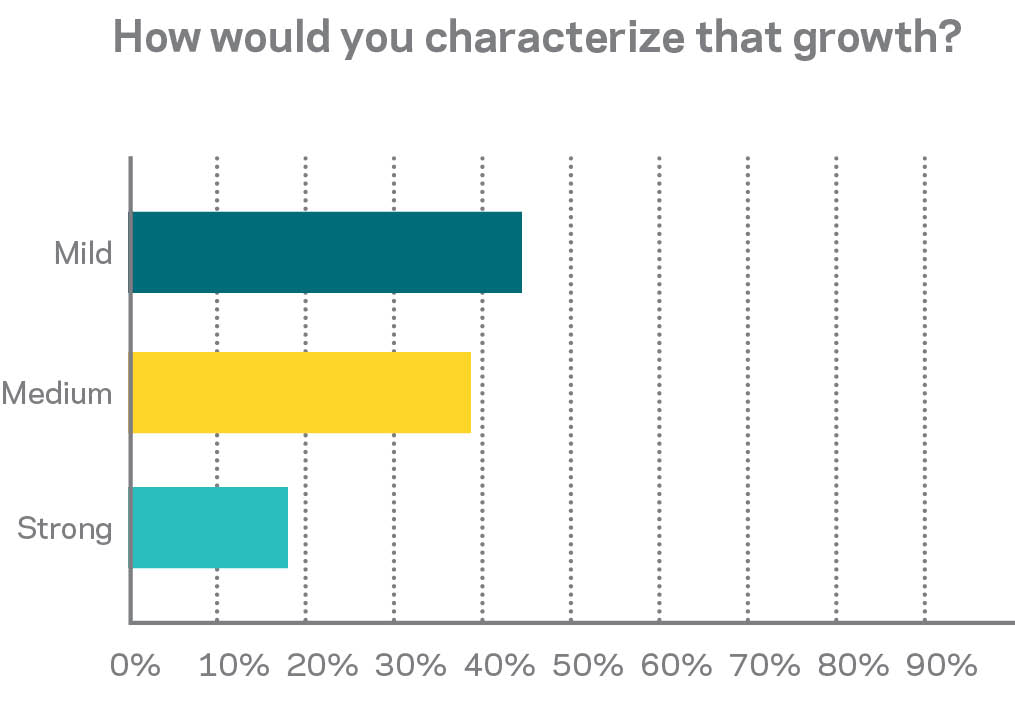

Eighty-three percent of respondents said they have experienced mild to medium growth in the last three years, with a whopping 92% forecasting continued success in the near future and 94% saying they are somewhat or very confident in today’s economy.

The combination of a strengthening economy and an adoption of digital marketing trends has led to more robust leads and sales. But as with any research, our survey also has uncovered a number of hot-button issues impacting the hot tub industry, both for good and bad.

As we turn the corner on the latter half of this decade and inch closer toward 2020, we’re taking a look at some of the biggest concerns hot tub dealers have and the ways in which they are adapting to the changing landscape.

Future Forecast

Across the nation, hot tub dealers are reporting growth. Some have even characterized the last year as their best.

Others compare current sales to the likes of the late 1990s and early 2000s. With at least 65% of survey takers somewhat confident and nearly the remainder very confident in the economic outlook, it would appear retailers are enjoying some much needed success. So much so, in fact, that some saw it as an ideal opportunity to expand.

