Turn on any news channel, and you won’t be able to avoid the barrage of economic indicators.

Housing starts? Up.

Consumer confidence? Down.

Home values? Up.

Stock market? Down.

It can quickly become an overwhelming swirl of data.

But the pool industry can sidestep that frustration by concentrating on a few key numbers and ignoring the rest.

“We’ve looked at a whole variety of economic indicators: new home sales, auto sales, gas prices, inflation, gross domestic product,” says Mark Laven, CEO of Latham International, a Latham, N.Y.-based manufacturer of pools and related products.

“None of those indices are correlated to new pool construction.”

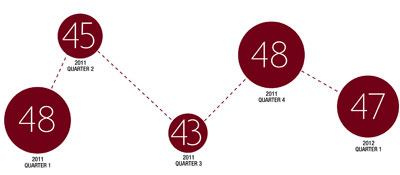

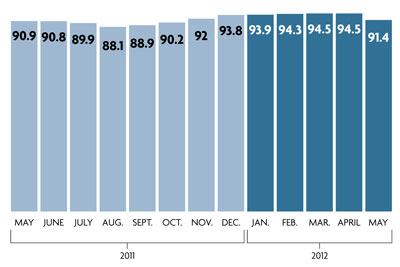

So what numbers do offer insight into the future of the pool industry? Different pool firms focus on slightly different mixes of indicators, but they all agree on the importance of one: consumer confidence.

Consumer confidence matters to pool firms because it’s a reflection of Americans’ willingness to spend money on purchases small and large. Changes in gas prices, home values and job situations all factor into this monthly indicator, which can change for the better or worse without warning. “When unexpected world events occur, you can see people react pretty quickly,” says Laven, who values the immediacy of the information provided by consumer confidence indices. “People will cancel contracts or put them on hold.”

Where will consumer confidence — and the pool industry — go in the months ahead? That’s a difficult question for anyone, particularly in an election year when the health of the economy is a major factor in the campaigns.

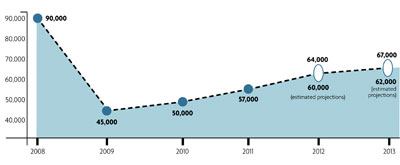

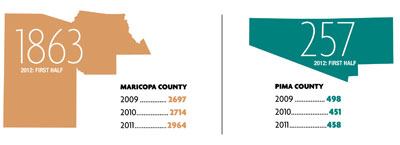

Many feel upbeat. Latham International doesn’t disclose sales, but Laven says they’ve seen “significant year-over-year increases” and predicts a 4 to 8 percent growth for the industry in 2012. He notes that the installed base has grown for three years in a row and estimates that about 64,000 new pools will be built this year. “The industry is outperforming the broader economy, much to our pleasure and surprise,” he says. “I think that’s a function of pent-up demand.”

He’s not alone in his cautious optimism. At PoolCorp, the publicly traded pool products distributor based in Covington, La., CEO Manuel Perez de La Mesa expects the industry to grow between 3 and 4 percent in 2012, thanks in part to a mild winter that started the pool season early in many areas of the country. Weather is one of the major factors that he watches, but Perez also follows a handful of carefully chosen indicators for PoolCorp.

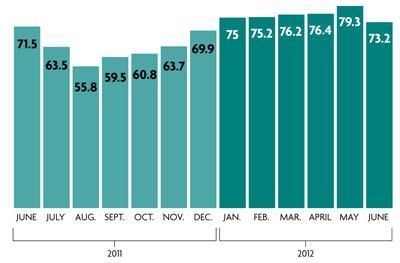

Like his counterparts, Perez watches consumer confidence closely and also keeps an eye on home prices. “Single-family home values not only need to

stabilize, but also show some consistent level of price appreciation,” he says, adding that a “genuine recovery in pool construction” will require several years of single-digit growth in home values. Once that happens, “consumers will start perceiving their homes as an investment versus an expense,” he believes.

Luckily for the pool industry, the housing market is finally starting to mend. “The best news is that home prices are stabilizing,” says Patrick Newport, U.S. economist at IHS Global Insight, a research and consulting firm based in Lexington, Mass. “This will help homeowners who are underwater. Many will now ride things out, rather than walk away. Should home prices grow faster than inflation, this will give consumer spending a boost.”

Yet others aren’t feeling so positive. “We don’t expect the industry to grow at all” in the near future, says Stuart Neidus, CEO of Anthony & Sylvan Pools, a Mayfield Village, Ohio-based pool builder. “So we are focusing on how we can get more market share.”

Of course, new pool construction is only one part of the industry. For pool service firms, the segment that matters is the installed base. That adds up to approximately 10 million above-ground and in-ground pools in the country, according to information from PoolCorp and P.K. Data, a Duluth, Ga.-based market research firm.

Still, the near-term outlook for this part of the industry is mixed, with industry leaders forecasting an annual growth rate of 1 percent compared to historical increases of 3 to 4 percent from the 1960s to the mid-2000s. Historically, maintenance and repair has been relatively recession-proof. Compared to installing a new pool, a customer’s decision to maintain and repair an existing pool is “nondiscretionary,” according to Perez, who says the demand for pool chemicals traditionally shows “little to no effect from the economy.”

That’s not the case for pool replacement and remodeling, which has suffered along with pool construction as wary consumers pulled back. “Last year, this segment was 30 percent below normal,” says Perez, “This year, it’s a little better, but it’s still close to 30 percent.” His company hopes to capitalize on the roughly $300 million market for replacement and refurbishment as consumers stop postponing major pool upgrades in approximately 2 million aging in-ground vessels.

Signs of life in the home remodeling market offer hope. “The remodeling market is steadily returning to normal,” says Stephen Melman, director of economic services at the National Association of Home Builders in Washington, D.C. After a 3.5 percent improvement in 2011, he and his colleagues are forecasting a 12 percent increase in residential improvements at owner-occupied homes in 2012. Next year, they expect such spending to increase another 7.9 percent.

Melman, like many people in the pool industry, believes there is considerable pent-up demand for home improvements. Those motivations represent a marketing opportunity for pool firms, which rely heavily on lifestyle in their sales efforts.

But it’s hard to tell if these improvement-minded homeowners are willing to spend the tens of thousands of dollars on a pool. “They are still relatively cautious” in their remodeling spending right now, choosing smaller projects like a bathroom remodel over a bigger (and more expensive) kitchen renovation, according to Melman.In the end, pool firms of all sizes may just have to be patient while consumers regain their confidence in their homes, jobs and the larger economy.

“Our crystal ball is as cloudy as everyone else’s,” Pool Corp’s Perez says, “but ours say it will be a long, slow recovery.”