A history-making achievement by PoolCorp may serve as an indicator of the industry’s performance.

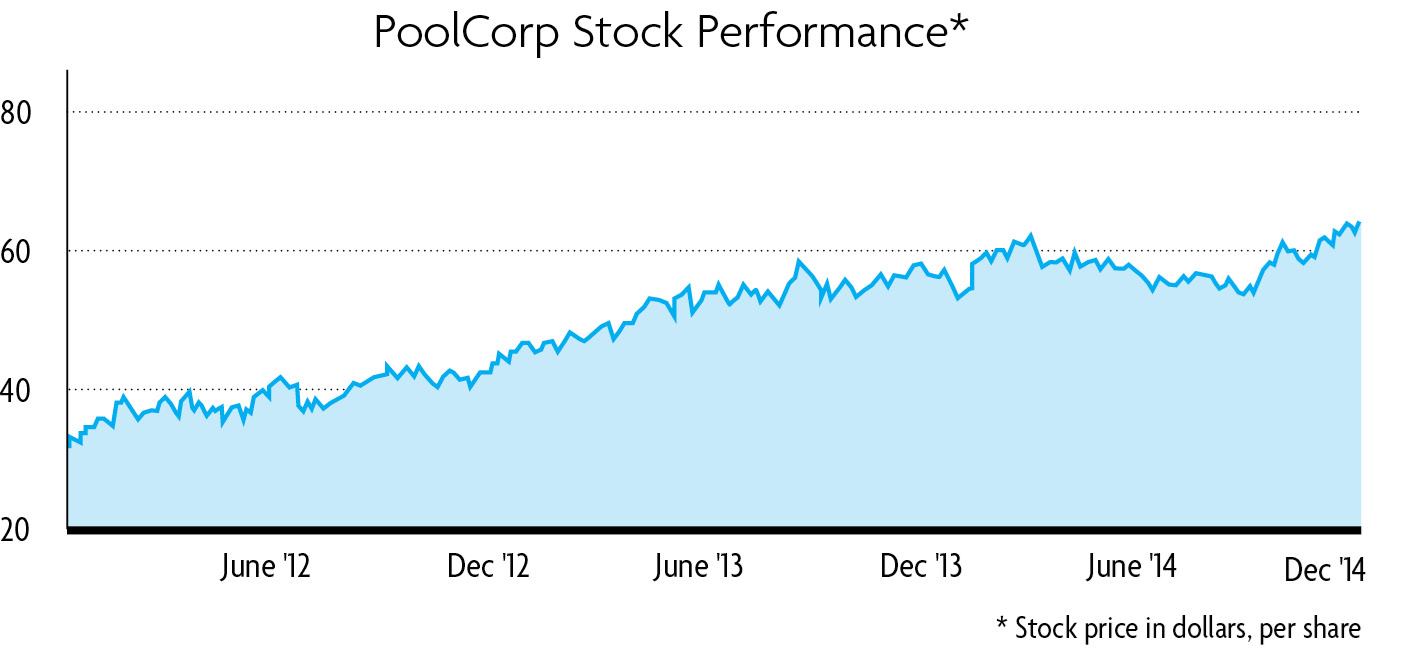

The only publicly traded company whose offerings are dominated by pool and spa products, the Covington, La.-based mega-distributor saw its stock reach $64.71 per share. The 52-week high occurred just before the end of 2014, the culmination of steady increases the company has enjoyed over the past few years.

“It’s definitely executing well, but the overall stock market has been on a tear, especially for companies that pay a dividend, as POOL does,” said Lamar Villere, portfolio manager for Milwaukee-based Villere & Co., one of the largest shareholders of PoolCorp stock.

“We’re long-term holders, so we don’t worry too much about price fluctuations, except when we’re buying or selling,” he continued. “We love the company, and the industry overall.”

PoolCorp President/CEO Manuel Perez de la Mesa points to two reasons for the solid uptick: the government’s efforts to stimulate the economy from recession has created a shift for investors to seek stock shares and, of course, the company’s own performance.

“We’re in a great industry, and we’re in a great space within the industry,” he said.

Gauging the pool and spa industry’s performance in the greater economy often proves challenging because studies generally lump its statistics together with general construction figures. But PoolCorp’s milestone points to a continued steady recovery, Perez de la Mesa said.

As the economic recovery continues, he said, homeowners are discussing how they want to spend their renovation dollars.

“There’s the expectation that homeowners will be doing more [outdoor improvements] over the next several years than they have in perhaps the last five years,” he said.

Investors view the industry’s potential differently than before the recession. At one time, it was the possibility of new pools that held Villere & Co.’s interest in PoolCorp stock.

But since the distributor’s expansion into landscape products and emphasis on the potential of service and renovations, it’s the millions of existing pools around the country that maintain the stockholder’s interest.

“This environment doesn’t look like the housing bubble, when we got out of [POOL] stock due to concerns that the valuation [was based on] long-term massive new pool builds,” Villere said. “We’re really in it for the long-term, defensive nature of pool maintenance expense.”

PoolCorp stock recently made news in another way as well — when Chairman Wilson “Rusty” Sexton sold 20,000 of his shares on Dec. 30, with media reports that his remaining holdings stand at nearly 5,500 shares.

While some may have taken that to signify an upcoming transition for Sexton, Perez de la Mesa said no such change will take place. Sexton, who has been involved with PoolCorp since its founding in 1993, still indirectly owns nearly 450,000 shares, or approximately 1 percent of the company, through a trust.

“A high percentage of his net worth is in POOL stock, and gradually, over the course of the past 10 to 15 years, he has begun to diversify,” Perez de la Mesa said. “It’s an immaterial amount relative to his total holdings.”

Last year was marked by more than unusual stock activity for PoolCorp. Last summer, it made inroads into the Australian market by purchasing a majority interest in Brisbane, Queensland-based Pool Systems Pty. Ltd. With its enhanced funds, the Aussie distributor then expanded with the acquisition of Niagara Pool Supplies, of Sydney, New South Wales.