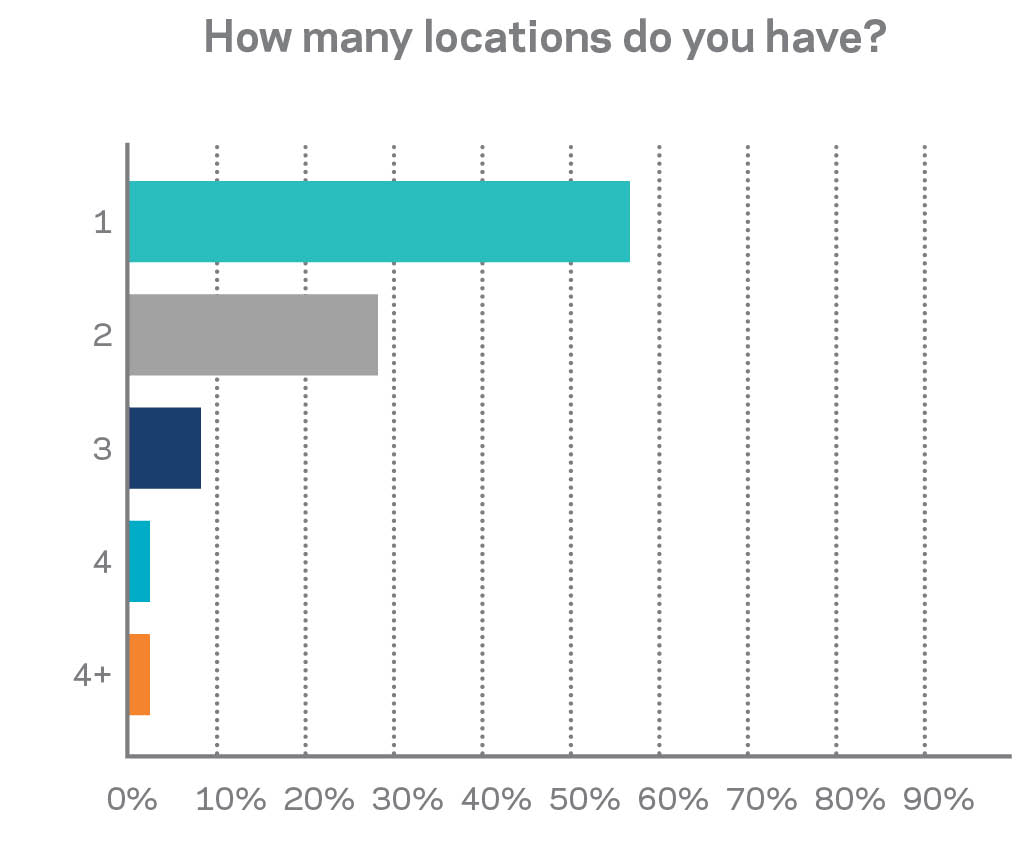

Steve Goldstein is one of them. Thirty years after he founded the Spa Doctor Spa and Stove Center in Modetso, Calif., he opened a second location in Stockton, Calif., in 2016.

“I kept looking at the economic indicators, and I looked at my savings,” he says. “I knew consumer confidence was high, there was an uptick in the economy and, in general everything was headed in the right direction. So I decided to get ahead of the curve.”

So far, the store is performing as he had anticipated and he expects a very strong second quarter.

Others are drawing a connection between hot tub sales and the flourishing pool industry.

Retailer Susan O’Connor said she is “amazed” at the health of the economy in her region. The pool side of the business is booming and it’s directly driving sales of hot tubs, as these new purchasers add hot tubs to their orders. Some of the increased interest in hot tubs also comes from former pool customers who had considered buying a tub but didn’t do so at the time they built their pools.

“We’re booked out several months. And this could be the trend for a while,” said the store/business development manager of Hendrix Pool, Patio & Spa in Seymour, Ind.

Overall, consumers are loosening the purse strings, she added.

Despite this positive forecast, it seems the majority of surveyed retailers do not feel the need to add locations. Three quarters said they do not plan to do so in the next 12 to 18 months, and only a handful are considering an expansion.

But the overall sense of satisfaction that retailers report seems to come at the benefit of manufacturers, as well, with brand loyalty at a high. Seventy-five percent of those surveyed characterized themselves as very happy with their manufacturers. The proof: More is that 83% expect to carry the same brand three years from now.

