The latest quarterly index from market intelligence firm Metrostudy represents an industry that’s still growing steadily but gradually.

Metrostudy, based in Irvine, Calif. and owned by PSN parent Hanley Wood, has released a report on the new inground pool construction sector for the second quarter of 2017. It shows a 7.7% increase in new inground pool construction activity compared with the same quarter of last year, and a 1.9% rise from the first quarter of this year.

The firm attributes the continued upswing to an increase in consumer confidence. “Rising home values, the bull stock market run, and still-low rates for borrowing money have been behind most of this confidence,” said Metrostudy Chief Economist Mark Boud.

These assessments and projections are largely based on Metrostudy’s New Pool Index (NPI). Launched in late 2016, it was developed to help fill the statistical gap suffered by the industry and predict future activity. In addition to tracking permit figures, analysts look at data points for each local market, including tax assessor information showing who owns pools, home sales, unemployment rates and reports from consumers. This provides a way to assess market conditions, make forecasts and supply detailed information about consumers in each market. By considering these variables, specialists expect to provide more reliable information than would be offered by raw statistics. The report is sold to interested parties.

The NPI works not as a raw number but as a comparator, showing how activity stacks up with 2007, the year with the highest new-pool activity. The figure works roughly like a percentage, showing how much activity was seen in a given year relative to 2007, which is reflected by the number 100. For other years, the number above or below 100 indicates the percentage increase or decrease. So an index of 120 would indicate that activity exceeded the 2007 baseline by 20 percent. Conversely, an 80 would mean it was 20 percent lower.

In the second quarter of 2017, the index basically maintained from Q1, rising to 45.3 from 45.

By the end of 2017, the NPI is expected to rise 6.5% over 2016. Annual gains of 3.9% and 3.6% are projected in 2018 and 2019, respectively.

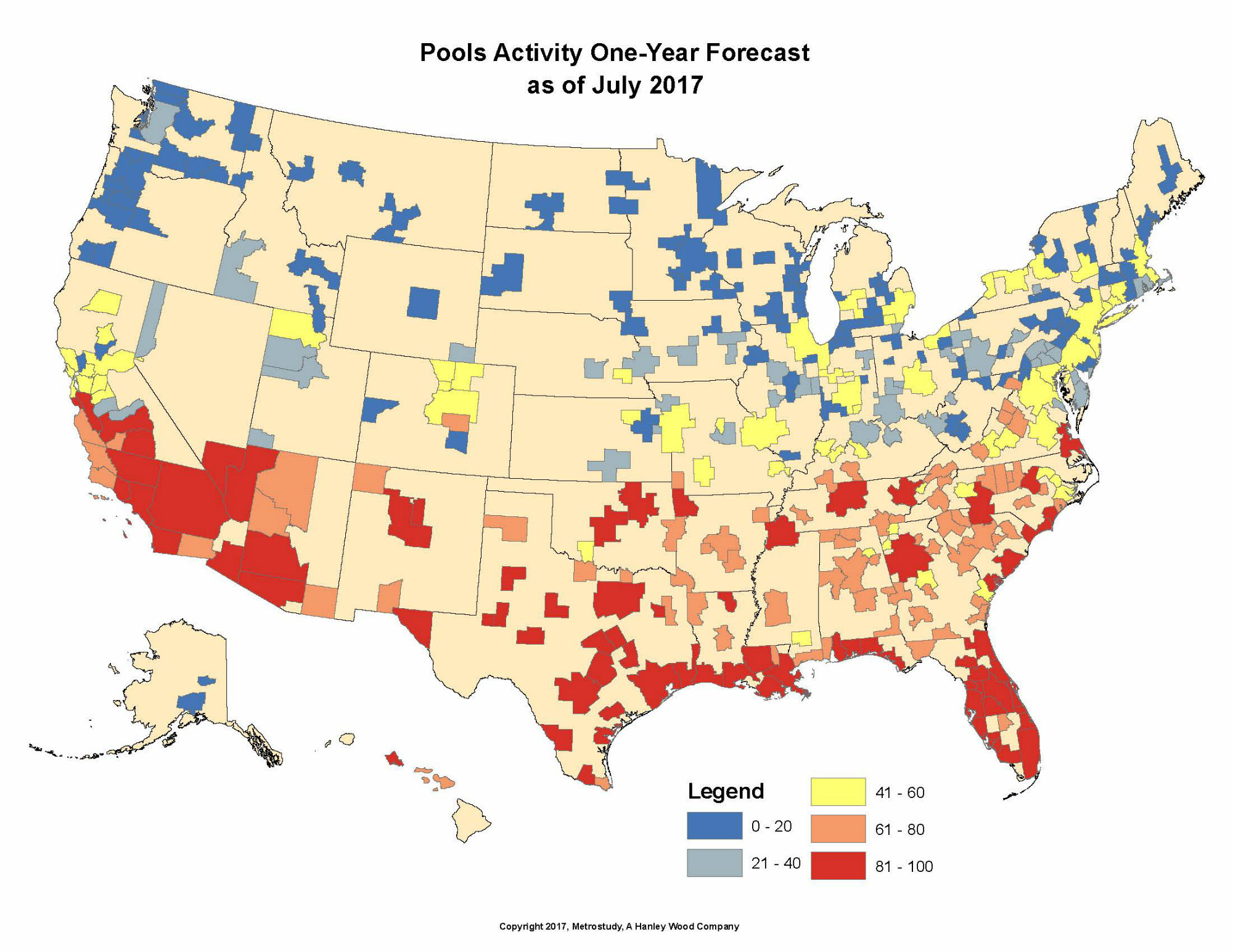

Metrostudy also assessed the number of new projects built in each of the 381 metropolitan statistical areas it studies. Here, the firm expects 354 of the markets to grow this year, with an average increase among these local areas of 19.5%. The year is expected to finish out with approximately 80,800 projects built in the U.S. A significant increase – to approximately 90,500 – is projected for 2018.

The market intelligence firm also ranks the 381 markets it analyzes. Once again, most of the top 10 for Q2 2017 are located in Florida. This can be attributed to a combination of brisk current activity, health economic conditions, and a high representation of demographics that traditionally gravitate toward pool purchases.

The top 10 market areas for Q2 2017 are: 1) Naples-Immokalee-Marco Island, Fla.; 2) North Port-Sarasota-Bradenton, Fla.; 3) Tampa-St. Petersburg-Clearwater, Fla.; tied for 4) Los Angeles-Long Beach-Anaheim, Calif.; and Miami-Fort Lauderdale-West Palm Beach, Fla.; 6) Pensacola-Ferry Pass-Brent, Fla.; 7) Cape Coral-Fort Myers, Fla.; 8) Panama City, Fla.; 9) Orlando-Kissimmee-Sanford, Fla.; 10) Deltona-Daytona Beach-Ormond Beach, Fla.

But the figures show a still-significant gap between current activity levels and those seen in the construction boom of the middle of the last decade. The main index figure for the new pool construction in Q2 2017 is 45.3. While this represents a 7.7% increase from the same quarter in 2016, it also means that the industry saw 54.7% less new pool construction than during the new-construction peak in 2007.

And, while encouraging, the recovery of new pool construction lags the home-remodeling industry. Home remodeling grew by a smaller percentage this quarter than the pool industry, with a 4.7% increase. However, the new index of 108.7 represents a new high for the remodeling industry, with an almost 9% increase over its previous peak. Remodeling completely recovered in 2015.

“The real strength in the pool industry over the last few years has been in renovation, repair and maintenance,” Boud said.