Ask Joe Jackson about his customers’ interest in the Virginia Graeme Baker Pool and Spa Safety Act, and he’ll answer frankly. “I’ve never ever had a request for a drain.”

The owner of Lotus Pool & Spa Services Inc. in Las Vegas adds that there is no real knowledge of the law until he brings it up with consumers.

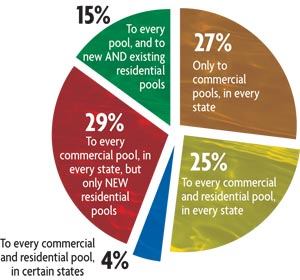

Unfortunately, that lack of awareness isn’t limited to customers. According to a recent Pool & Spa News survey, nearly 75 percent of pool builders and service technicians don’t know exactly where or when VGB applies.

The study, which was designed to evaluate the state of safety awareness throughout the industry, revealed that the road to safety compliance is far more complex than it appears at first glance.

Moreover, consumer interest in safety products varies widely. Whether it’s a cover, a fence or an alarm, it’s rare to hear a specific request from a homeowner, though our study did discover a few exceptions. Here’s a look at that data, and what it may mean for safety compliance throughout the industry.

Industry awareness

While groups like the Independent Pool and Spa Service Association are working to educate the industry on VGB compliance, thousands of builders and techs across the country remain unaware of the regulations.

In the Dallas area, “probably half the pool builders don’t even understand [VGB] or know about it,” says Debra Smith, owner of Pulliam Pools, a Pool & Spa News Top Builder based in Ft. Worth, Texas. “Some builders might do one or two pools a year, and they don’t even know how to build a pool properly, let alone what the current regulations are.”

Many builders reportedly have kept their costs down by cutting corners on safety, which means that an unknown number of non-VGB-compliant residential pools are still being constructed every day.

“A lot of our competitors are cheaper than we are,” Smith says, “because they’re still putting [only] one main drain in. It costs more to build pools the correct way.”

For builders like Smith to compete effectively with noncompliant operations, the promise of safety must be worth the added cost for the customer.

“We educate our customers on why we do it the way we do,” she explains. “We tell them that we try to build the safest pool possible.”

To combat corner-cutting technicians, groups like IPSSA and the Association of Pool & Spa Professionals have been working to spread the latest regulatory information among members.

According to APSP’s Houston chapter president Michael Miller, the groups’ emphasis on education is starting to make a difference.

“I think it’s working well,” says Miller, who is also president of Miller Pools in Pasadena, Texas. “There’s still some confusion, but that has trickled down to nearly nothing. There’s definitely been improvement within the industry.”

Personal favorites

VGB requirements have inspired a variety of new technologies, and many service professionals have discovered that certain safety products make their own lives easier.

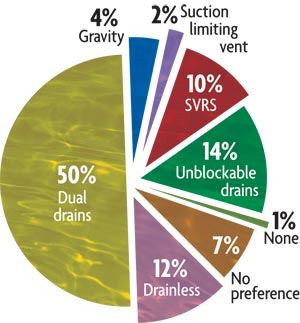

The survey indicates that only about 14 percent of residential pool owners nationwide own a Safety Vacuum Release System, but some techs highly recommend certain types.

For instance, single-switch SVRSs have become a favorite for Flash Rose, owner of Flash Pool Service in San Antonio. “They’re user-friendly,” he says. “You can [deactivate the SVRS] for 30 minutes to vacuum the pool, and after that it resets. Any other device, you have to override the safety system to vacuum, which means now you’ve got the whole liability.”

Justin Cravens prefers an SVRS-and-pump combo, because its release system can prevent electrical damage. “It doesn’t fry the motor like some of the vacuum systems, which put air into the system,” says the retail manager of AquaRama Pools & Spas in Marietta, Ga. “It actually turns the motor off; you go out there and manually reset it to turn it back on.”

For Miller, a pump with built-in SVRS is both a personal favorite and a top seller. “I’m finding more often that [customers] choose the route of going with that pump,” he says, “because of the power-saving variable speed, and the fact that it has the SVRS that meets the code commercially.’”

Smith says VGB only reinforced her faith in her company’s preferred products. “Dual drains are our standard,” she says. “And they have been, forever and ever.”

Most others would agree: More than 50 percent of builders and techs rated dual drains as the most effective type of safety equipment, beating out all other choices by far.