Digital Dance

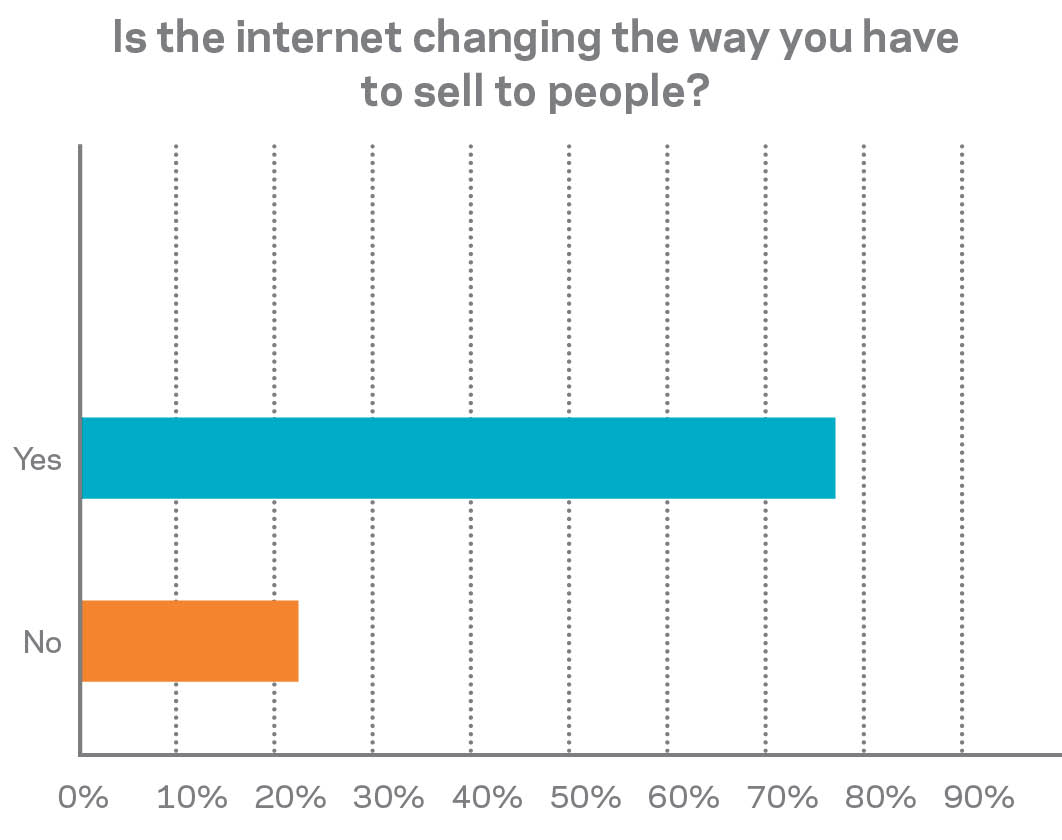

The hot tub industry continues to adjust to the changing digital landscape. From website design and functionality to lead generation, dealers are adjusting their business plans to leverage the power of the internet.

For instance, 66% of respondents said their websites now are designed for compatibility with mobile devices. Perhaps more telling, 78% of the spa retailers surveyed said the internet has changed the way they sell.

