In literal terms, the last part of 2017 was a disastrous one. Wildfires, hurricanes and floods took a number of pools out of commission at least temporarily, hurting the pool/spa-maintenance companies that serve them.

October’s wildfires in California’s wine country took a particular toll, with some companies losing a significant portion of their routes — and some losing all their accounts as homes were downed.

To assist service companies living through such disasters, IPSSA’s insurance provider will offer coverage to help reimburse techs for individual accounts that are lost.

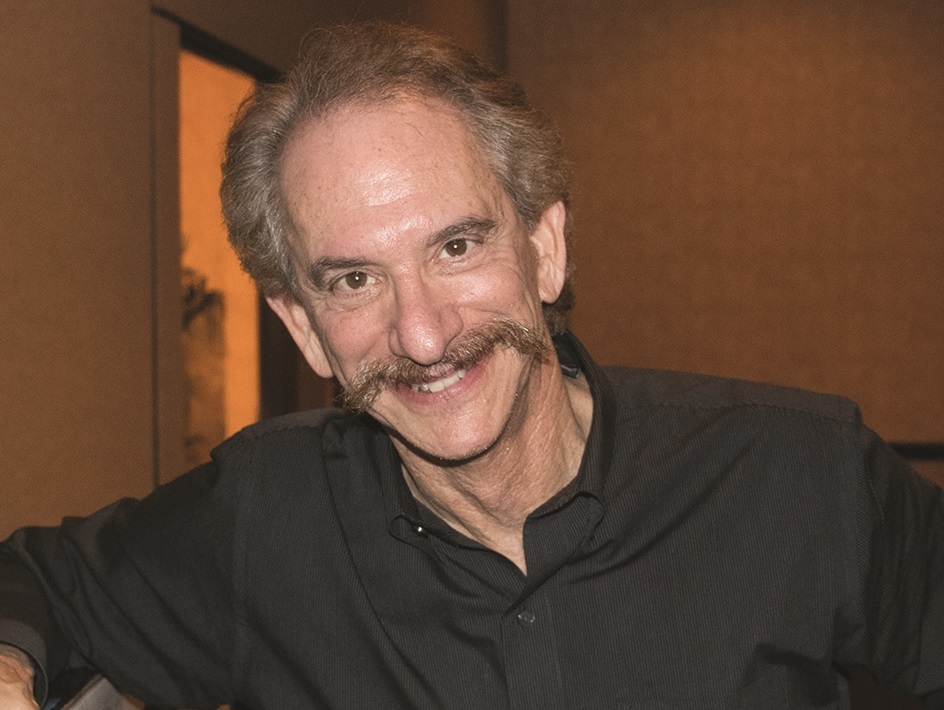

Arrow Insurance, a division of HUB International, is offering a first for the pool/spa industry — and possibly for all service trades, said the carrier’s senior vice president, Ray Arouesty.

It is somewhat modeled after a type of coverage called business interruption coverage or income replacement coverage. Generally enjoyed by retailers, manufacturers and others who perform their work on premises they own, the coverage reimburses companies at least in part for income they lost as the result of a fire or other catastrophe.

“It’s not unique if you’re a store owner. But the coverage has never been written for a contractor who would lose money because his customer’s homes or properties burned down,” Arouesty said.

Under the new coverage, which will be included in plans for IPSSA members, companies can receive up to $25,000 in a year for accounts that have been permanently lost due to wildfires, hurricanes, floods or earthquakes. If service firms charge $100 per month for a residential pool, the policy would compensate for approximately 20 lost accounts.

It works like this: After a claim is filed, a 30-day waiting period goes into effect to verify that the loss is permanent. Claimants also must document how much income he or she will lose from each account. The company could then receive up to $25,000 — not to exceed the amount of the loss — in periodic payments for a span of up to 12 months. The policy does not specify a minimum loss that a company must take.

The policies will go into effect April 1. Arouesty expects the coverage to add $1 or $2 at the most to the IPSSA insurance premium. It may be added for free, he said.

Arrow Insurance may offer the coverage to non-IPSSA members in the future but, because this kind of policy has not existed before, it will take time for the provider to assess how it works out.