Customer awareness

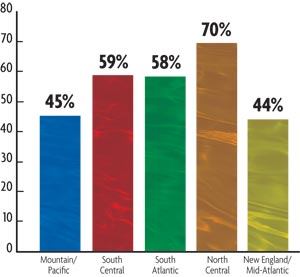

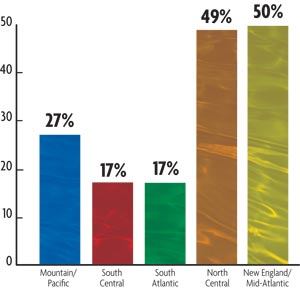

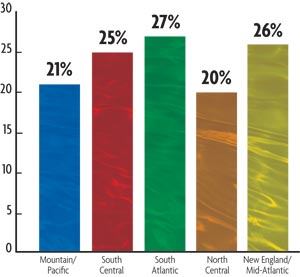

According to the survey, the percentage of residential customers who have heard of VGB varies widely, but the national average falls at 24 percent.

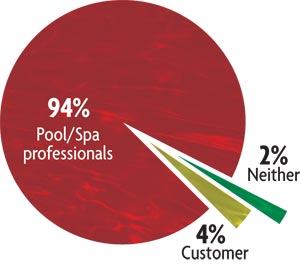

One thing is clear, however: The customer hardly ever initiates a safety discussion. Approximately 95 percent of builders and techs report that they, not the customer, are the first to bring up pool safety.

Noel Conley, owner of Miracle Pool Service in Garland, Texas, has found this is true on the retail side as well: “There’s almost zero awareness” of safety legislation among customers at his retail shop, he says.

A rare exception is when home inspectors get involved. “You might run into someone that had some questions if they had just purchased a home with a pool, and the inspector made some comment about their drain cover,” Conley says.

Uneven residential VGB enforcement means that, for many homeowners, the issue rarely or never arises.

“I get a few that ask, ‘What’s this new law?’” Rose says. But for existing residential pools, VGB compliance remains unenforced, “so a lot of them don’t [ask].”

Still, say others, it all depends on who you talk to.

“Some customers are really aware,” Cravens says. “The news-watching crowd is more aware of [VGB] than your everyday customer. Some of them know all about it, and even knew about it before we did.”

Randy Gallagher, owner of Gallagher Pools & Spas in Westminster, Md., agrees that safety questions often are inspired by news reports.

“When [a news show] runs a special on it,” he says, “I get a couple calls saying, ‘I want the proper drain cover.’ That’s about the only thing that residential consumers have asked me for.”

The implication of this lack of customer interest isn’t hard to see: Down the road, ignoring safety compliance is likely to create additional costs for the homeowner.

“We wind up having to change motors or drain covers,” Jackson says. “People just buy the pool, and they hire a pool guy to take care of it, and that’s it. If the pool guy doesn’t tell them anything about [VGB], they have no idea.”

Specific requests

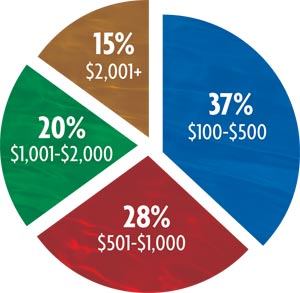

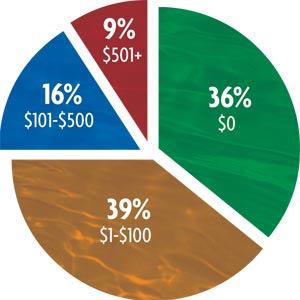

Approximately 70 percent of builders and techs report that their customers don’t request any particular safety equipment, and a full 75 percent report that their customers spend less than $100 per year on safety equipment.

But that doesn’t mean homeowners aren’t interested in safety: Many customers are willing to learn about VGB’s requirements, and some decide they want to make sure their pools are compliant.

“Once you inform them about the drain covers, they’re like ‘Oh yeah, I want ‘em!’” Miller says. “And we’re like, ‘Well yeah, you’re getting ‘em! ‘Cause that’s the way it is.’”

Overall, it’s external layers of protection that tend to draw the most attention from homeowners.

“There are two requests that I run into the most, though not that often,” Conley says. “Some [customers] ask about safety covers, and some of them have been interested in fencing.”

But only a few customers request any specific pieces of equipment, Smith says. “Every now and then they’ll want a pool alarm.”

Rose’s experience has been similar. “The only things I really get questions on are fencing and alarms for small children,” he says.

Several companies reported that as much as 100 percent of their customer base requested at least one additional layer of protection, such as a fence or safety cover.

This figure varied widely, however, with other companies reporting percentages below 10 percent, and the national average falling at 27 percent.

Again, this variance implies that many customers (and perhaps future owners of those same properties) are only delaying the costs of retrofits that their states will eventually require.