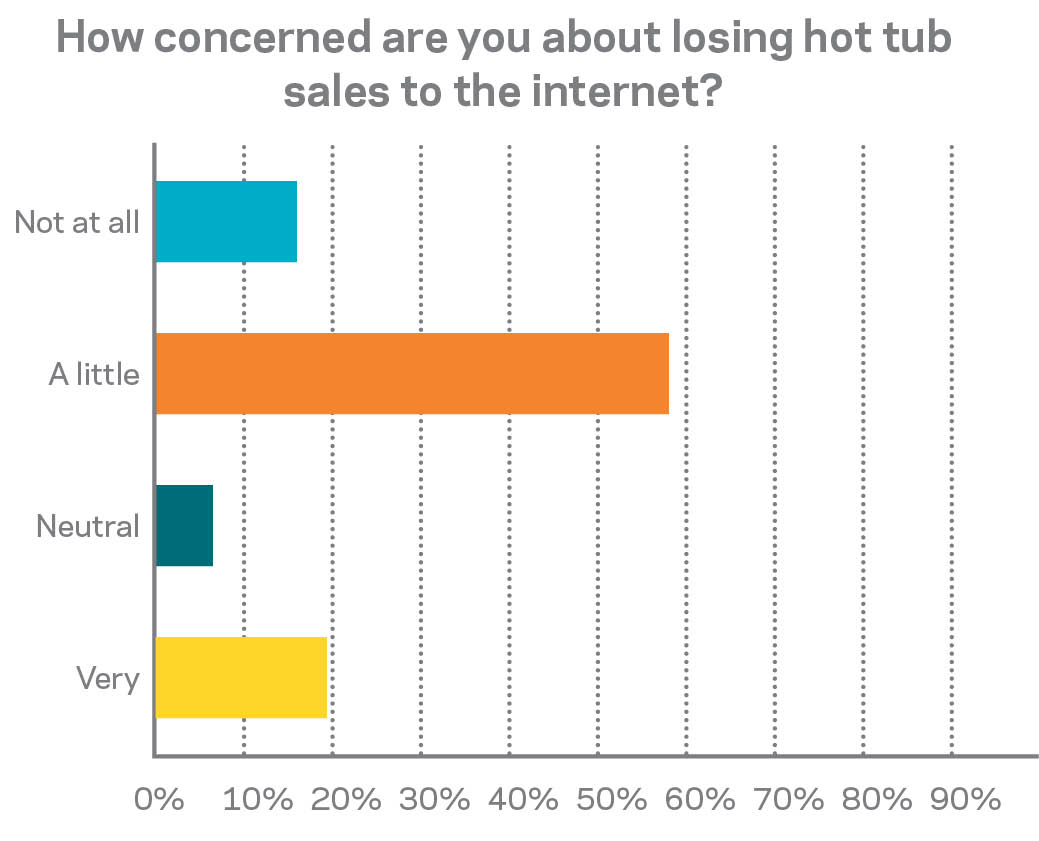

But, in stark contrast to pool-retail peers who have been combating online sales for years, these survey takers only label the internet as somewhat of a threat. This result comes despite the fact that 69% of respondents believe they lose water-care sales to the web.

The retailers provide a clear explanation for this difference: Currently, only the lowest-budget hot tubs can be purchased online. Additionally, manufacturers generally do not post prices online, with the exception of certain plug-and-play models. This prevents the level of showrooming, and online price checking with which pool-supply retailers often contend. However, some retailers note one or two manufacturers that have toyed with showing prices online, and they wonder if the status quo will change in this regard.

While most hot-tub retailers don’t feel the heat from online competition, they still must respond to the changes in consumer buying habits that the world wide web has spawned. Hot tub prices may not appear online for the most part, but that doesn’t stop consumers from doing their research. When it comes to these big-ticket purchases, a majority of dealers say their customers are becoming much more educated about the products and already have a good sense of what they want before they even walk into a showroom.

“People who come in don’t tell us right away, but you can tell they are researching,” says Josh Davis, store manager of Baker Pool & Spa in the St. Louis area. “We’re getting a lot of online leads, and we’re trying to sell over the phone because people don’t even want to come into the store.”

Even so, Davis admits there are still misconceptions deriving from the web. For instance, those entry-level and plug-and-play models that are priced and sold online influence the public’s perception of what hot tubs should cost. A potential customer might see one style of hot tub online for $10,000 and assume that is the same price point as something that normally would cost double, Davis explains.

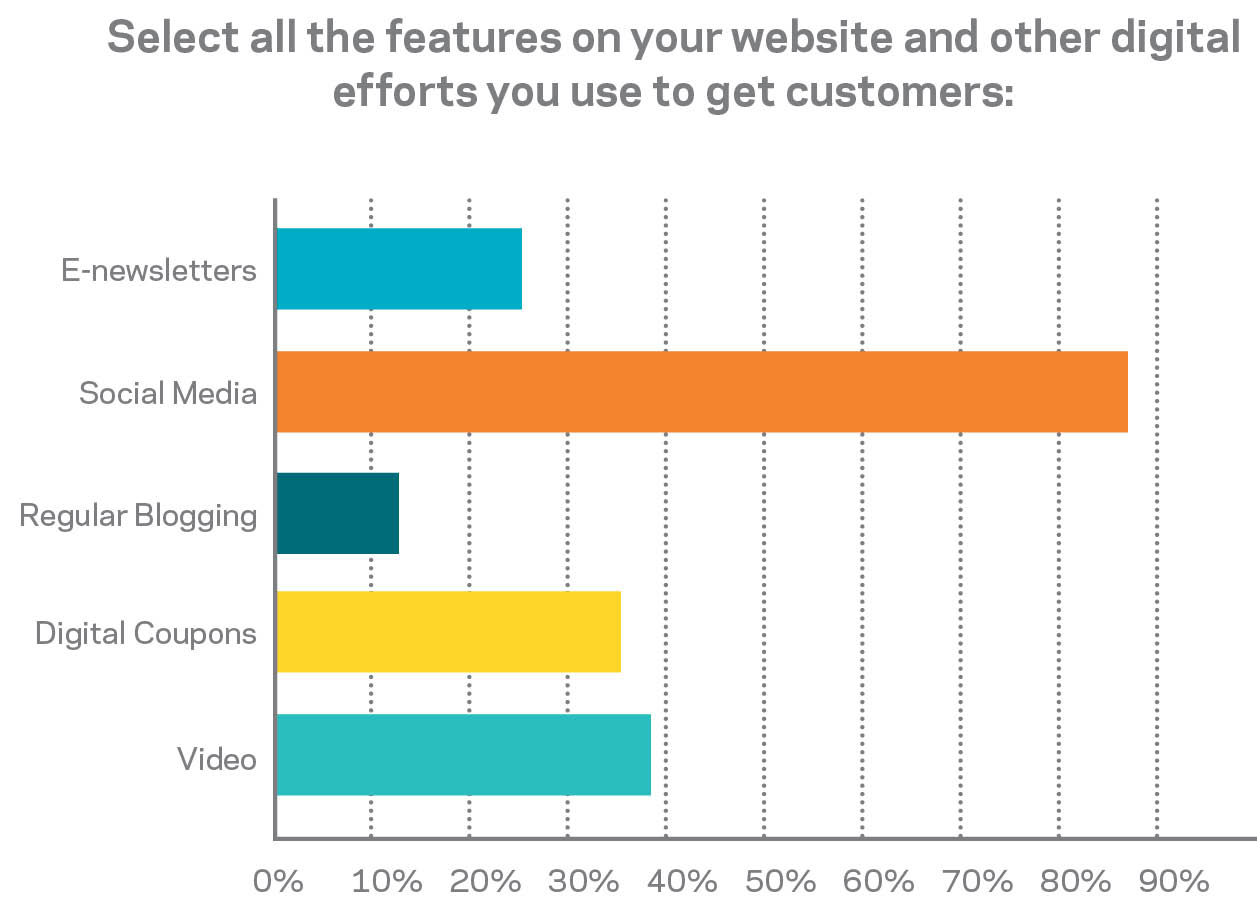

To tackle this new style of shopper, dealers are embracing digital advertising and other technologies more than ever.

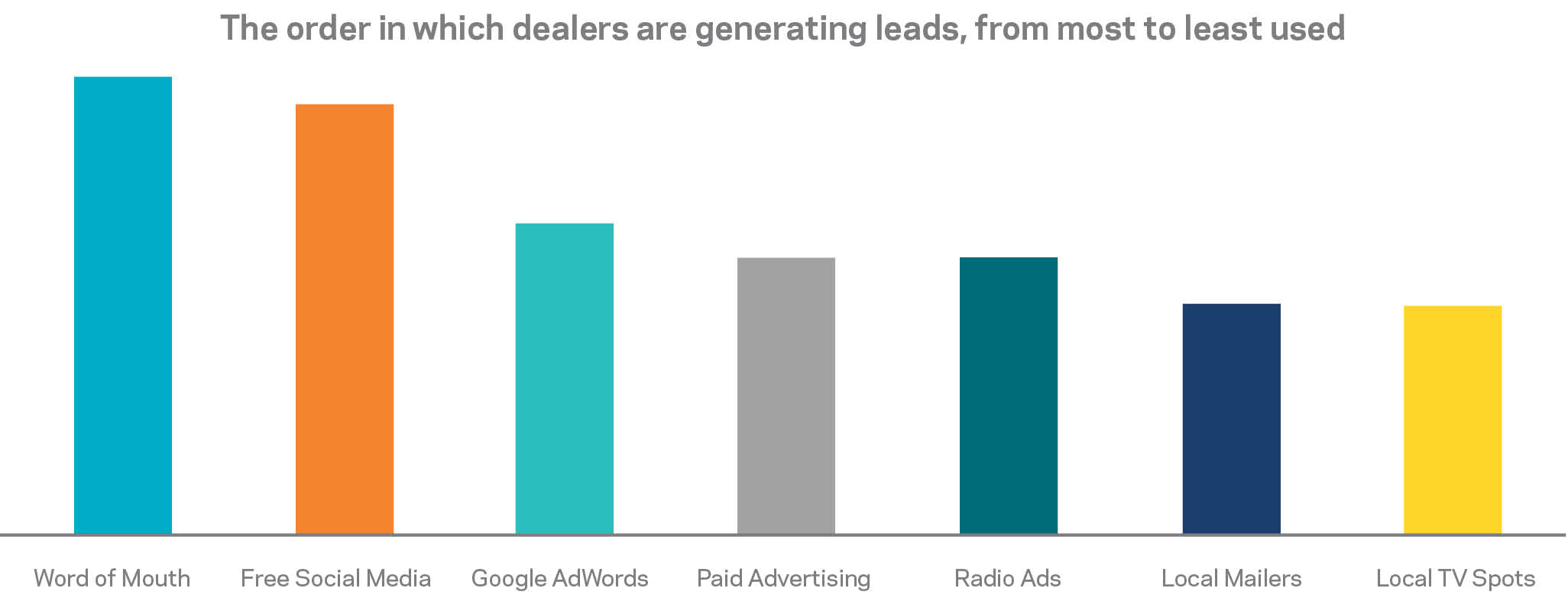

Word of mouth still ranks as the top form of lead generation. However, 72% of respondents said they have changed their overall approach to lead generation in the last three years.

As a whole, dealers now place a much greater emphasis on their social media presence. In fact, 58% rank it as their second-highest lead generator after word of mouth. Google AdWords and paid or promoted Facebook posts follow closely as other popular methods of advertising today.

This is the very reason that Allen Jerabeck says dealers need to modernize their sales approach and attempt to attract younger buyers. In days past, dealers were the knowledgeable ones, and they prided themselves on serving as the experts in a sales transaction. Now, customers have most of their questions answered before they even enter the store, explained the sales and marketing manager of Johnson Pool and Spa in Windsor, Calif.

“Dealers need to invest in attracting millennials,” he said. “Things are changing pretty rapidly, and it’s not just the 50 year olds [who have] the money. It’s the 27 year olds, too, and [retailers] who aren’t targeting them with digital advertising are missing the boat.”

Jerabeck joined Johnson Pool and Spa eight months ago and began using Google AdWords a few months later. While still in the early stages of data analysis, he expects his online leads to increase as a result of the effort.

Of course, he is not alone in this category. Despite believing that the majority of his sales will continue to solidify in-store, Goldstein recently oversaw a complete website overhaul to focus on search engine optimization (SEO), keyword searches and organic leads. He has also doubled his digital advertising budget. Currently he is in the process of developing an entire division dedicated to handling leads.

“We want to make sure we are nurturing those leads from the minute we get them until they are ready to be turned over to the sales person,” he noted.

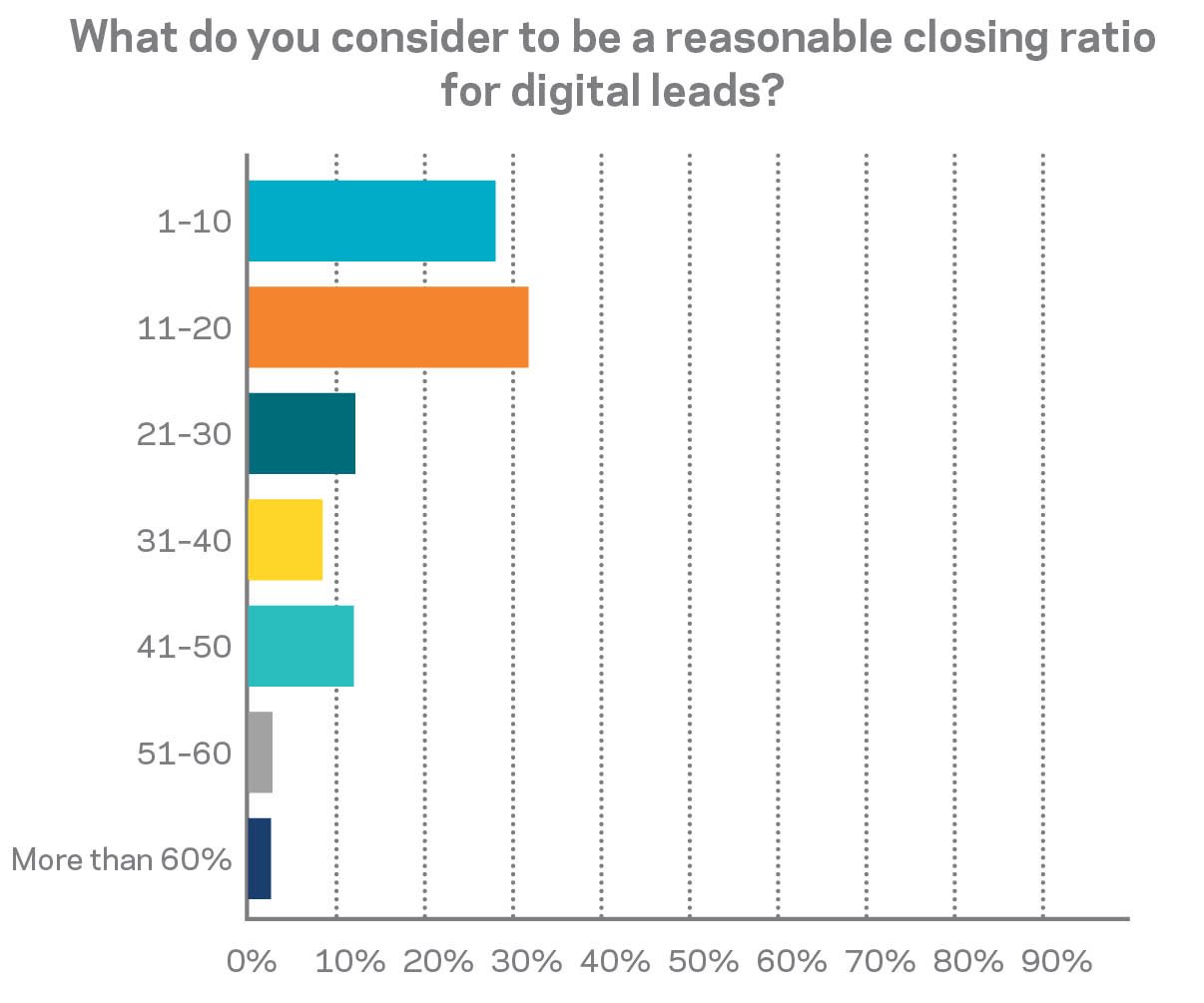

At this point, dealers seem to have moderate expectations of web-generated leads, with just under 60% saying that a reasonable online closing ratio should be between 10 and 20%. In-store lead conversions, on the other hand, are expected to reach more than 40% by two-thirds of survey takers.

Looking Ahead

Even with the positive advancements that have taken place over the last few years, survey respondents identify issues that must be addressed for the industry to continue moving forward.

The hot tub retailers surveyed made a multitude of suggestions for improving the industry. Among those, one wish easily dominated: Dealers would like to see manufacturers become more proactive about promoting the wellness aspect of hot tub ownership.

“Spas have not become a household name, and they are not as common as a cell phone,” Goldstein says. “So the question is, ‘How do we get there?’ Hot tubs will always be a disposable-income item, but they have a place in the market, and I believe we could easily double or triple sales if we have the right message.

“Wellness is really the centerpiece of how we are going to move forward in penetration.”

Lacy Simmonds couldn’t agree more.

The co-owner of Kennewick, Wash.-based Mirage Pool n Spa cited this issue as her biggest concern. Like several other survey takers, she suggested a national advertising campaign as a way to lead the effort.

But Simmonds took it one step further, suggesting that the industry as a whole should forge a relationship with healthcare providers. She would like to see APSP and other industry leaders reach out to the medical community and work to spread the message about the health benefits of hot tubs.

But she also has taken matters into her own hands by establishing relationships with several local wellness experts, including general practitioners and chiropractors. She recommends that fellow dealers consider this route as well.

“It really means something to a customer when their doctor says, ‘You need a hot tub,’” she said.

With the oldest baby boomers well into their 70s, and millennials showing an increased interest in health and fitness, this seems by many the route to a successful future.